Guest post by Quoth the Raven from his Substack, QTR’s Fringe Finance:

Like every other horrible contrived piece of financial advice you’ve ever read, I’m gonna start this piece off by reminding you that sometimes patience is key when it comes to investing.

Those who read me regularly know that I often rail against the “patience” of passive investing, because I hate the idea that the financial media and the financial world in general have bought into the fallacy that stocks will only go up, forever.

This assumption has been the function of a broken monetary system that has relied heavily on the US dollar remaining the global reserve currency – a concept I believe could be at risk more so now than it has been in my 40-year lifetime.

And so the patience I’m advocating for now comes on a slightly smaller timeline.

My readers know that my general macro view right now is that we are “on the brink” – with an interest-rate pipe bomb making its way through the plumbing of our economy and financial markets. To me, it isn’t a matter of if it eventually explodes, it’s a matter of when.

To be honest, my Fringe Finance readers and my Twitter followers have been quite supportive of my writings over the last few months, even though the market has, for the most part, held up. It certainly hasn’t shown any fear or capitulation, as I am predicting. For their patience, I’m grateful.

However, I have an internal clock that continues to tick away in the back of my head. With every trading session that passes, I ask myself whether or not today is going to be the day that markets finally wind up limit down. Hell, I asked myself that this morning when I woke up at 4:30AM to write this piece. But not only have the rate hikes of 2022 not made their way through the system yet, blowups of large companies like Evergrande and FTX have done little to catalyze and type of additional concern or new sentiment.

But that doesn’t mean it’s not coming.

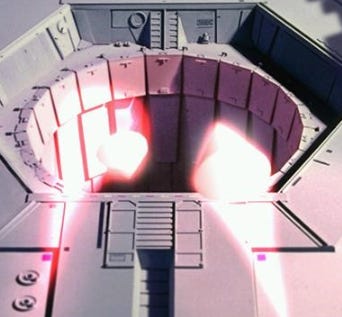

At the end of Star Wars, the entire score is settled between the rebels and the empire in just a matter of seconds at the end of the movie. It’s two hours of exposition for the viewer that line up the weeks before the the rebels deal a death blow to the empire. For those in the Star Wars universe, it was an end to a years-long conflict they were enduring. Their patience paid off and there literally came a day where they woke up staring at the massive Death Star, but went to bed with it completely destroyed.

How quickly things can change in just a day’s time.

With markets, we’re not privvy to two hours of exposition. Nor are we living through some unbearable years-long set of circumstance that make it so obvious to us on the daily that a climax is going to be necessary before we can revert. Instead, things are slightly different, but our quality of life hasn’t been meaningfully impacted…at least, yet.

Yet in the background, the middle of the movie continues to play out. I wrote an article last week talking about the fact that nobody seems to have even noticed that consumers are totally tapped out. All the while, rates continue to rise.

While the movie plays out in the background, we have been running the fool’s errand of celebrating slight CPI misses and forthcoming 25 bps or 50 bps rate hikes. Meanwhile, people talk about the neutral rate heading over 5% as though it’s a normal, run-of-the-mill occurrence. But with our current levels of debt and the shifting geopolitical and economic landscape, it’s actually unprecedented.

Markets were slightly shaky on Monday, but it came after weeks of massive rallies for causes that, as noted above, I believe to be completely ridiculous. We are nowhere near re-testing recent lows, which is where I believe the market has to go if we have any real hope of re-rating equities, mean reversion and ever again finding fair valuations. I mean, FTX just blew up days ago, and people don’t think there’s still excess in the system? We could just be getting started. In fact, these blowups are just what Dr. Powell and his 5% rate aspirations have ordered.

More importantly, as I wrote about several weeks ago, I believe any perceived “good news” from the Fed is nothing more than a fake out – a trap door waiting to lure people in before the bottom swings open – at this point. It’s easy for me to think this way because I also believe that even if inflation went to 2% today and the Fed completely stopped raising rates, it still wouldn’t be enough to prevent the economic destruction that’s already in the works. In other words, the Death Star’s fuse has already been lit – the shots fired into the thermal exhaust port – and now it’s just a question of when the catalyst or pressure point is going to emerge.

As an investor, I have been using green days like yesterday as opportunities to add to longer dated index puts (mostly on the QQQ). I also speculate somewhat recklessly in shorted dated options with a small amount of capital because I just can’t believe that a blowup isn’t far off. And all it’s going to take is one catalyst or one day of sentiment change to set the ball in motion for a serious move much lower.

If I had 30 seconds on financial media to try and snap people out of their bull market catatonia, I’d remind them that bad news isn’t good news anymore – and good news isn’t bad news anymore. It’s all bad news with rates at 4%.

There’s no more market theory that allows for poor number and a lagging economy to be positive developments for equities like there was in the throes of unlimited quantitative easing. Back in those days, everything was good news. With rates at 4%, the opposite is true.

I’ve written it before, and I’ll write it again: it’s not easy to drop the recency bias of the last 10 years and convince yourself that the entire playing field has changed over the last 11 months – but it has. For the last 20 years, investors have been playing home run derby in markets, cracking out slowly thrown meatballs by a 65 year old pitching coach over the 100 foot right field wall of a Little League stadium.

With rates at 4%, they’re now left trying to take Justin Verlander out of the park at a Major League ballpark. If investors can even wave a bat at a ball quick enough to make contact, they’re definitely not taking it out of the park. In other words, it’s a completely new game right now.

I take deleveraging dips in things like gold, silver, uranium and oil as opportunities to buy. Ultimately, I think those commodities are going to wind up higher. I also like dips like yesterday’s to add to some of my favorite defense stocks and ETFs, like Johnson & Johnson (JNJ), the iShares U.S. Aerospace & Defense ETF (ITA) and the iShares Cybersecurity and Tech ETF (IHAK).

As for the “big score”? I’m still waiting for that morning where we wake up and everyone realizes the days of celebrating with Air Heads at the snack bar after yet another 10-0 mercy rule win are long gone.

“Stay on target…” is the voice I hear in my head. We’re making our trench run as we speak.

Guest post by Quoth the Raven from his Substack, QTR’s Fringe Finance.

Own the Next Major US Gold Discovery for Just US$1 Per Share

Smart investors are making an absolute killing on select gold stocks as inflation soars. But what’s the safest and smartest way to invest? Here’s an under-the-radar Canadian gold company that’s zeroing in on the next major US gold discovery… trading at an insanely low US$1 per share.

It’s time to position for your own profit-windfall in the newly emerging gold bull market.