A thread just appeared on Twitter in which a couple of people who seem to understand the commodity trading business explain the nightmare that now confronts those traders. Here’s an excerpt, with a few technical terms explained for clarity:

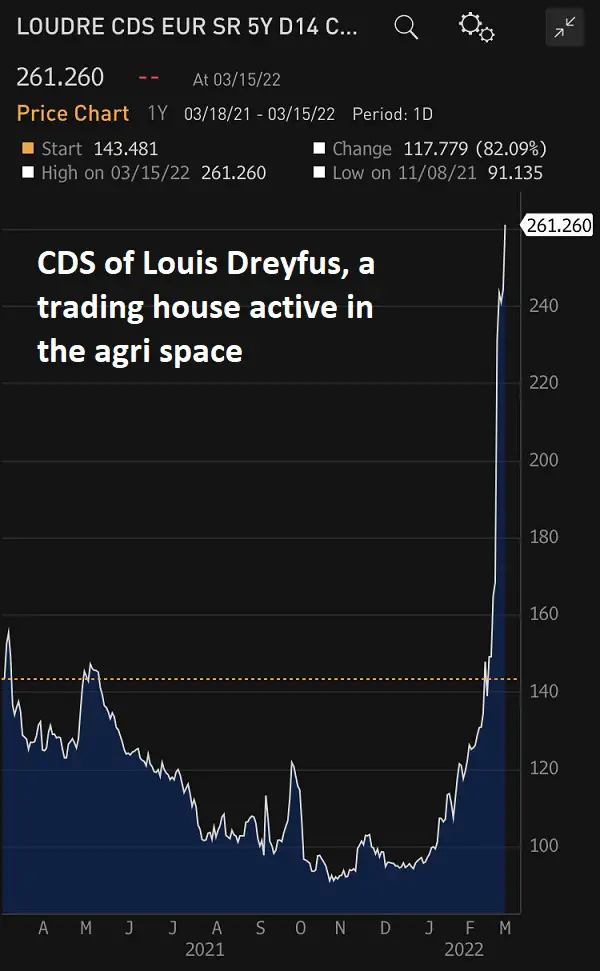

Commodity trading houses have had to manage liquidity at current price by re-entering the market and upsizing their facilities. They are obviously under pressure and the bond market is repricing. Here you have the CDS [credit default swap, a form of insurance against bond default] of Louis Dreyfus, a trading house active in the agri space. Friends tell me Blackstone already walked out on [global commodities trader Trafigura Group]. Capital and LOCs [letters of credit] are exceedingly hard to come by in this space and part of the reason you saw oil pricing blow out to $130 and then collapse back below $100.

Following the initial invasion we saw mismatched books and back-to-back trades start to blow up as reflected in the Urals discount imploding vs skyrocketing Brent [oil price indexes].

What happens when an oil trader who is expecting a physical Urals delivery and is short futures against it suddenly sees their posting margin requirements explode on the hedge while risking force majeure on the delivery?

The requirements to post greater margin during the blowout in futures and associated liquidations created a level of volatility that blew through VAR [value at risk] and control limits, and forced both commodity desks and HFs/CTAs/systematic trend followers to cut exposure, both long & short.

The ‘tell’ that this interpretation is correct would be to see a significant decline in Open Interest amidst high volume. This is in fact what has happened, as Open Interest has *collapsed* to lows not seen in over FIVE YEARS.

Why does OI [open interest] matter? Imagine it’s the 80s, you are looking out on a pit of 300 people screaming oil quotes at each other. Many participants. Lots of quotes and order book depth. Penny wide bid/ask, 10-20 contracts on each side. Heterogenous participants. Efficient. Continuous.

Now imagine one day 250+ of them are dead. You see much less open interest. One or two contracts on the bid/ask which is now a nickel wide. Mkt topology is homogenous because the survivors operate similar styles in a thin order book. Inefficient. DISCONTINUOUS.

This is precisely where the oil futures market is today. My suspicion is the culling of OI was completed in that final “look” below $100 this week. So what happens next?

The market is now illiquid and discontinuous. Expect to see gapping on minimal volumes that pre-February would have been easily absorbed and executed without moving markets. Air pockets.

The issue comes back to VaR, volatility, and risk controls. Market makers and trading desks do not have the balance sheet to make markets in sizes to which we grew accustomed.

Previously if you bought a future, chances were good that a desk would open that contract shorting to you. Not so much now. So if you want to buy futures, you may have to go and find a guy who already owns a future to sell to you, but he may only sell a dime or quarter higher.

The price move from $130 to $95 had almost nothing to do with supply/demand modeling and is entirely attributable to the vol mechanics I described above: books were disrupted, vol went nuts, and traders cut size. But the fundamentals of the oil market have not improved. We went into the invasion tight on the inability of Opec+ to increase production as measured by growing “overcompliance,” difficulty in expanding shale due to labor/input shortages, plus roaring demand.

If anything the market has only grown tighter due to disruptions which will *increase*, not decrease, from here as new trading routes need to be drawn up, tanks at Black Sea ports hit tops, and production is shut in.

The oil market imho has now ceased mass OI liquidation, will now begin to reassume its primary function: price discovery.

Now think about the psychology of participants here. Equity market bullsht “look through the conflict” has infected participants to the point where people are entirely misreading why oil collapsed from $130 to $95. The relief is palpable – especially among equity tech longs.

But put yourself in the position of the head of jet fuel procurement at United. Oil ripped in your face to $130, you can explain to your CEO why you are not fully hedged and supply guaranteed through 2024 because “invasion.”

Now the oil price washed out – emergency is over. The market will “find a way” from here. But then oil starts rising again – $2-3/bbl a day grinding higher. And then it gaps over $125. CEO calls you asking what you have been doing about it. What do you do? Simple. You try to save your job by panicking. You try to buy oil futures but they are illiquid. So you start calling Valero directly and ask them for 5mn gallons of jet next month and are shocked to hear “we might be able to do 200k.”

This is when the “come to Jesus” moment happens and the DISCONTINUITY of a low OI futures market reveals itself in all its glory. Because now oil is at $150, and the red bar on Bloomberg hits reminding everyone that we are now at new all-time highs… … but then the commentary of “actually in real terms that $147 2008 high is closer to $200 today” starts coming in droves and everyone knows that if we go to $150, we are going to $200. And then the market is a complete and total sh*tshow.

Side note: what goes through equity investors’ minds when they start thinking of $150 oil as not an aberration spike but rather a ‘new normal’?

——————————–

Free Report: 5 Stocks to Protect Your Portfolio During Tumultuous Times

Markets are an absolute disaster.

With Russia’s invasion of Ukraine, inflationary threats, a potential recession, and likely interest rate hikes on the way, investors are terrified. Plus, with oil prices now above $110 a barrel, there are concerns pump prices could substantially curb consumer spending.

And unfortunately, no one is quite sure what comes next.

Here are five ways to protect your portfolio right now.

5 thoughts on "Why Oil Might Spike — And Stocks Tank — From Here"

This is soooo possible. Precious metals will follow.