Less than 24 hours after beating the apparently wimpiest case of covid-19 ever, Donald Trump decided that his subjects’ lives aren’t exciting enough. So he called off Congressional talks on the latest stimulus bill.

Never a dull moment in pre-apocalypse America.

There’s just one problem: Virtually everyone from small businesses, to renters, to mortgage holders, to airlines, to movie chains, to cruise lines, to growth stock money managers has been holding on by their fingernails, hoping for the infusion of newly created Fed cash that might buy them another few months of normal life. Today that hope evaporated.

Among the likely results:

Plunging consumer spending. Those $1,200 checks were nice, and those $600 weekly unemployment checks were even nicer. But both have stopped coming and the money is gone. In the past couple of months, increasingly desperate Americans have been dipping into savings to put food on the table and gas in the car. Now that further help is definitely not on the way they’ll have to keep eating their already meager seed corn while cutting back on pretty much everything. Less stuff will be bought, the economy will roll over, employment will plunge again and we’ll be back in that capital-D Depression we just crawled out of.

Industry-wide bankruptcies. Some recent headlines reveal the hardest-hit sectors:

Regal Cinemas, the nation’s second-largest theater chain, to close

Airline Shares Dive As Trump Spikes Stimulus Talks

U.S. oil producers on pace for most bankruptcies since last oil downturn

U.S. Small Business Bankruptcies up 33% Year to Date

These guys, among many others, need massive, targeted bailouts and they need them now. After the election (more realistically after several months of post-election turmoil) will be too late. Multi-thousand-worker layoff announcements will become a daily occurrence, as will high-profile failures.

Residential real estate bust. The end of mortgage and rent forbearance will cause an avalanche of defaults as homeowners can neither make their payments nor refinance, while renters can’t cover the rent that their landlords are now free to demand. Speaking of landlords, rising defaults will send increasing numbers of them into defaults of their own.

Plunging stock prices. The stock market has recently been playing a game with the Fed in which the Fed tries to tighten (or at least stop easing) and stocks respond by tanking. The Fed then capitulates and starts easing again, after which stocks resume their ascent of Bubble Mountain.

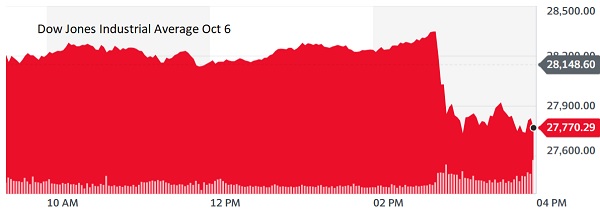

This time around stocks were rising on the very specific promise of a new batch of $1,200 checks being sent to Millennial gamers Robinhood stock traders, who would immediately convert their windfall into Big Tech call options. Take that away and the environment is suddenly hostile for stocks that recently exceeded dot-com era overvaluation levels. Today’s 500-point reversal on the Dow when stimulus talks failed illustrates how fast and furious the action might be in a non-bailout environment.

Oh, and don’t forget that it’s October, the month when, for some reason, huge crashes like to happen.

Of course everyone at the Fed, along with every politician up for re-election in November, knows all this and is absolutely terrified. So we’re back to The Number, i.e., the amount by which stocks have to decline to turn fear into panic and generate the next big liquidity infusion.

It might come tomorrow. It might come three weeks from now. Everything depends on the amount of punishment the political/financial Establishment is willing to endure.

The one certainty is that no one with money at risk should even think of taking a vacation this month.

13 thoughts on "So No Stimulus Bill This Month … Really?"