Paying someone in order to lend them money seems kind of pointless.

Yet the practice of stashing wealth in places where it yields nothing (and maybe even costs a bit for storage) is more common than you might think. Chinese, Russians, and Brazilians, for instance, buy US and Canadian condos and leave them empty as a way of moving their money beyond the reach of their rapacious governments. The taxes and condo fees produce a negative return, but most of the original investment will be there when needed. Other people store gold and silver in overseas vaults, paying 1% or so each year in fees. As the saying goes, such people are more concerned with return of capital than return on capital.

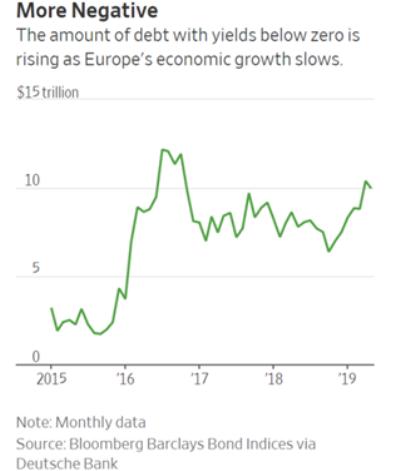

Even so, the spread of this kind of attitude beyond a small group of rich-and-worried is a sign of potential trouble. Which is why the surge in negative-yielding European bonds is worth watching.

In a healthy economy with lots of profitable opportunities, few investors have an interest in, say, a government bond yielding -0.3%. Europe is clearly not that kind of place anymore, as the outstanding amount of negative-yielding government bonds is up by 20% this year to about $10 trillion. That’s the highest since 2016, when the ECB was depressing rates by snapping pretty much every available eurozone sovereign bond.

Now QE has been scaled back but interest rates are still plunging. And it’s not just government bonds. Brand-name European companies like Sanofi SA and Moet Hennessy also have outstanding bonds that trade with negative yields.

Clearly, growth is slowing in Europe and investors are scrambling to protect their capital against the coming wave of defaults.

Some implications:

Negative yields during an expansion (this one is now 10 years old and counting) deprive central banks of the ability to cut rates to fight the next recession. Yes, a -0.4% lending rate can be cut to -1% and maybe even -2%, but somewhere down there is a line that can’t be crossed – that is, a rate where the unintended consequences make the cure worse than the disease. We don’t know where this line resides, but we’re liable to find out in the next downturn.

At that point it’s not clear that fiscal policy — bigger government deficits and more central bank asset purchases — will be enough to stop the downward momentum. If they’re not, then it’s game over for the world’s hyper-leveraged economies.

As a Deutsche Bank economist put it recently, “It’s just not a great starting point to already have negative interest rates … It’s getting more and more difficult for policy makers to respond to headwinds.”

Europe’s sudden lurch to the downside also explains the recent rise in the dollar’s exchange rate (illustrated in the following chart with the DXY index). Current US bond yields, being low but positive, look increasingly attractive compared to, say, the German Bund’s -0.4% yield. And America’s relative stability makes it possible for bond and real estate investors to still find assets that offer returns both on and of capital.

But in a fiat currency world it’s all relative. The US is making the same mistakes as Europe, accumulating an ever-larger mountain of debt, keeping interest rates so low that the next recession will be hard to fight with monetary policy, and electing politicians with “free stuff for everyone” platforms. It’s just moving a little more slowly than most other major economies.

Looked at this way, Europe is the “proof of concept” experiment for negative interest rates. In the next (maybe imminent) recession, we’ll find out how far down rates can go, and what happens when they get there. And we almost certainly won’t like the result.

7 thoughts on "Negative-Yield Bonds Are Back In Style. Why That’s A Bad Thing"

Long hours work in the office , managing all the annoying work load. The promotion and admiration you always wanted. A family gateway you constantly desires for. So, you have the possible opportunity to do all and more. An online work which ensure that you get everything you always desired. Freedom to work from anywhere , the salary you always wanted and a time which you can invest with your loved one , You will capable of doing everything. Therefore, work towards your goal. An internet opportunity which makes you fulfill all your aspirations. Get the job done small number of hours regularly and make lot of cash , approximately $24000 per week. This opportunity really excellent. So get set go and explore >>> crawnsit.a-loch.de

One year past I made the decision to leave my prior job and I am very glad these days…. I started earning a living online, for business entity I found out over the internet, only a few hour each day, and I bring in even more than I actually did on my office workplace job… My pay-check for prior 30 days was $9,000… The most important thing regarding this is the additional free moments I managed to get for my little ones…and that the only requirement for this job is basic typing and also access to broadband… I am able to put in quality time with my relatives and good friends and also take care of my children and also going on family holiday with them really frequently. Don’t avoid this chance and try to act fast. Test it yourself, what it’s about… xnarecipe.and-you.de

After 5 years I made the decision to leave my previous occupation which transformed my personal life… I started out working on a special job from the internet, for organization I discovered on internet, for a few hours every day, profit a lot more than I made on my old job… Last check I got was $9k… Fantastic thing about this is that I get more time for my family. See, what it is about… http://www.bigto.in/K5rdC

To me there are a lot of very strange things going on here. First of all, interest rates are supposed to represent the “cost” of money – what it costs to borrow it. Therefore, it is the proxy for money’s value. With interest rates being so low globally, and even negative in certain economies, that means the value of money is considered very low. It should also follow, therefore, that “price inflation” should be more prevalent than it seems to be. More money should be required in exchange of goods and services than it is, if money has so little value. But that’s not exactly what’s happening.

It’s almost like the same dynamics with interest rates are occurring with purchases. Just as some borrowers (e.g., bond sellers) are literally charging people for lending to them (by purchasing their bonds), sellers of goods and services evidently don’t want to receive too much money for their wares either. It’s like the world is choking on money and nobody wants any more of it.

It’s truly an example of too much money chasing too few goods and services, which should mean prices for those goods and services should rise. But the only things that are rising in price are “investments.” Bonds are expensive because they have an inverse relationship with interest rates. When bond rates are negative the bond can cost more than par and the lenders/buyers of the those bonds will get less back than they lent. Similarly for equities. Stock prices are high and although they may still pay dividends now the market parameters are blinking caution because the future value of those stocks – any capital gains that might accrue – are “expected” to be negative, resulting in losses just like with some bonds. It’s crazy.

If you would like to produce $8450 /per month simply by taking advantage of your own access to the internet combined with personal pc then Allow me to share with you my past experiences. Twenty four months in the past I was working through privately agency without getting paid decent wage according my effort. Well then my buddy revealed to me an online web job that you can try in the home by utilizing world wide web and pc and most amazing thing about it one may get the job done in time we wish and get the cash on each and every week basis. It’s as opposed to a buzz which you simply recognize all over the internet that yields to help you become shockingly wealthy in a handful of months or so. At present after utilizing this life-changing opportunity for twenty four months I most certainly will admit that this is actually the top online business I am going to get considering that by doing this venture I can work when ever I am free to do it. Every Time I was being employed in private business I were not capable to spend time with my family but now since 24 months I am executing this web-based venture and now I am getting the additional time with my friends and family at home or just by heading outside to any place I prefer. This business is just as really simple just like visiting web pages and implementing copy-paste paste job that everyone can do => eskinswarm.a-loch.de

When I was doing work for my previous employer I was on the search for genuine working at home opportunities where I could receive a nice income and also additionally enjoy enough time to put in with my family and offcourse I am not searching for internet scams that misguide you to make you very very rich in just few days or so. Eventually I stumbled upon a superb opportunity and I can’t tell you how delightful I am these days. The best things about working from internet are: Your Office Can Be Anywhere- you’re not bound to your house. You can take good care of your work while traveling, having fun in the fantastic outdoors , and even listening to your favorite band at a live concert. And you can additionally save on food expenses because you’ll easily be able to whip up your own dinner and coffee when you work-at-home. Your Routine Can Be Your Own: A lot of the work which can be done remotely these days can also be executed on a flexible schedule. If you do need to work specific hrs, you’re sure to still have some break time—time you can use however you’d like! Even if you have just 10 minutes, you can do something which just wouldn’t be possible in a traditional office: bust those samba moves, enjoy a few tunes on your guitar, or even take a relaxing power nap. You’re guaranteed to come back feeling more relaxed than you would after ten minutes at your desk surfing Facebook or twitter. You Can Learn More and Become More Self-dependent:Because you don’t have co-workers just a few feet away or a tech team one floor down, you’ll find yourself building the skill of looking for your own answers and becoming more proactive to find what you need on your own. Of course you can still ask questions and get help if you wish to. But, a lot of the time, you could do a Google search, download a free guide. Here’s the means through which to begun ->->->-> urladda.com/vDy

Make around $13000 a week. I left my job after doing work for the same employer for a long period. While I was working for my previous company I was in search of reputable work at home opportunities wherein I could earn good money as well as additionally get enough time to commit with my family and offcourse I was not in search of scams that misguide you to make you very very rich in just few days or more. Lastly I came across a fantastic opportunity and I can’t tell you how delighted I am these days. The advantages of doing work from internet are: Your Office Can Be Anywhere- you’re not tied to your house. That doesn’t mean your only other location will be the coffee shop around the corner. You can take care of your work on a trip, having fun in the good outdoors , or even listening to your favorite band at a live music show. Here’s the right way to begin> nor.si/00tcJ