Money managers who don’t recommend gold to their clients are becoming the exception rather than the rule. This week saw a couple more big-name banks join the pro-gold parade:

UBS advises investors to put money in gold as hedge against economic uncertainty

(RT) – The recent weakness of gold represents a “great entry point for investors” ahead of risk events such as the US election, said UBS Global Wealth Management.

“We like gold, because we think that gold is likely to actually hit about $2,000 per ounce by the end of the year,” the firm’s regional chief investment officer Kelvin Tay told CNBC.

He explained that “in [the] event of uncertainty over the US election and the Covid-19 pandemic, gold is a very, very good hedge.”

According to Tay, the precious metal is also attractive due to the low interest rate environment. He pointed out that if interest rates stay low as the US Federal Reserve has indicated, the opportunity cost of holding gold (which is a non-yielding asset) will be “quite low.” That’s because investors are not forgoing interest that would be otherwise earned in yielding assets.

This is the time to buy gold, says Wells Fargo

(Kitco) – Gold prices saw a $200 tumble in September, which Wells Fargo is viewing as a great buying opportunity during a well-expected correction.

“We’re buyers of gold,” Wells Fargo head of real asset strategy John LaForge wrote on Monday. “After a great seven-month run, gold cooled off in August and September. Gold spot prices today sits about $200 lower than its all-time high of $2,075, per ounce set in August.”

Gold’s correction was bound to happen after the 2011-high was breached and prices rose above $2,070 an ounce in August.

However, Wells Fargo’s optimistic view on gold has not changed with the bank remaining bullish on the yellow metal.

“The fundamental backdrop looks good. Interest rates remain low, money supplies excessive (quantitative easing), and we are doubtful that the U.S. dollar’s September rally has long legs,” LaForge said. “We view gold at these prices as a good buying opportunity and, as evidenced by our 2021 year-end targets, expect higher gold prices.”

Back in July, Wells Fargo released its updated gold price forecasts, stating that gold could rise all the way up to $2,200 – $2,300 by the end of next year, which means there is still a lot of upside potential.

Right now gold accounts for less than 1% of global investible capital. But as the above sentiment spreads throughout the mainstream investing community, typical portfolios for both individuals and institutions will contain increasing amounts of precious metals. To understand what a move from below 1% of total investable funds to, say, 5% over the next few years would mean, it’s helpful to compare the amount of capital in the world compared to the amount of gold.

Estimates of how much gold exists above-ground are all over the place, but most cluster around an amount that yields a value of about $10 trillion at current prices.

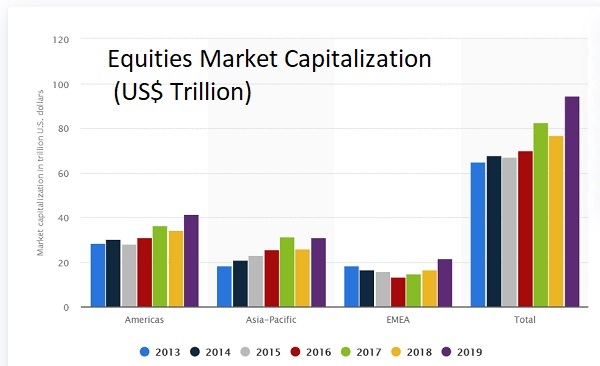

That’s a big number. But not when compared to other asset classes. Equities, for instance, total about $100 trillion worldwide.

Even bigger are:

Bonds and other debt instruments: $250 trillion.

Real estate: also $250 trillion.

There are other categories like cash and derivatives, but let’s ignore those and just add up the big three, for a total investable global capital figure of around $600 trillion.

Now assume that 4% of this flows into precious metals. You’ve got $24 trillion pouring into a $10 trillion sector, which doesn’t sound physically possible – unless the price of gold rises dramatically.

And that’s assuming that the end-point is gold accounting for 5% of the average portfolio. In a world where increasing political and financial instability makes traditional financial assets – including cash — seem unduly risky, and where gold is rising, both fear and greed might send considerably more than that into safe-haven assets.

18 thoughts on "Mainstream Investors About To Pile Into Gold"

What happened to PaperIsPoverty’s comment?