Guest post by John Rubino from his substack:

The idea that the world’s central banks can inflate the biggest financial bubble in human history — appropriately called the everything bubble — and then deflate it gently into a soft landing is mathematically and philosophically impossible. So the question is not if but when we get a bust that’s commensurate with the boom.

Based on the following three indicators, that bust is imminent.

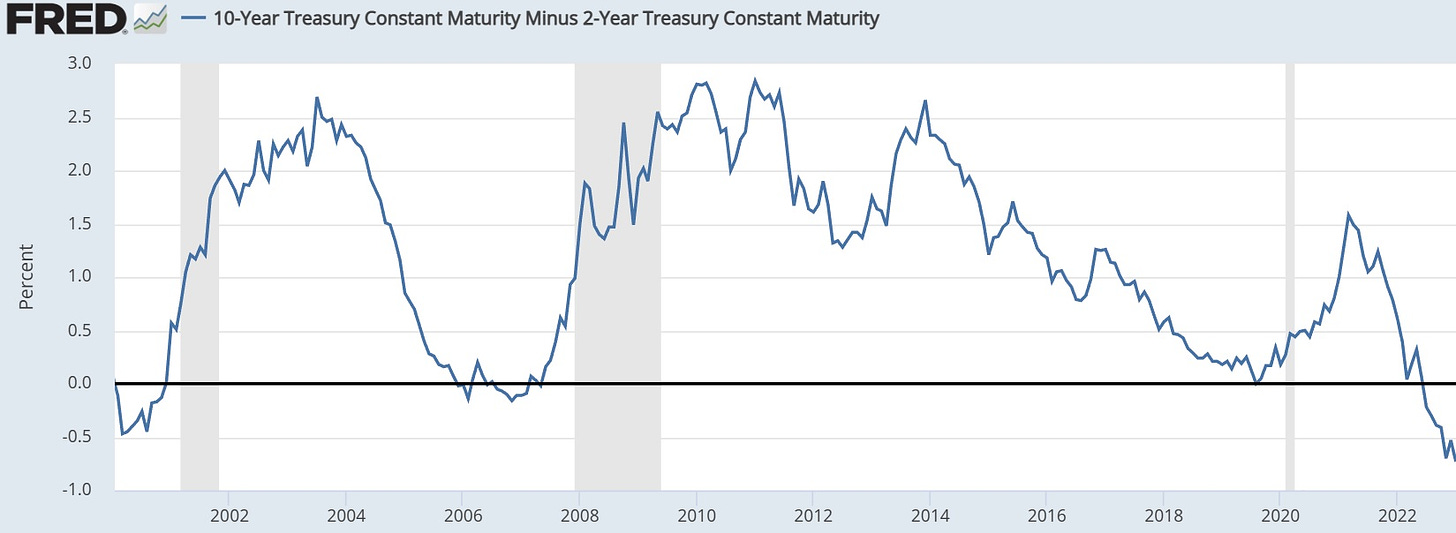

Massively inverted yield curve

When short-term interest rates rise above long-term rates, a slowdown usually follows. That’s because traditional banks (though not necessarily the monstrous hedge funds that the biggest banks have evolved into) make most of their money by borrowing short and lending long. In normal times, long-term rates are higher than short-term, reflecting the higher risk of lending into the distant future, so the spread between a bank’s borrowing and lending rates produces a nice spread, which translates into a decent profit.

Invert the yield curve by pushing short-term rates above long-term rates, and this business model breaks down. Banks stop making suddenly-unprofitable loans, their customers have less money to spend and invest, and the economy shrinks.

Note two things on the following chart, which depicts the spread between 10-year and 2-year Treasury bond yields. First, when this spread went slightly negative (i.e., 2-year rates higher than 10-year) in 2000 and 2007, recession followed within a year or so. Second, today’s yield curve is a lot more than slightly negative. It is, in fact, one for the record books, implying that the credit markets expect a dramatic slowdown.

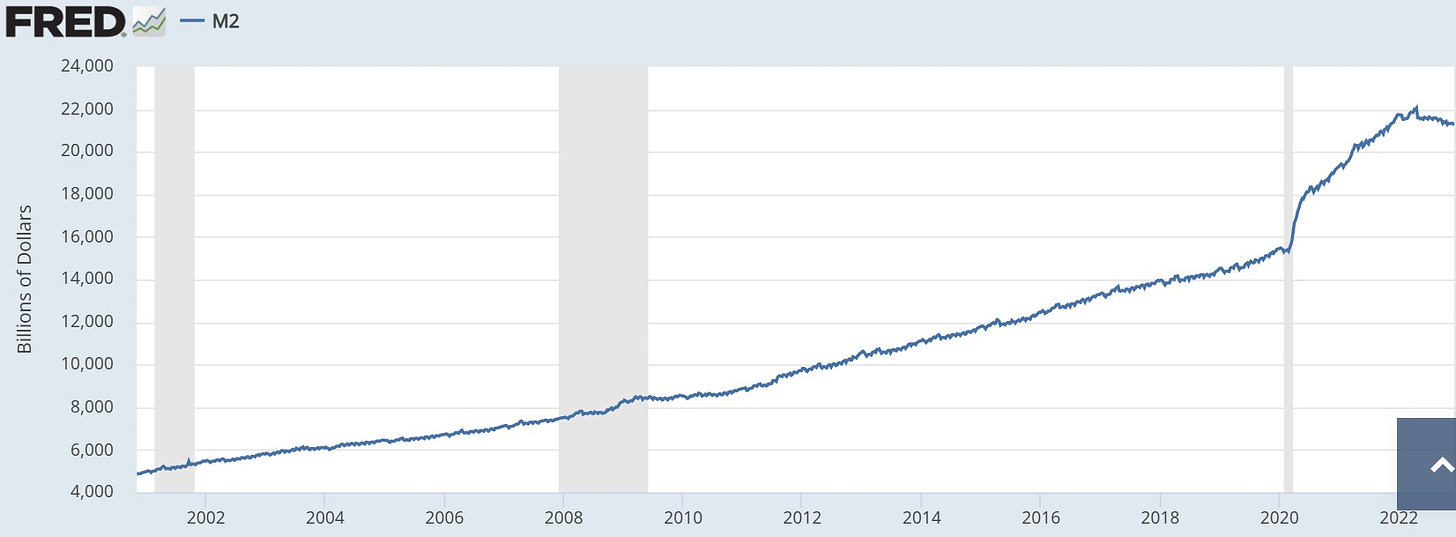

Shrinking money supply

A Ponzi scheme needs ever-greater amounts of money flowing in to avoid collapse. Today’s global economy is a classic example of a Ponzi scheme. Therefore, it needs an increasing money supply to function.

As you can see from the next chart, the M2 money supply has never stopped growing — until now. And with the Fed still raising interest rates and shrinking its balance sheet, the spigot is off and M2 is virtually guaranteed to keep shrinking.

The upshot? No more growth until the Fed turns the spigot back on, and rising instability as overleveraged, illiquid entities start imploding.

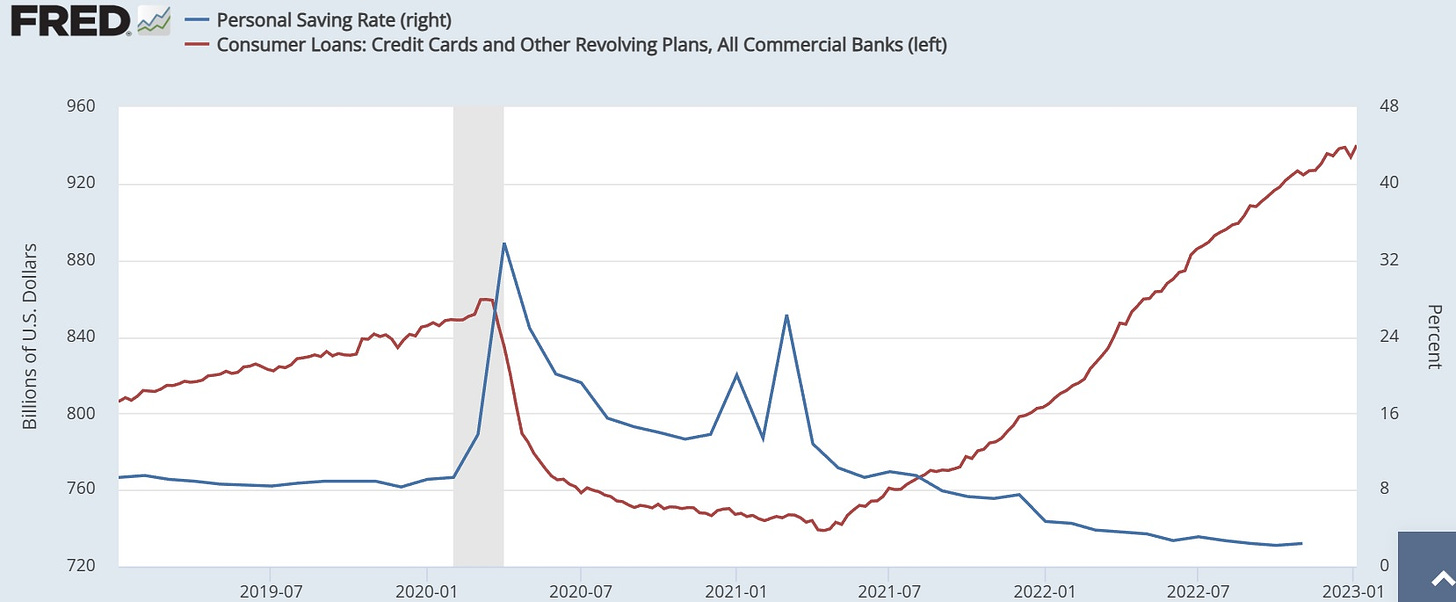

Tapped out consumers

Americans’ credit card debt is soaring while their savings rate plunges. Apparently, after their stimmy checks ran out consumers began paying their rent and feeding their kids by maxing out their credit cards. Now they’re carrying balances that are compounding at 20%+ interest rates. In other words, they’re in no shape to drive the economy higher with their spending.

In an economy that’s 70% consumer spending, maxed out credit cards equal negative growth.

Any of these indicators would by themselves justify caution about the year ahead. But three of them at once paint a clear, very scary picture. Explained another way, the Fed is tightening into an already hamstrung economy, and something is going to break pretty soon. Either a major company defaults, or consumer spending falls taking corporate profits and stock prices along for the ride.

Stay tuned for the investment thesis that flows from imminent recession.

Guest post by John Rubino from his substack.

The Top 5 NASDAQ Stocks to Own for New Year 2023

Even in the worst of times, markets have rallied back. Just as they always have. So, if you’re thinking of quitting the market, don’t. There are plenty of bargains and hot investing ideas to jump on. In fact, here are five of our best ideas for 2023.

One thought on "John Rubino: Why Recession Is Imminent, In Three Charts"

If you look at the budget allocations it is clear that all the old age programs would be manageable without the massive programs and support for the younger generations. These programs could have been easily supported without the managerial elite’s war on labor. The war on labor lead to off shoring and large amounts of immigration from the worlds poor. The people we imported tend to be very low income and utilize these income support programs and Medicare to a very high degree. Our elites did this by design to force the middle/working classes to subsidize the new workers, which in turn increased profits and transferred vast wealth to our overlords. The situation was also like mammon from heaven for the government bureaucrats, because importing mass numbers of foreign peoples broke down social trust and culture. This justified the bureaucrats interventions, increase their power and job security. This alliance between government and business interest is why you see all the racial propaganda, because it makes it much easier to steal from people you demonize. All of this interventions leads to centralization destroying other power centers in the county such as churches, clubs, local governments, private schools, private colleges, etc. After this it becomes impossible to stop, because virtually everyone is dependent on the system, so for change to happen it literally has to collapse.

The incentives created by Democracy will always lead to this, because one man one vote basically becomes legal theft. Organized interest will steal the population blind. These interest get away with it, because they control the money through their control of the media and other institutions(schools, colleges, government, etc) that are used to build consensus to justify the theft. Again this is why white people are told they caused every evil in the world such as slavery, holocaust, native genocide, oppressed women, stole land from Mexico, oppressed gays, etc. So, when they say they want equity they really mean your equity in your house or any other assets they can get their hands on.