From Jay Taylor’s Gold, Energy, and Tech Stocks newsletter:

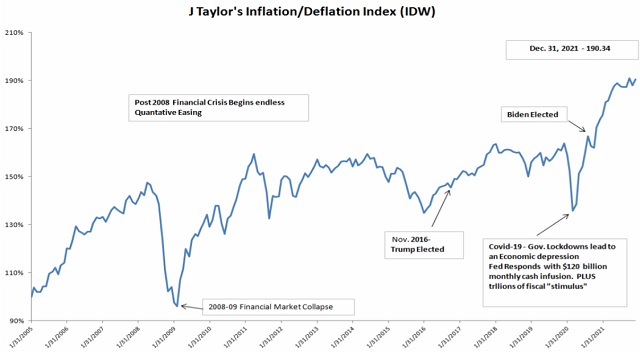

If there was one word that caught the mainstream market off guard in 2021 it was “inflation.” My Inflation-Deflation Index finished near the high for the year at 190.34.

But of course when the word inflation is mentioned most people think of the CPI. More from an Austrian economic perspective, I view the massive rise in stocks and bonds as a major component of inflation that is ignored by the mainstream. But it is at the heart of the massive redistribution of wealth from the middle class to the elite, and Nancy Pelosi absolutely loves the ability to use insider information to get rich. Based on a Periodic Transaction Report that members of Congress are required to file, she has purchased millions in call options in Google, Micron, Roblox, Salesforce, and Disney.

Unfortunately, the strike prices for these call options are not reported but they are longer-term bets that go through 2022 and some into 2023. How objective in making laws that impact those major companies do you think she will be, given her vested interest? Or perhaps more importantly, I should ask, How interested do you think she would be about doing what she could to curb major inflationary pressures that are sending millions of Americans into poverty? The massive amount of money printed by the Fed and fiscal stimulus, combined with COVID-related supply chain issues, have led to this inflation problem.

The big question on the minds of gold and gold share investors is, Why have gold shares not performed well in 2021 despite the fact that consumer prices are taking off like a rocket? I think the two charts here provide a clue to the answer of that question. Note above left the chart displays the year-over-year CPI, which at last report is rising at a 6.8% annual clip. By contrast, the 10-year Treasury is yielding a mere 1.3936%. No doubt a portion of that disparity in the 10-year rate and the CPI is due to the Federal Reserve’s manipulation of rates by printing money out of thin air to buy Treasuries.

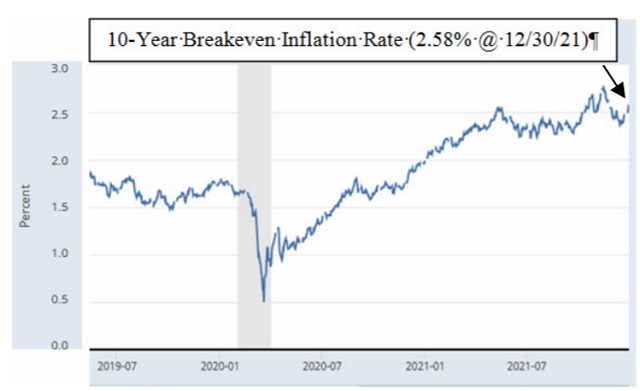

What does “the market” think inflation will be? To answer that question, take a look at the 10-year breakeven inflation rate below. The breakeven inflation rate represents a measure of expected inflation derived from 10-year Treasury. People who want to protect their wealth against what they anticipate will be the inflation rate going forward buy Treasury Inflation Protected bonds, or “TIPS.” Investors collectively bid the TIPS to their view of inflation. So what a TIPS rate of 2.58% as of December 30, 2021, tells us is that the market is still largely buying into the notion that the higher inflation rate over the past few months is still largely transitory.

I must give credit to Kevin Smith of Crescat Capital who used this insight to answer my question about why gold performed so poorly in 2021. You can listen to my discussion with Tavi Costa and Kevin Smith about markets from Crescat Capital’s perspective on my YouTube Channel, JayTaylorMedia.

So based on the TIPS market, it looks like the market in general does not believe we have a growing inflation problem and that the Fed is powerless to keep prices from rising faster and faster.

Actually, as a 74-year-old, I lived through the 1970s double-digit inflation, and what is happening now is very much like the 1970s. If there was one reason why real wages for workers in recent decades declined, it’s globalization and the exportation of high-paying jobs in America. With globalization, labor unions lost their power.

For the first time since the 1970s, labor has tremendous leverage to demand whatever they want, wage-wise. The reversal of globalization is part of the reason labor is gaining power, but it’s also the trillions of dollars that Biden sent to Americans who can now sit on the couch rather than work.

The political pressure to redistribute wealth to the middle classes is powerful. I doubt that the Nancy Pelosi’s of this world will allow their riches to disappear, at least directly through higher taxes. So that will leave the Fed to fund massive fiscal stimulus that many voters will demand.

But perhaps the biggest reason I think rising inflation is sooner or later inevitable is because the debt load is so great now that the Fed will have to keep pumping money into the economy to suppress interest rates as long as they can. Jim Bianco has suggested that the Treasury rate is not saying anything about inflation expectations but rather it is telling us how high rates can go before the system breaks down. During the last Fed hiking cycle, the breaking point was a mere 2.38%.

The 10-year Treasury closed the past year at 1.512%. And given trillions of dollars more of debt-based money in our system, can you imagine the Fed can even hike to 2.38% if that’s all it took to break the system in 2019?

Actually, every time the Fed engages in a systemic hiking of rates, that

always ended with the system breaking down. When that happens next time, we could get a major deflation of financial assets, which is why I’m continuing to hold shorts on the S&P 500 and Junk bonds. Doing so has hurt this letter’s portfolio performance greatly. But I just have to believe equity prices will have to come back to mean valuations this year, unless of course Nancy Pelosi knows something I don’t know. I imagine she does. But contrary to her apparent belief, she isn’t omniscient.

——————————–

Nearly half of your favorite blue-chip stocks will be gone in 10 years.Legendary investor’s new prediction could alter the course of your financial life. The clock is ticking.

Full story here.

4 thoughts on "Jay Taylor: The Interest Rate That Breaks The Markets"