It’s been hard, lately, to untangle the many causes of inflation’s sudden surge. How much is due to the pandemic lockdown distorting year-over-year comparisons? How much to crippled supply chains forcing manufacturers to pay up for needed components? And how much to good old-fashioned excessive money printing?

Whatever the cause, headline inflation numbers have been brutal, with the CPI rising at rates that would normally call for a fast, hard tightening. See Key inflation indicator posts biggest year-over-year gain in nearly three decades.

But now commodities are giving back some of their recent gains. Lumber, for instance, was the gaudiest inflation story of the past year, adding tens of thousands of dollars to the cost of a new home. But its price is now tanking, as homebuilders delay projects and lumber yards loosen up on their suspiciously tight inventories:

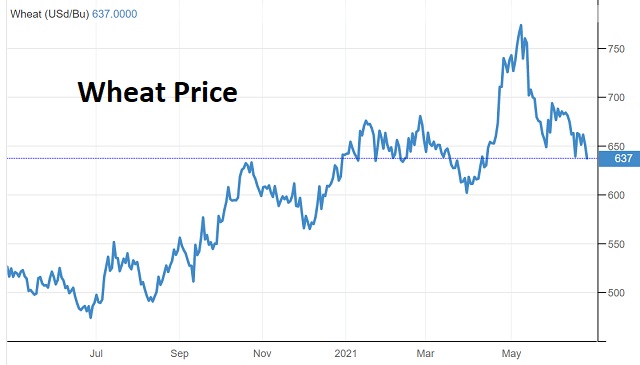

Among the other industrial and agricultural commodities that followed lumber higher in the past year:

Two conclusions:

1) Price trends in the industrial and agricultural commodities space are generally flattening, with only iron ore continuing higher. But price levels are still waaayyy up. Given the time lag between changes in, say, the price of wheat and its eventual impact on the cost of living, the past year’s commodity price increases imply big CPI numbers for the balance of the year, which in turn implies mounting pressure on governments to do something. Put another way, the longer this goes on, the harder the “transitory” inflation label is to justify.

2) As supply chains unkink and lockdown effects lessen, inflation trends will begin to moderate. But the world will still be left with central banks that are incapable of ever raising interest rates or otherwise tightening, for fear of crashing the hyper-leveraged global financial system. So this year’s CPI, while dramatic, is less important than the chaos sure to erupt when the world figures out that ZIRP, NIRP, and QE are the permanent new normal.

——————————–

4 thoughts on "These Big Inflation Numbers Are Interesting But Ultimately Unimportant"