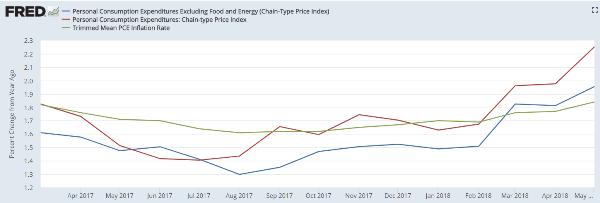

One of the things giving “data-driven” central banks wiggle room on their pledge to tighten monetary policy is the fact that there are several definitions of inflation. In the US the thing most people think of as inflation is the consumer price index, or CPI, which is now running comfortably above the Fed’s target. But the Fed prefers the personal consumption expenditures (PCE) price index, which tends to paint a less inflationary picture. And within the PCE universe, core PCE, which strips out energy and food, is the data series that actually motivates Fed action.

And that, at long last, is now above the 2% target, having risen 2.3% in the past year.

On the following chart, the core PCE is the blue line. Note the steepening slope towards mid-year. This is clearly a trend with some momentum which, if it continues, will take this index from slightly above target to substantially above.

A more surprising above-target reading just came from Germany, which didn’t used to have inflation of any kind. But now it does:

(Reuters) – German inflation surpassed the target set by the European Central Bank for the euro zone in June, the second month in a row it has done so, lending support to the ECB’s decision to close its bond purchase scheme at the end of the year.

Data published by the Federal Statistics Office on Thursday showed that EU-harmonised German consumer prices rose 2.1 percent year-on-year. The same measure had increased by 2.2 percent in May. The yearly figure matched a Reuters forecast.

Again, note the pop over the last couple of months. If this is sustained, the European Central Bank will have to speed up its leisurely tightening pace. Right now it’s scaling back its bond-buying but not signaling higher rates – which will definitely have to be on the menu if German inflation stays above 2%.

Emerging Market Crisis

But there’s a tricky dynamic now in play: Higher interest rates and rising currencies in the core of the global financial system cause trouble on the periphery, which then boomerangs right back to the core. Already, since the US Fed began raising rates and the dollar started rising in response, the effects have been dramatic: In just the past quarter:

- The DXY index, which tracks the US dollar against other major currencies, rose 5%.

- The Argentine peso and Brazilian real fell 30% and 14%, respectively.

- The Turkish lira and South African rand each fell nearly 14% versus the dollar.

- A bunch of Asian emerging market currencies fell 3% – 6%.

- Europe’s emerging markets weren’t spared. The Hungarian forint (-10.0%), Polish zloty (- 9%), and Czech koruna (-8%) led a long list of EU peripheral currency losers.

- China’s stock indexes fell by double-digit percentages in the quarter, though that might have more to do the incipient trade war than relative inflation and interest rates.

- Asian junk bond spreads (their yields versus those of high-grade bonds) widened dramatically.

- Emerging market bank stocks got crushed, including Banco do Brasil (-30%), Banco Bradesco (- 30%), and Brazil’s Ibovespa stock index, down 27% in U.S. dollars.

- Last but definitely not least scary, US and European bank stocks fell hard last week, which isn’t surprising since they’re on the hook for untold amounts of the aforementioned emerging market securities and currencies.

Now, all of this might blow over in coming months the way so many other mini-crises have since the beginning of the Great Monetary Experiment in 2009. But if central banks keep tightening in the face of all this carnage, it might blow up instead of over.

Put another way, stopping the current slide towards financial chaos might require a quick about-face by major central banks towards lower rather than higher interest rates, expanding rather than contracting balance sheets, etc.

Which is a bit of catch-22: The peripheral crisis will keep moving towards the core unless stopped by massive central bank ease. But — given the rising inflation now being reported — central banks won’t switch back to massive ease unless the peripheral crisis moves much closer to the core (or something else equally terrifying happens first).

The resolution or lack thereof won’t be long in coming.

11 thoughts on "Emerging Market Crisis Spreads To The Core, Central Banks Face Catch-22"

I’m not sure why the Fed and “the core” care about all this. If gold were rising then si, but it’s not, at least not yet.

Perhaps our new FED chair will allow for there to be consequences for bad lending. Investor beware.

The capital flight into the dollar is also the result of the immigration crisis in Europe, created by Merkel, who was trying to soften her hardline image against Greece and periphery countries who were not paying their interest to German banksters. Govt corruption is also a driving factor behind capital flows, and as Socialism collapses under the weight of debt, the corruption becomes exposed as govt’s must get more desperate in going after other people’s money. Just wait and see how totalitarian govt’s become as interest expense consumes budgets, and rates will rise due to the loss of confidence and trust in govt.

Why do you ignore the impact of ZIRP on pensions? You should know that the primary reason the Fed sacrificed savers and pensions is it caved to international pressures to keep rates low. This may seem acceptable, since the massive amount of dollar-based debt held by foreigners will suffer more when the dollar rises.

The Catch-22 is that it is a rising dollar that will force the financial reset sooner, not a falling dollar, and it is the larger debt problems abroad that is driving global capital into the dollar.

Excellent and to-the-point article thanks, expresses exactly my view also in my article at https://www.theburningplatform.com/2018/06/30/the-financial-jigsaw-issue-no-7/

When 2008 hit I was cold-cocked flat. I had no idea how the economy worked and never saw it coming. This time I’m ready because I read, read and read!