After an artificial pause in 2017, US government debt has resumed its inexorable climb…

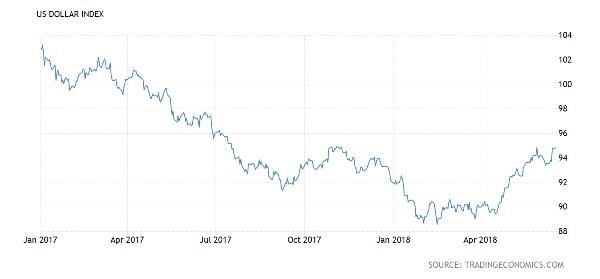

…the dollar has fallen by around 5%…

… and inflation – even the massaged-beyond-recognition Consumer Price Index (CPI) – has shifted to a higher gear, driven by rising oil.

All of which should be great for gold, right? Well, not so much. It’s almost exactly unchanged from last June:

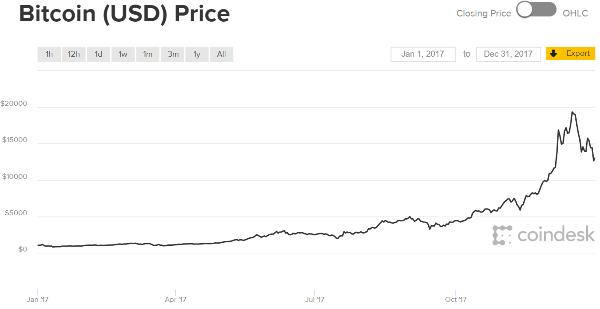

Gold’s failure to take off like like a rocket when conditions become this favorable has been a puzzle for its fans. One explanation that has gained a lot of, ahem, currency is that it’s been replaced of late as the world’s safe haven asset by cryptocurrencies, bitcoin in particular. Bitcoin’s price action in 2017 appears to support this thesis. While gold was treading water, the capital markets may indeed have responded to the newly-inflationary environment. They just chose to hide out in cryptos rather than precious metals.

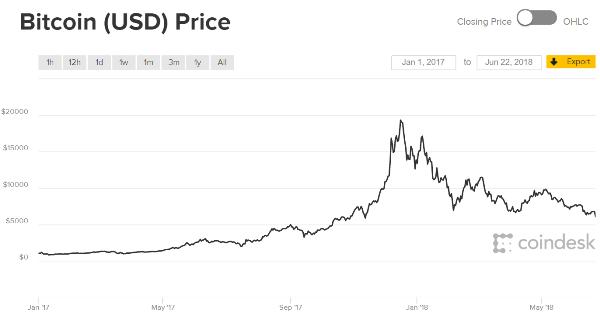

Which makes the last few months a bit of a mystery. Most of the above inflationary macro trends are still firmly in place. But bitcoin has fallen out of favor, hard. Here’s the previous chart, extended to include the first half of 2018:

So if global financial markets are increasingly unsettled, and cryptos have proven to be unsound hiding places, where is all the terrified capital going to scurry next?

In every cycle of the past 2000+ years, the answer has been gold and silver. Let’s see if history remains a useful guide.

8 thoughts on "If Bitcoin’s Rise Was Bad For Gold, Will Its Fall Be Good?"

Far too many people view cryptocurrencies and precious metals as mutually exclusive, when they share many qualities. In the case of bitcoin, it is scarce and expensive to mine. I think cryptocurrencies are here to stay, and like precious metals are an alternative form of investing.

I invest in both cryptocurrency as well as gold. I try my best to ride the way up, then sell for gold, and buy low again (maintaining a hedge). The thing is though, most people investing in crypto don’t understand economics or money. They believe Gold is for old people and Bitcoin is the new Gold.. In reality though.. Bitcoin has no reason for it’s value. There are a ton of way better cryptos out there. Now though, people are doing gold-backed cryptos. One of the most interesting ones I saw was Quintric, which livestreams their vault of legal tender gold. If you don’t know what that is, it’s basically a return to the gold standard. I don’t have any investment in it, I just think it’s really cool and I want them to do well. Check it out!

I just found out about them on Steemit! Can’t believe I found someone here into Cryptonomex. Stan is a gem in the crypto world. I’m going to have to do more research into legal tender gold. Can’t wait for July 4th:)

What I find ironic is that cryptos are supported because of speculative plays on alleged possibilities, but they are not well understood.

That said, I consider the drop in PM prices to be somewhat expected because they are being sold to cover long option positions and margin calls as the stock market drops.

Furthermore, the dollar is also strengthening since it is the least ugly contestant, and everyone has dollars so it is supported to avoid mutually assured destruction.

There are obviously hundreds of millions of people who would love to transition to cryptos, but the collective industry has got to make some evolutionary changes. Nascent instability & volitility is natural & understandable. But unless cryptos’ role is nothing more than a proxy for treasuries & bonds (and not useful as currency), they’ll remain extremely dangerous investments.

Gold is being effectively held in a headlock by paper based trading that prevents true price discovery so articles like this one become redundant. History is NO guide as EFTs weren’t around to distort Au markets.

Gold will only come to the fore when paper based assets are discredited through an economic reset due to the amount of debt across the planet.

This article presents gold as a speculative investment, it’s not, it’s cheap insurance for tail risk events that are inevitable, but timing unknown.

Still, John, love your work, it gives us plenty to consider !!!