Guest post by Richard Mills from Ahead of the Herd:

Gold is a safe haven in times of war, or any other type of geopolitical instability.

During the 1970s, which saw a number of upheavals in the Middle East including the Iranian Revolution, the Iran-Iraq War, and the Soviet invasion of Afghanistan, gold rose 23% in 1977, 37% in 1978, and 126% in 1979, the year of the Iranian hostage crisis.

Gold also spiked when the US bombed Libya in 1986, when Iraq invaded Kuwait in 1990, after 9/11, and when the US attacked Iraq in 2003.

More recently, in 2020 gold reached $2,034 an ounce on fears of the coronavirus spreading and causing economic devastation.

While gold has since pulled back, due to the US Federal Reserve raising interest rates five times this year (and very likely a sixth, in November), on 40-year-high inflation, the precious metal once again returned to safe-haven status following Russia’s invasion of Ukraine.

After the US and the UK announced bans on Russian oil imports, on March 8 spot gold touched $2,051 per ounce, the highest since August 2020 when it reached its all-time peak of $2,072.50.

Blowing up the Treasury

Gold right now is a classic contrarian play, given that its price has declined about 10.8% so far this year.

Soaring bond yields indicate that investors think the Fed Reserve will do whatever is necessary to bring down inflation, and will succeed, without crashing the economy. But, once the Fed can no longer deny that it’s wrong about being able to control inflation, and that the economy is weaker than they think, it will go back to loose monetary policy, i.e., quantitative easing (good for gold).

The Fed, or US central bank, claims it will stop raising the federal funds rate when it reaches 4.6%, about 150 basis points higher than the current FFR, which is in a range of 3.0 to 3.25%. When the Federal Open Market Committee meets in early November, it is expected to hike rates another 75bp, to a range of 3.75-4.0%.

Most market participants see the Fed’s tightening policy as similar to what Paul Volcker’s Fed did in the late 1970s, when double-digit inflation necessitated a cycle of rate hikes that brought the FFR to 20%. Volcker succeeded in taming inflation but the price was the 1982 recession, considered one of the longest and worst in economic history.

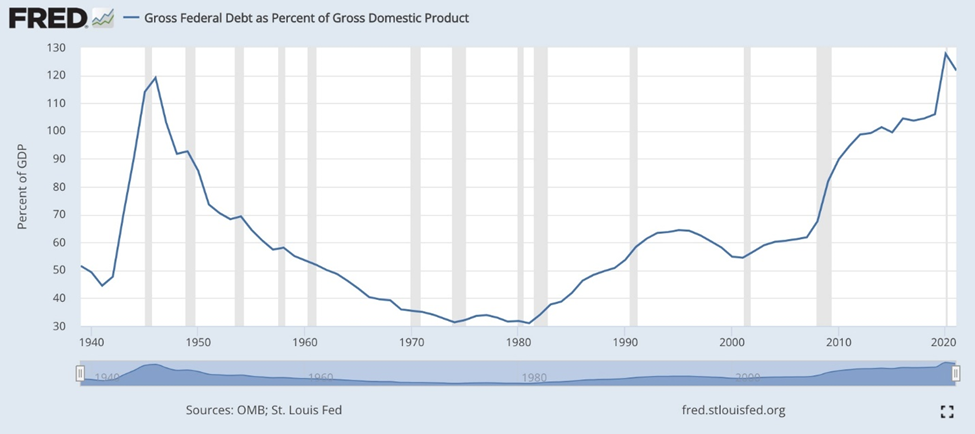

There is one crucial difference between 1982 and 2022, and that is the debt. According to the FRED chart below, the US debt to GDP ratio in 1982 was around 35%. Today it is more than three and a half times higher, at 125%.

This severely limits how much and how quickly the Fed can raise interest rates, due to the amount of interest that the federal government will be forced to pay on its debt.

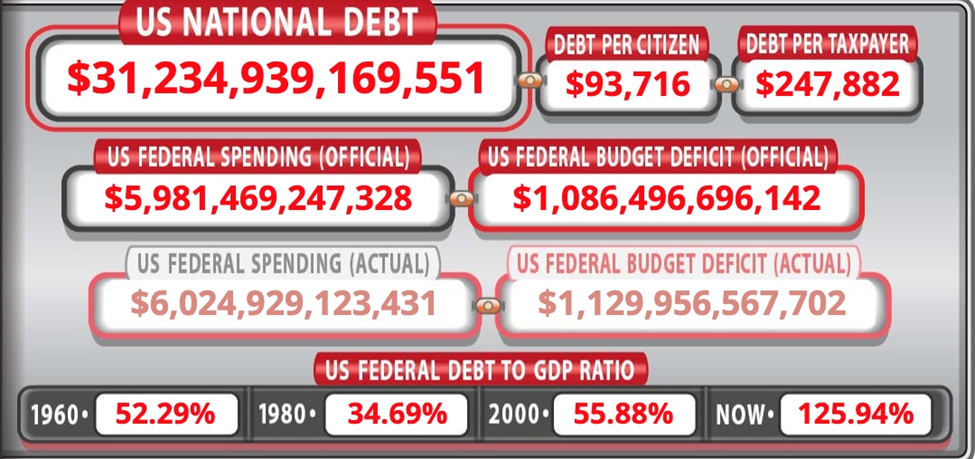

During 2021, before interest rates began rising, the federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. If the Fed raises the FFR to 4.6%, interest costs would hit $1.028 trillion — more than 2021’s entire military budget of $801 billion!

Both political parties have been spending money like a drunken sailor on a Saturday night in Prince Rupert, and must keep doing so, to get re-elected; reducing expenditures is not a solution.

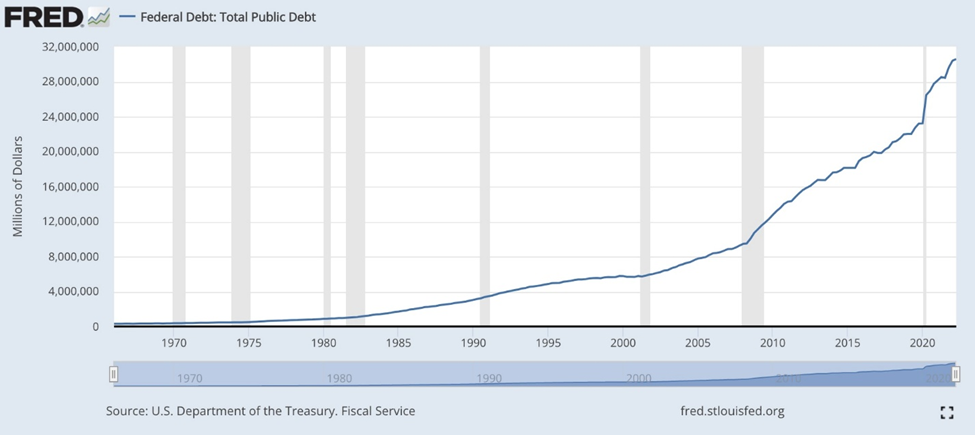

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2008-09 financial crisis and the covid-19 pandemic in 2020-22.

Obama added $8.6 trillion during his eight years in office. When Trump was handed the keys to the White House in January 2017, the national debt stood at nearly $20 trillion. When he left, in Q1 2021, it was at $28.1T. So far the Biden administration has added over $3T to the debt. The Committee for a Responsible Federal Budget estimates “the Biden Administration has enacted policies through legislation and executive actions that will add more than $4.8 trillion to deficits between 2021 and 2031, or nearly $2.5 trillion when excluding the effects of the American Rescue Plan.” [of $1.9B – Rick]

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now standing at a gob-smacking $31.2 trillion.

Considering that egregious over-spending with annual deficits exceeding $1 trillion is likely to continue, the question is who will fund the higher interest costs? The answer is investors, foreign and domestic, who buy US government bonds and notes, issued by the Treasury Department to fund government expenditures.

The problem is that right now, just about everyone is fleeing Treasuries.

Bloomberg reported on Oct. 10 that the biggest players in the $23.2 trillion US Treasury market are in retreat:

From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away. And then of course there’s the Federal Reserve, which a few weeks ago upped the pace that it plans to offload Treasuries from its balance sheet to $60 billion a month.

Emerging-market central banks have trimmed their stockpiles by $300 billion this year, International Monetary Fund data show.

Central bank buying represents the largest reduction in demand for US Treasuries. According to Fed estimates, the balance sheet could fall from nearly $9T to $5.9T by mid-2025, should Fed officials stick to current roll-off plans.

Commercial banks are also bailing on T-bills, with demand from them dissipating as Fed tightening drains reserves out of the financial system. A JPMorgan strategist was quoted saying that banks during the second quarter purchased the least amount of Treasuries since the final three months of 2020.

If the regular buyers of US debt continue to stay away, it will fall to the lender of last resort, the Federal Reserve, to step in. Because the United States holds the reserve currency, it can buy up as many Treasuries as required, by printing money, something no other country can do. These days bills aren’t actually printed on a press, they are just added to a computer screen, but the inflationary effect is the same.

The key point is, the Fed can only push interest rates so high, without blowing up the Treasury and being forced into an aggressive bond-buying program (QE), thus accelerating inflation. The irony is that in trying to bring down inflation through interest rate hikes, the Fed, because of the high debt levels, will fail, and will be forced into a loose monetary policy involving interest rate cuts and QE.

And there’s something else, another bad outcome. The Jerome Powell Fed must realize that in raising interest rates so high that they cause a recession — which is the road we are now likely headed down — they will also be crimping tax receipts, making the deficits worse. How?

The US economy, and economies elsewhere, is about two-thirds driven by consumer spending, so by raising the cost of borrowing, to buy houses, cars, televisions, etc., they are in effect, “killing the consumer”, who is already struggling with a September Consumer Price Index of 8.2%. Everything has gone up, including the essentials — food, fuel, electricity. In a recession, consumers buying less means lower sales taxes paid. If workers lose their jobs it will mean less income tax submitted. A recession also translates to lower corporate earnings, lower economic growth and less business taxes entering government coffers.

Emerging market crisis

The strong dollar is causing problems among developing countries who borrow in currencies other than their own, usually dollars or euros.

Developing-world economies that borrowed heavily in dollars when interest rates were low, are now facing a huge surge in refinancing costs.

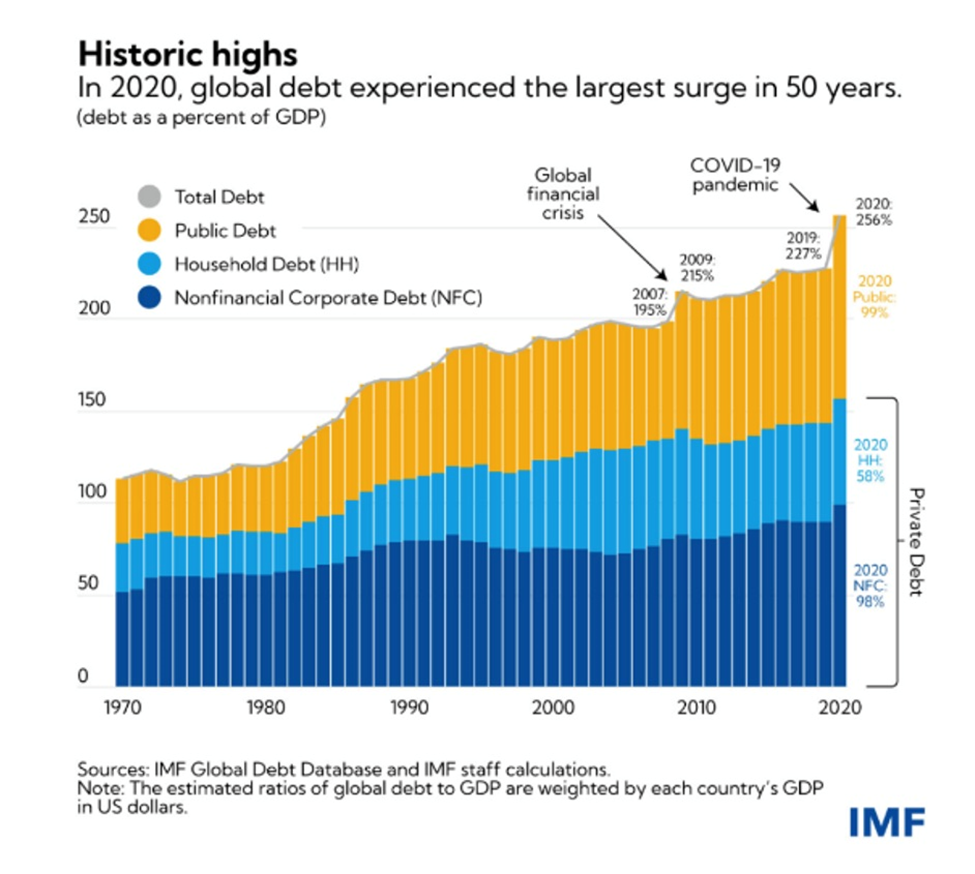

The 16% climb in the greenback this year has raised the cost of their dollar-denominated imports and triggered inflation, as the value of their currencies relative to the dollar plunged, prompting their own central bank tightening cycles. The latter is hindering economic growth. The IMF has downgraded its 2023 growth outlook for the world economy to 2.7%, down from the 2.9% they had estimated in July.

Sovereign dollar bonds from a third of countries within the Bloomberg EM Sovereign Debt Dollar Index, are trading with a spread of 1,000 basis points of more over US Treasuries — a generally considered metric of distress.

A wave of defaults across developing nations would have major implications for the global economy, just as Asian debt contagion in 1997 spread to Russia and Latin America.

So long as the dollar is at a high level, this risk grows. According to Bloomberg 15 of 23 emerging-market currencies are down more than 10% this year, heaping pressure on governments at a time when energy bills are also rising. Developing-nation governments need to pay back or roll over about $350 billion in dollar- and euro-denominated bonds by the end of 2024.

Japan and the UK are two examples of what can happen when currencies flop and/ or government bond yields climb too high.

Japan in September intervened to support its currency for the first time since 1998, raising speculation the country may need to sell its hoard of Treasuries to further prop up the yen.

The Bank of England came to a similar conclusion after only testing QT. When new (now resigned) Prime Minister Liz Truss promised tax cuts, and social spending to lower the cost of electricity, the UK bond and currency markets had a hissy fit. The British pound plummeted and yields on government bond yields soared.

Truss’s unfunded proposals triggered a gilt-market rout. For five days, not a single gilt, the UK equivalent of a Treasury note, was sold!

Alarmingly, this episode could be a preview of a world sovereign debt crisis, wherein central banks are forced into printing money and buying bonds via quantitative easing.

De-dollarization

Meanwhile, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

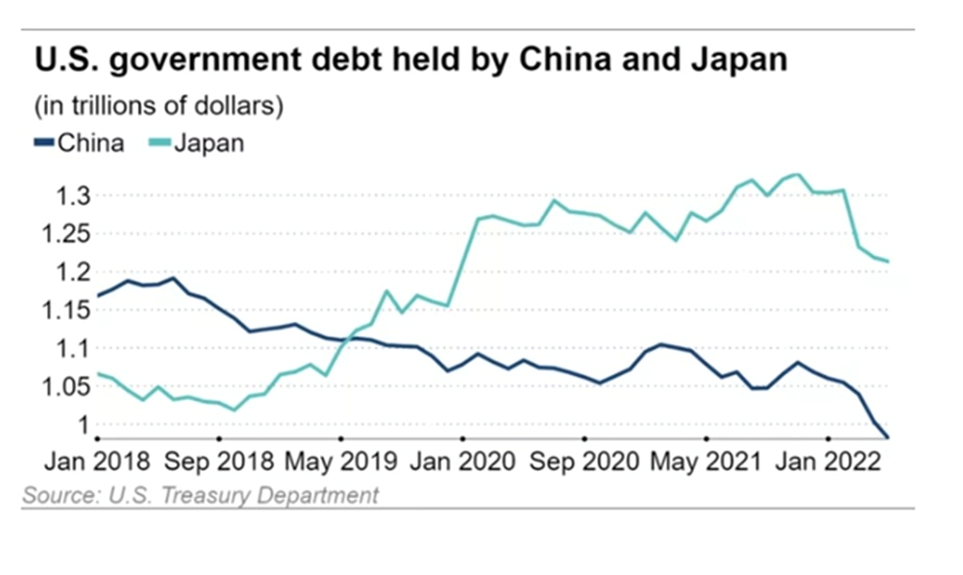

For the first five months of this year, China’s Treasury holdings fell below $1 trillion, a 12-year low, with concerns about the risk of Russia-style sanctions accelerating a financial decoupling driven by political tensions, according to Nikkei Asia. The country sold US government debt for a seventh straight month in June, signaling that Beijing is trying to defend the yuan against the dollar, added Markets Insider.

Between de-dollarization and investors fleeing Treasuries, it appears likely that the US Federal Reserve will be forced into buying the debt, issued to finance the federal government’s expenditures.

It must be noted that the majority of this debt is short-term, i.e., the vast majority of outstanding US Treasury bonds will mature in the next four years. Former Treasury Secretary Mnuchin tried to extend the duration but there was not enough demand for long-term Treasuries.

One may conclude that the US can easily refinance this debt. I’m not so sure. The lack of Treasury buyer interest is troubling. What happens if Japan offloads their $1.2T pile of Treasuries? Or if US fiscal deficits balloon further, requiring more Treasury debt to be issued? Will there be enough buyers?

The rapid increase in the interest rate on US 2-year Treasury bonds is expected to have a hugely negative impact on the federal budget.

With over $31T of debt, the US government budget is at great risk of running unsupportable deficits if interest rates continue to increase.

Gold historically performs best when government deficits are large and/ or growing. While the market currently doesn’t understand the looming US deficit problem, we believe when it becomes more apparent that the government has a debt servicing issue and that interest rates are making it worse, then demand for US Treasuries will fall even further. Could we be heading for a “no bid” situation like in the UK when buyers for UK gilts completely disappeared?

Eventually, if the debt grows more rapidly than the GDP, which it has done for several years now, the interest payments could become so high that the US defaults on its debt. While that would be catastrophic to the global economy, it would obviously be good for gold.

Safe-haven demand ramping up

Gold investors love nothing more than geopolitical instability to watch the value of their bullion grow. Heightened global tensions such as wars, terrorist attacks, border skirmishes or civil wars scare investors into putting their funds into safe havens like gold.

The world today is clearly becoming more dangerous, evidenced by the war in Ukraine, escalating tensions between the US and its adversaries, such as Russia and China, and even traditional allies like Saudi Arabia.

Earlier this month, the Saudi government rejected a request from the Biden administration to delay an oil output cut until after the midterm elections, stating that all OPEC decisions are based on economic forecasts and needs. The early October decision by OPEC+, which includes non-cartel oil exporters like Russia, to slash 2 million barrels a day starting in November, has angered US lawmakers who, according to CNBC, are calling for a re-evaluation of relations with the kingdom.

The war in Ukraine reached a dangerous phase Sunday, when the Russian Minister of Defense alleged that Ukraine was preparing to use a “dirty bomb” on its own territory. The claim by Sergey Shoigu sparked fears that Russia might be laying the groundwork for using a nuclear weapon and blaming Ukraine for it. President Putin has threatened to use nukes to reverse the course of his war. ABC News reported the Ukrainian Ground Forces commander saying that Putin’s nuclear threat is real and that the West “should be worried”.

Not helping to de-escalate tensions, last week NATO began a round of nuclear exercises simulating the dropping of ‘tactical’ B61 nuclear bombs over Europe. Although these drills are presented as routine, they are occurring alongside parallel Russian exercises. It’s hard to imagine worse timing.

Surely with concerns about armageddon expressed at the very highest levels of power, these exercises should have been called off as a message that the West won’t contribute to escalating nuclear tensions? Instead, our leaders are systematically failing to reduce the risk, anti-nuclear and anti-war campaigner Dr. Kate Hudson wrote in an Aljazeera opinion piece.

In China on Sunday, President Xi Jinping secured a historic third term as the country’s top leader, after retiring key party leaders from the new Central Committee to make room for his allies.

The move is a break from the traditional two-term limit, allowing Xi to remain in office another five years. The limit was introduced by Chinese leader Deng Xiaoping in 1982 to prevent a return to a Mao-style cult of personality, but Xi removed it in a 2018 constitutional amendment.

During the twice a decade Communist Party Congress, which concluded on Saturday, Xi appeared to order the exit of former president Hu Jintao, in what looked like a modern-day purge. According to The Indian Express, Hu is the leader of a group called “tuanpai” or populists, that is opposed by Xi and his group of “princelings”, who have marginalized opponents.

That makes it likely the incident was a show of force by Xi, who is widely seen to have cemented power by eliminating rivals and dampening the lingering influence of party elders.

For the West, it’s another example of increasingly authoritarian rule.

Xi has strengthened the power of the Chinese military and has consistently maintained that China must re-unite Taiwan, a US ally, with the Motherland. Last year Xi said that “reunification with Taiwan must be fulfilled,” after sending a record number of military jets into the island’s air defense zone. He has also pledged to “smash” any attempts at formal Taiwanese independence, the BBC said.

Conclusion

Between all of the global pressure points requiring a safe-haven investment, and the fact that, by “blowing up the Treasury” with incessant interest rate hikes that are going to force the Fed to pivot back to monetary easing including QE and interest rate reductions, we see the perfect setup for gold, soon coming to a market near you.

The time to buy gold, or any other investment, is when it’s hated and undervalued. The current sentiment in the gold and silver markets is very negative. Producers and junior miners are on sale and the juniors with the best development projects are offering major upside.

Personally I am taking advantage of the lull in the markets to accumulate positions in high-quality exploration companies with excellent projects in low-risk jurisdictions.

I see us going into a rising gold price environment and historically the greatest leverage to an increasing gold price is a quality junior. Also, for several metals like copper, lithium, nickel and graphite, the green revolution is demanding more metal than can be supplied, and junior companies own the world’s future mines, making them extremely attractive take-over targets.

Guest post by Richard Mills from Ahead of the Herd.

4 Top Stocks for a Bear Market

Historically, things like precious metals, consumer staples, commodities, utilities, health care, and transportation stocks have performed well in a bear market. Our experts say these 4 stocks are positioned well – even in a down market.

Click here to get the names & ticker symbols of all 4 stocks.