When the financial markets got, um, choppy towards the end of 2018, the Fed caved almost instantly. But only rhetorically.

Fed chair Powell promised to stop raising interest rates and shrinking the money supply, and the financial markets, trained to salivate at the sound of Fed happy talk, immediately morphed from “risk-off” to “risk-on.” Stocks are now approaching last year’s all-time highs, bond prices are way up (which is to say long-term interest rates are way down) and the financial press is back to celebrating the “Goldilocks economy.”

But remember that as far as actual monetary policy goes, nothing has changed. Last year’s Fed Funds rate increases are still in place, while the Fed’s balance sheet remains diminished (which is to say the cash drained from the economy as the bonds in the Fed’s account were retired remains out of action). So the damage has not been undone, and it’s starting to bite. Some examples:

US retail sales are falling:

source: tradingeconomics.com

Housing, which a year ago was in a mini-bubble, is rolling over. Housing starts are down…

source: tradingeconomics.com

… while existing home sales have cratered:

source: tradingeconomics.com

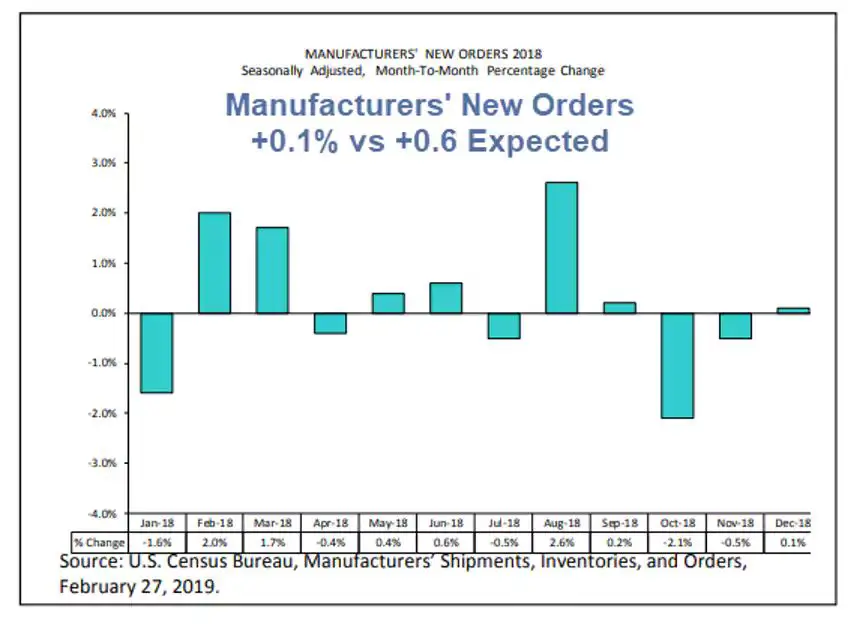

US manufacturing orders missed big in the most recent reporting month:

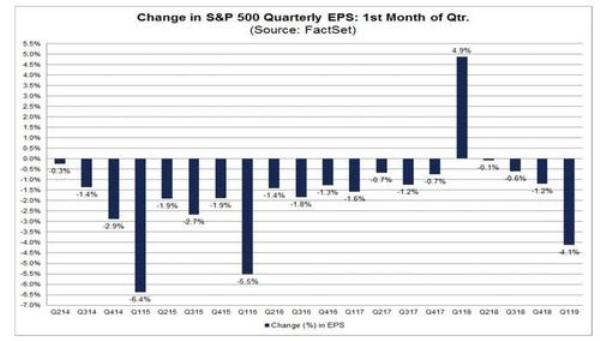

Corporate earnings, meanwhile, are so weak that analysts are talking about an “earnings recession”:

From a February Zero Hedge article:

One week ago, when looking at the dramatic collapse in consensus Q1 EPS estimates, we noted that the “profit party” is over and the days of near record earnings growth are about to end with a bang as a result of the recent barrage in profit warnings and negative preannouncements, first and foremost starting with Apple, which issued a shocking guidance cut one month ago for the first time since 2001. As a result, analysts have slashed their S&P500 earnings estimates for the first quarter, and the Q1 bottom-up EPS estimate dropped by 4.1% (to $38.55 from $40.21) during this period.

All eleven sectors recorded a decline in their bottom-up EPS estimate during the first month of the quarter, led by Energy (-22.5%) and Information Technology (-7.3%). Overall, seven sectors recorded a larger decrease in their bottom-up EPS estimate relative to their 5-year average and their 10-year average for the first month of a quarter.

And the slowdown is global. Here’s German GDP growth:

In February MarketWatch asked:

Is Germany already in a ‘technical’ recession? These economists think so

Investors are worried that a global slowdown led by China could begin to sap U.S. growth, but it’s Europe that’s looking a little sickly at the moment.

Expectations that Germany, Europe’s largest economy, could post a second consecutive quarter of falling gross domestic product were on the rise after a dismal reading on November industrial production last week, which showed a 1.9% fall, defying a forecast for a 0.3% rise.

“Industrial production data was a proper disappointment this month. Our German GDP tracker has deteriorated to minus 0.1% [quarter-on-quarter]. This would be the second consecutive [quarter-on-quarter] GDP contraction, meaning Germany could now be in a technical recession,” wrote economists Evelyn Herrmann and Gilles Moec at Bank of American Merrill Lynch, in a Monday note (see chart below).

Germany’s slowdown is attributable in part to slowing activity in China, the economists said. And concerns about China are certainly on the rise thanks to homegrown headwinds and the continued trade battle with the U.S.

What does all this mean? Mainly that despite the recent bounce in US financial asset prices, the Fed didn’t succeed in stabilizing the real economy. With the major countries pretty much all slowing down, corporate profits will likely fall this year. Falling corporate profits tend not to support record-high share prices. And the longer the slowdown continues the bigger the risk that stock investors will catch on and panic, taking us back to the flash bear market of late 2018.

Then it gets interesting. Realizing that words have failed, the Fed will be forced to stop promising and start delivering. So the second act of this play will be not just a pause but a reversal of last year’s tightening.

But this won’t work either. A modest reduction in interest rates and slight increase in asset purchases will buy, at most, another two-month pop in share prices, followed by another realization that the economy is still weakening, followed by yet another, probably much bigger stock market plunge.

Eventually, we’ll settle into a permanent state of ever-increasing QE, zero-to-negative interest rates and every imaginable kind of fiscal stimulus.

A simple way to guage our place on this path is the price of gold. When Act Two (gradually falling interest rates, modest QE) is implemented, gold should bounce back up to around $2,000/oz. Once Act Three (massive, permanent QE, NIRP, bailouts for bankrupt states and cities) is in full swing, gold should pass $5,000 on its way to infinity.

11 thoughts on "Remember, The Fed Hasn’t Actually Done Anything Yet"

I hope JR is right on his analysis but I’m still dubious and concerned.

He writes, “A simple way to guage our place on this path is the price of gold.”

Well, that may sound simple but I don’t think it will be. For one thing, investors haven’t cared about all of the central bank debt monetizations throughout the world for the last 10 years so I’m not so confident they’ll be any wiser if/when the Fed reverses course. Similarly, investors haven’t cared – and still don’t – about the ECB’s “whatever it takes” monetization efforts in Europe that JR thinks the Fed may have to resort to, and they certainly haven’t cared – and still don’t – about the BOJ’s actions to buy up every single Japanese government bond that’s issued ((to the consternation of regular Japanese investors, if you can believe it.)

Therefore, I’m wary of feeling so confident that investors will run to gold (i.e., increase demand for) just because more of the same continues, or even MORE of more of the same. I just don’t know what will trigger a change in sentiment, but it seems that whatever it will be it won’t be “rational.” Rationality in politics and finances was left at the train station a long time ago.

Furthermore, EVEN IF gold demand increases amongst the sharpest knives in the drawer the PRICE of gold may still not go up because of the wildly alleged purposeful price suppression schemes that central banks, et al have been, and supposedly still are, engaged in.

Remember, ex Fed Chairman Alan Greenspan (or was it Paul Vocker?) said that the one mistake that was made during the reflation efforts by the Fed in the early 1980’s was “losing CONTROL of the gold price.” (Emphasis mine.) So, if things really AREN’T different this time (they supposedly never are) then I have no reason to think gold price controls will be not used, or continued – and even more diligently this time, given the “lesson” of 1980.

I admit I don’t know exactly how it’s done – or even if it’s done very much at all given the apparent lack of gold demand now (CB purchases not withstanding) – and so I don’t have a good sense about how long it can continue, or what will foil it.

In any case, I find all of this interesting as hell, and am looking forward to seeing how it unfolds.

P.S. Thanks, John, for fixing the bit coin “meter.”

Start making residual profit on weekly basis… This can be a great part-time job opportunity for anybody… The best benefit of working over the internet is that I am always home with the kids.The best part about it ,work from comfort of your house and get paid $100-$2000 every week … Start now and have your first cash by the end of this week…> https://wplnk.com/12a1

The internet work opportunities have become a emerging trend in all over world these days. The latest research suggests higher than 75% of the people are working in on-line job opportunities at their house without having difficulties. The Online world is doing well every single day and therefore everyone is having an ocean of opportunities over the internet to earn an income. Every person would like to spend time with his/her family by getting out for any attractive place in the world. So web-based income enables you to accomplish the work at any time you want and enjoy your life. Though selecting the right strategy and setting a right destination is our strategy in the direction of financial success. Already lots of people are bringing in such a great income of $34000 in one week by using highly recommended and successful methods of generating income online. You can start to get paid from the first day at the time you explore our web site. GET IT HERE >>>>> https://lnk.ski/vfy5

On-line work opportunities are becoming a emerging trend in all over world now. A current research illustrates more than 77% of the people are working in internet job opportunities at their house with no difficulties. The Online world is growing day-after-day and therefore everyone is having an ocean of work at home opportunities via internet to generate an income. Everybody really want to spend time every day with his/her relatives by going any beautiful place in the country or any other country. So on-line income allows you to carry out the work at any time you want and enjoy your life. Though selecting the best direction and also building a proper destination is our milestone in direction of success. Already most people are generating such a great earnings of $10000 each week with the help of suggested and successful methods of earning money online. You can start to earn from the 1st day as soon as you see our site. FOLLOW THIS >>>>> https://crown.link/ac

On-line job opportunities are increasingly becoming a emerging trend in all over world now. Latest survey tells us over 75% of people are working in web-based jobs from home with no problems. Every person desires to hang out with his/her friends by going any wonderful place in the country or any other country. So web based income enables you to complete the work at any time you want and enjoy your life. However selecting the best path furthermore building the right aim is our ambition towards success. Already a lot of people are obtaining such a good revenue of $41000 each and every week making use of suggested as well as successful ways to making money on the internet. You will start to earn from the 1st day after you browse through our web site. >>>>> http://www.helios-store.com/Bmj

Internet based job opportunities have become a trend in all over world nowadays. A current research demonstrates more than 76% of people are working in web-based jobs from home without having issues. Everyone would like to spend time with his/her best friends by getting out for any wonderful place in the world. So web based income enables you to do the work at any time you want and enjoy your life. Though determing the best strategy furthermore setting up a right aim is our end goal towards success. Already the majority are gaining such a good earnings of $34000 every week making use of highly recommended and powerful methods of generating massive income online. You can start to get paid from the first day after you have a look at our web site. >>>>> https://iplogger.org/2L6Cj5

On-line job opportunities increasingly becoming a trend in all over world nowadays. A current survey shows even more than 78% of people are working for online jobs at their home without any issues. Everybody wants to spend more time with his/her family by getting out for any attractive place in the country or any other country. So on-line income enables you to carry out the work at any time you want and enjoy your life. Though selecting the proper method furthermore setting the right target is our goal towards financial success. Already plenty of people are being paid such a decent earnings of $29000 each week through highly recommended and powerful techniques for generating massive income online. You can begin to earn from the 1st day once you look at our website. >>>>> http://aadgo.com/x1bpR

Current study shows that over 75% men and women are involved into online activities. On-line arena is becoming bigger and even better and making a great number of work at home opportunities. Work at home on-line tasks are becoming poplar and transforming individual’s day-to-day lives. Why it is preferred? Simply because it lets you work from anywhere and anytime. You are able to get much more time to allocate with your family and can plan out tours for vacations. Individuals are making nice earnings of $31000 per week by utilizing the efficient and intelligent ways. Performing right work in a right direction will always lead us towards success. You can begin to get paid from the 1st day at the time you have a look at our website. >>>>> REGISTER

I actually gain approximately $6,000-$8,000 each month using the internet. It is absolutely enough to undoubtedly replace my past workplace salary, mainly taking into account I only just do the work nearly 20 hrs weekly from home.I ended up losing my job after doing work for the same enterprise for years, I required very trustworthy income. I was not researching for packages that miguide you to make you millionnare within few days you can see all over the net. Those all of them are type of ponzi multi level marketing plans in which you have to first get prospects then sell something to friends and family members or any individual so that they will be in your team. The greatest benefit of working online is that I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. Honestly,it is actually easier than you would believe, all you have to do is fill out a simple form to get front line access to the Home Profit System. The guidelines are incredibly easy, you don’t have to be a computer whiz, however you should be aware how to use the net. It’s as easy as being on Facebook. Here’s the best method to start >>>> http://4sq.re/wkn24

Earn residual money every week… This is an amazing part-time work for everyone… Best part about it is that you can do this job from comfort of your home and start getting from $100-$2000 at the end of every week … Apply for the job now and have your first paycheck by the end of the week…> http://sonc.xyz/bs

Excellent overview on the likely direction of the Fed and markets. The fact is that growth has stopped and has been negative if you believe John Williams at http://www.shadowstats.com/alternate_data

which conforms to my projections described in Chapter 13 of my book: The New

Emergent Economy”.

I propose that USA is already in recession (and has been ever

since 2000) – just check out GDP figures published by John Williams at: http://www.shadowstats.com/alternate_data/gross-domestic-product-charts which is why the 95% are suffering a severe depression but the elite are fudging the stats and SNAP etc

avoids the food queues.

My timing is rather more restricted to the 2020s because EROEI is driving the global economy to slow down quicker than expected.

https://ourfiniteworld.com/2019/02/22/have-we-already-passed-world-peak-oil-and-world-peak-coal/

A free pdf of my book is available on request to: peter@underco.co.uk