This week’s theme is “spikes and crashes,” and why they’re great for gold and silver.

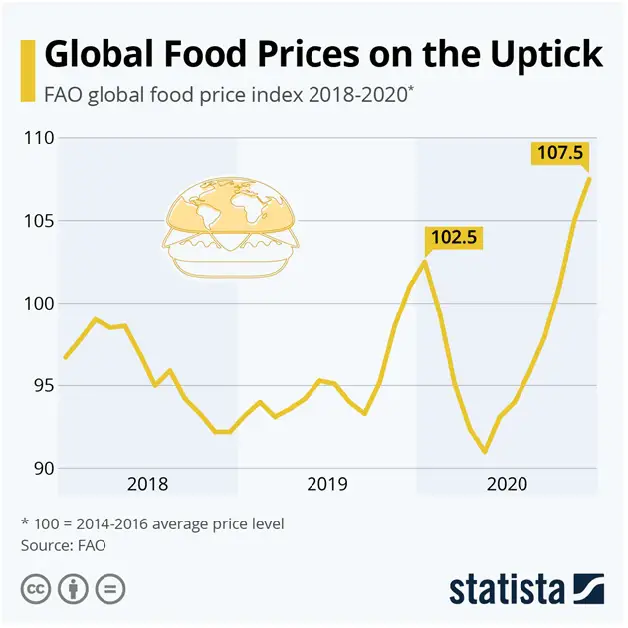

Let’s begin with inflation, which is suddenly spiking after decades of illusory quiescence. What actually happened was that there was raging inflation, but only in “good” sectors like stocks, bonds, and real estate. Now price increases are migrating to the “bad” places like food and raw materials.

The result is a sudden jump in overall inflation, which going forward will be a lot harder to hide from the general public.

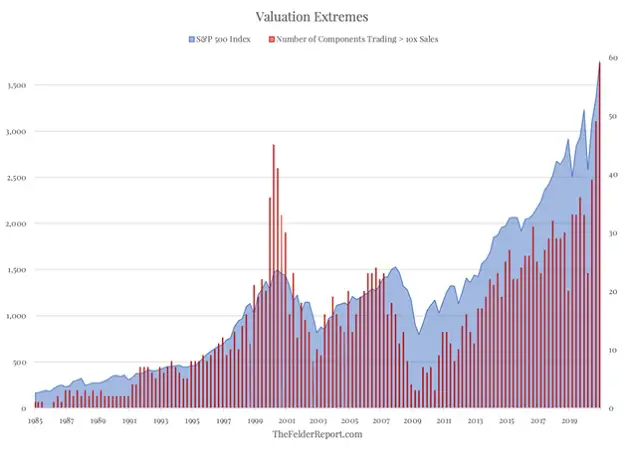

Stocks, meanwhile, are now as overpriced as they’ve ever been, according to a growing number of measures. Check out the spike in the number of companies trading at more than 10 times sales. In case you’re not familiar with that measure, it implies a really, really expensive stock. Members of the DollarCollapse staff are now shorting some of these ridiculous situations, including Tesla.

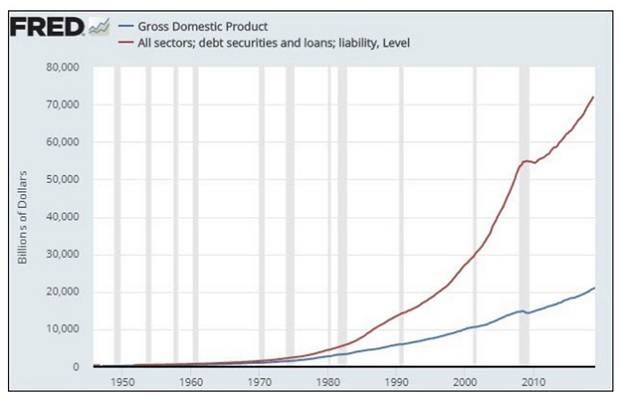

The fuel for this inflationary fire is debt-to-GDP, which continues its parabolic rise. This year should see it go vertical — which is why shorting Tesla does carry some risk even at current prices.

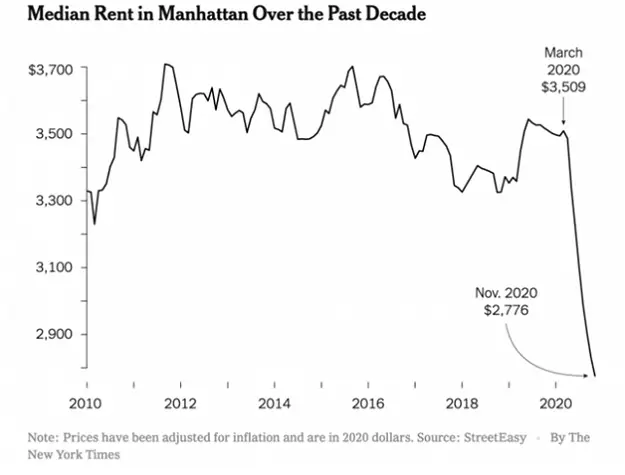

One of the rare places where inflation has been replaced by extreme deflation is big-city apartment rents. This has less to do with the overall economy than with the sudden realization that cities are no longer safe places to live. But it does portend serious trouble in commercial real estate, which will necessitate a massive bailout, which will require more borrowing by the federal government, which will feed parabolic increases in all these other things.

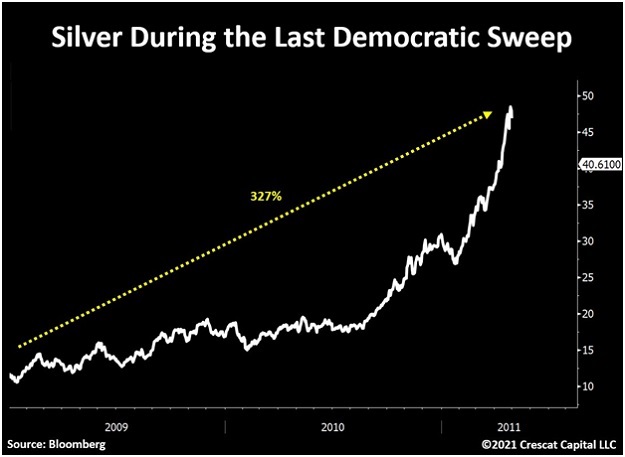

Meanwhile, with the Democrats now fully in charge of the government, it’s useful to revisit a past spike from the last time this happened.

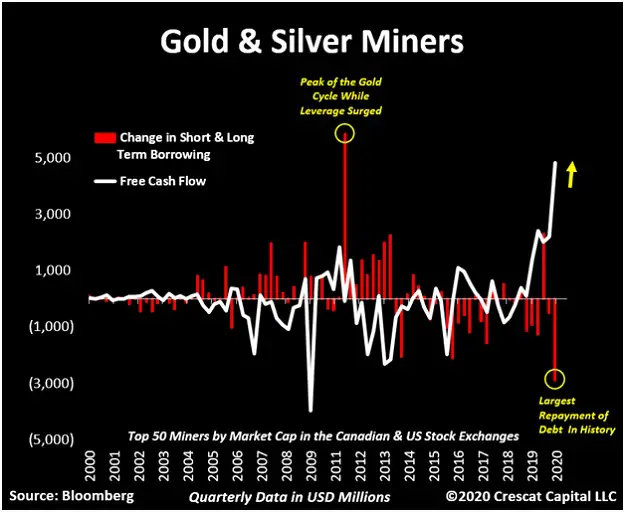

And last but not least, the precious metals miners are displaying both spikes and crashes, the former in free cash flow and the latter in debt. Both are good news and can be traced back to rising gold and silver prices that translate into lots of extra money. In the short run, this means higher dividends for shareholders of the big miners. In the longer run it points to massive takeover activity in the junior miner space. Good news all around.

4 thoughts on "Extreme Charts – January 8"

The blog is good and effective but please upload some more relevant blogs related to bitcoin trading