Stocks have completely recovered from their flash bear market of late 2018.

But now they face a hard question: Can already record high prices continue to rise in the face of falling corporate profits?

Let’s start with the “falling corporate profits” part:

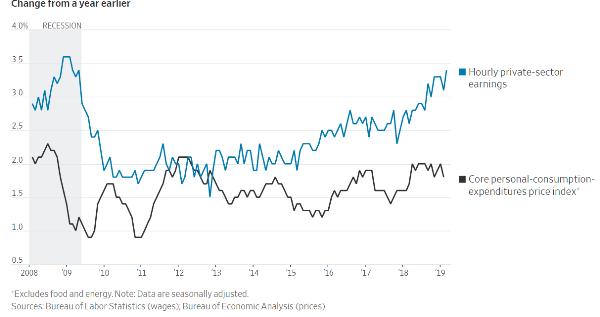

A business generates improving profits when the things it sells rise in price faster than the cost of production. So on the following chart you want labor costs to be flat or falling, and the other line – a measure of inflation – to be rising. But lately the opposite is true.

A big part of the past decade’s spike in corporate profits came at the expense of workers, who saw real wages stagnate while the cost of living rose. Now, with labor markets tightening and minimum wages rising, workers are getting a bigger slice of their employers’ revenues. That means shrinking corporate margins and, other things being equal, slower to negative earnings growth.

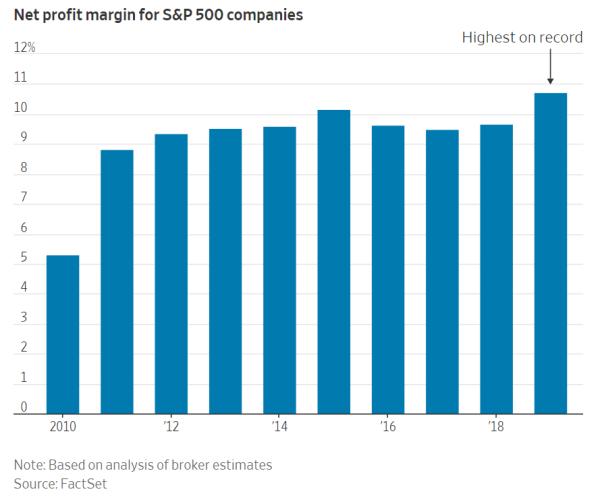

Now let’s look directly at corporate profit margins. Note that they stopped widening in 2015 as wage inflation began to bite. Then they spiked in 2018 when the Trump corporate tax cuts provided a one-time windfall. But that windfall is over and future comparisons will be with last year’s unbeatable earnings. As a result, public companies are going to report lower year-over-year profits going forward.

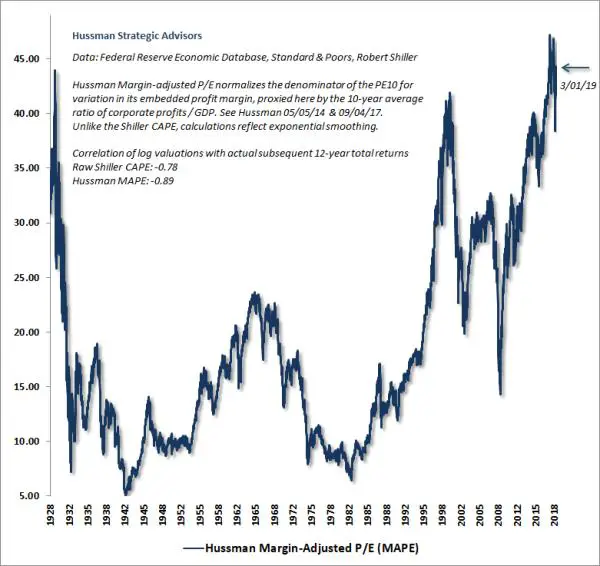

Why does that imply falling stock prices, especially when corporate profits stagnated between 2015 and 2018 while share prices kept rising? Because of what those rising share prices did to valuations. Stocks are now a lot more expensive both nominally and compared to earnings than they were in 2015, which means the air pockets under them are much bigger. They’re priced for perfection, and falling earnings per share is the definition of imperfect for the stock market.

Based on history, the next few years look brutal for the US stock market. Which raises yet another question: Is history still worth anything in a world of out-of-control central banks and hyper-profligate governments?

15 thoughts on "The End Of The Bull Market, In Three Charts"

Earnings are so 20th century. Endless credit and unlimited political power are the keys. There is only one fundamental, liquidity.

I generally make nearly $6,000-$8,000 every 30 days online. It is absolutely ideal to doubtlessly replace my prior professions salary, primarily thinking about I simply just work almost 20 hour each and every week at home.I got rid of my job after doing work for the same company for many years, I required very reliable source of income. I was not interested in programs that promises to make you rich in just few days you can see all over the net. Those all of them are sort of ponzi multi-level marketing plans in which you have to initially get leads then sell a product to friends or relatives or anyone to make sure they will be in your team. The best part of working on line is that I am always home with the children and also enjoy time with family on different beaches of the world. Honestly,it is actually simpler than you would believe, all you have to do is submit a very simple form to receive front line access to the Home Profit System. The instructions are incredibly simple, you don’t have to be a computer expert, however you should know how to use the internet. It is as easy as being on Facebook. Here’s the easiest method to start => https://crown.link/c0

The one thing left out here is share buybacks. The argument hinges on stocks being priced to perfection, which is measured as the P/E ratio. Corporations, however, still have all the power they need to manipulate the P/E ratio to remain exactly where it is via buybacks. They have scheduled as much in buybacks this year as they did last year. Since earnings are actually “earnings per share,” buybacks reduce the number of shares. Corporations have so much cash still stockpiled from foreign-profit repatriation or still have that repatriation to exercise that they will EASILY be able to manipulate their stock P/E ratio to remain exactly where they want it throughout 2019. Beyond that, I don’t know; but most have enough cash to do that until then.

I’ll go with the last line in this piece, which means ordinary logic and certainly history goes out the window when central banks and governments are involved in unprecedented activities.

Probably the main thing I failed to understand back in 2009 – when I was deciding whether or not to re-invest back into the stock market because of the Fed’s new QE program – was the power of “liquidity”, which basically means easy/cheap money. The newly created “money” by not only the Fed but all the other central banks of the world basically has to go somewhere, and its effect will be higher prices, and that is still going on primarily by the ECB (Europe), BOJ (Japan) and BOC (China).

I heard a similar sentiment from an interview of a former Dallas Fed advisor, and the founder and publisher of Quill Intelligence, Danielle DiMartino Booth. To quote her,

“I am guilty in my investing life of having fought the Fed, and what that means is that if you cannot appreciate the fact that liquidity is going to float financial markets then you are going to end up crying (in tears), and – again – that is something I learned the hard way, and that is you follow the liquidity and where it takes you, and you have to be agnostic about it even against the rational, logical methods that fundamentals are sending out about investments.”

A vacation to the most fascinating destinations in the world with your family and friends and a beautiful house you desire to to purchase. Is your present job really capable of fulfilling your dreams? If your answer is no then it truly is time for you to change. We bring to you a web-based job which is certainly as simple as being on any search engine like google or doing copy paste task. It really does not need technical knowledge and it does not require anything to sell. It is not similar to any internet scams that claims to make you “rich over night” and then turned out to be pyramid schemes or stuff where you will have to sell to your friends and family. It is simple to start and you will receive the instruction guide within few weeks. You can make almost $20,000-$30,000 per month. You are able to invest much more time with my family and friends and can go out for remarkable trips. This job offers you opportunity to be own own boss and can work from any location. Don’t wait for too long, Go and give it a look this awesome online job opportunity.>>>>>>>>>>>> HURRY

Besides the central bank float created by the ECB, China and Japan, there is a large cash hoard still piled up from foreign profits that were repatriated last year because many corporations did not spend anywhere near all that money, and then there are corporations that have not even exercised their one-time repatriation right yet. So, that means they still have tons of available cash to use to manipulate their own stock prices upward. To the extent that the principles use that money to buy their own shares out, they don’t have to worry about what comes after.

I still remember the time when I lost my job few months back from my company where I have given a lot of time and hardwork. I was never ever into policies like get rich “overnight” which later on end up being an online marketing techniques in which you ought to firstly get very interested customers and then sell a product to friends and family members or any person in order that they will be in your team. This internet work has provided me convenience to work-at-home and now I can enjoy valuable time with my spouse and children and get plenty of spare time to go out on a family journeys. This job has presented me an opportunity to generate earnings around $15000-$16000 each and every month by doing simple web-based job. Go and check out most stunning work opportunity.>>>>>>>>>>>>> http://www.bigto.in/K5rdC

Home based jobs are becoming a trend all over the over world nowadays. A recent research illustrates more than 72% of people are being part of internet based jobs at their house without any complications. Everybody really want to spend more time with his/her friends by getting out for any lovely place in the country or any other country. So web based income enables you to accomplish the work at any time you want and enjoy your life. However discovering the right method and building a right target is our goal in direction of achieving success. Already plenty of people are being paid such a nice earnings of $34000 per week making use of suggested and powerful techniques for earning money online. You can start to get paid from the 1st day when you see our site. PLEASE SEE >>>>> throatedturtle.betrunken.org

To help you make $8781 every month as a result of taking advantage of your trusty net connection and laptop or pc then simply I wish to discuss my working experience. Two years before I have been in private corporation not being paid respectable compensation matching my intense work. After which my mate revealed to me a web employment you can use in the home with the assistance of world wide web and computer and best thing is we will do the job anytime we intend to and get a hold of the revenue on /week after week basis. It’s in contrast to a promotion which you simply see online that insures to turn you to be shockingly wealthy in 2 or 3 weeks or so. At this point after focusing on this earning opportunity for couple of years I could state that it is the ideal using the web job I am able to have due to the fact by working on this project I can deliver the results any time I am free to do it. While I was working thru private business I used to be not capable to spend some time daily with my household however right now during 24 months I am dealing with this via the web employment and at this moment I have been taking pleasure of the free time with my loved ones at home or rather by heading outside to anywhere I prefer. This role can be as simple and easy as using online sites and executing copy paste job that anybody is able to do ->-> eskinswarm.a-loch.de

How would you respond to the “milkshake” thesis that the dollar will strengthen dramatically (as will gold) and dollar inflows will propel the stock market to 40,000 on DOW and then the carnage will begin and gold end up the clear winner? (this is not Martin Armstrong’s theory)

http://financialsurvivalnetwork.com/2019/04/brent-johnson-the-milkshake-explains-it-all/

Well it is one senario, Anthony, and quite plausible. My feeling is that the market is behind the curve at present but the bond market knows more and is generally right in the end. Although the inversion is not complete,

My analysis indicates that the porrr corporate profit reports going forward will eventually impact the market. IMHO investors are relying on the Fed to come to the rescue once more – but I don’t think it’s going to work this time.

The main reason is to do with energy and EROEI. My book explains this and much more. For a free pdf of my manuscript email me at: peter@underco.co.uk

I also think it isn’t going to work because the economy is going to go into recession, regardless of what the stock market does. It’s certainly not unheard of to have a recession hit before a market crash (and the market really already crashed and got a huge hopium bailout from the central bank anyway. Once the economy goes into recession for a thousand reasons the Fed cannot control, then the stock market is bound to come down in response to the recession.

As you’ve followed with me Peter, you know my emphasis last year in my own articles was that a stock market crash was the big economic news for 2018. That is a fait accompli. It was bad enough to get the Fed to pull a face-losing hard stop on its long telegraphed plans. My emphasis this year is on a recession where whatever the market does is now secondary to that. The market is no longer the front-burner issue.

(None of this disagrees with your point but just adds another layer of support to your statement that the market is now behind the curve. It’s a following indicator now, rather than a driving force.) I don’t think we’ve ever seen an incomplete inversion like this one immediately preceding a recession, but that doesn’t mean an incomplete version is not sufficient. We just haven’t seen it happen at quite this high level of inversion to know. I think we are about to learn that this much inversion is both enough of a tell and enough of a driver to see recession follow even if the inversion never makes it to 2s over 10s.

Thanks Dave for your support and you are totally correct IMO. Recession is the name of the game and some say the USA is already in recession, if not, at the leading edge. So we are on the same page, which is comforting for me. Thanks again, I can sleep well in the knowledge that my investment strategy is correctly in place!

I would not be surprised at all to find out down the road that we got there ahead of my own summer prediction.

I too would not be surprised. Your forecasts are accurate because you look at the facts, unlike the Fed who are fooling themselves with their false models.