Emerging market chaos is now front page news. Let’s start with Argentina, where the peso has resumed its plunge:

In response:

Argentina Central Bank hikes interest rate to 60 percent

(AP) — Argentina’s Central Bank has increased its benchmark interest rate to 60 percent in efforts to halt a sharp slide in the value of the peso.

The sliding value of the currency prompted Argentina to seek a financing deal earlier this year with the International Monetary Fund and President Mauricio Macri now is asking for an early release of those funds.

The peso slipped about 7 percent against the dollar Wednesday and was down another 5 percent early Thursday. It’s been trading at 35.9 to the dollar.

The Central Bank said Friday that it was hiking its benchmark interest rate in response to the current currency scenario and the risk of greater impact on local inflation. The rate was set to 45 percent earlier this month.

It’s hard for developed world readers to grasp the implications of 60% interest rates. Suffice it to say normal life is on hold – in some cases permanently – for most Argentines.

Brazil, meanwhile, has currency issues of its own, with the real falling hard in the past year. But a much bigger problem is looming just across the border, where Venezuela is in the throes of a full-on hyperinflation that’s sending its citizens fleeing in every direction. In response:

Brazil sends army to border as Venezuelans flee crisis at home

(Reuters) – Brazil said it was sending armed forces to keep order near the Venezuelan border area, while Peru declared a health emergency, as a regional crisis sparked by thousands of Venezuelans fleeing economic collapse escalated on Tuesday.

In Brazil, where residents rioted and attacked Venezuelan immigrants in a border town earlier this month, President Michel Temer signed a decree to deploy the armed forces to the border state of Roraima. He said the move was aimed at keeping order and ensuring the safety of immigrants.

Peru, meanwhile, declared a 60-day health emergency in two provinces on its northern border, citing “imminent danger” to health and sanitation. The decree, published in the government’s official gazette, did not give more details on the risks, but health authorities have previously expressed concerns about the spread of diseases such as measles and malaria from migrants.

The exodus of Venezuelans to other South American countries is building toward a “crisis moment” comparable to events involving refugees in the Mediterranean, the United Nations said this week.

Temer blamed the socialist Venezuelan government of President Nicolas Maduro for the migration crisis.

“The problem of Venezuela is no longer one of internal politics. It is a threat to the harmony of the whole continent,” Temer said in a televised address.

There are close to 1 million Venezuelans now living in Colombia and more than 400,000 in Peru, the countries said in a joint statement after the meeting on Tuesday. Just 178,000 of those in Peru have legal permission to stay or are being processed.

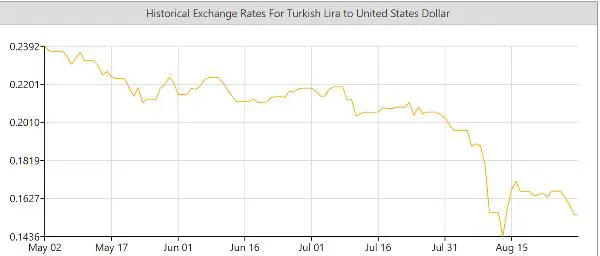

Turkey, whose authoritarian government is causing turmoil both at home and with its NATO allies – most notably the US – has been trying to manage a currency crisis for months, but this week central bank officials started leaving and the the lira’s plunge resumed.

Turkish lira extends slide amid reports central bank deputy governor resigning

(MarketWatch) – The Turkish lira extended its slide Thursday amid news reports the deputy governor of the nation’s central bank will step down. The U.S. dollar hit an intraday high of 6.84 lira in earlier action and remains up 4.6% near 6.76 lira.

Reuters, citing two persons familiar with the matter, reported that the deputy governor and Monetary Policy Committee member, Erkan Kilimci, was set to resign. Lira weakness this year has been exacerbated, analysts say, by Turkish President Recep Tayyip Erdogan’s pressure on the central bank not to raise rates. The lira is down more than 40% versus the dollar in the year to date, a slide that raised concerns about potential ripple effects on other emerging markets and about exposure to Turkey by some European banks.

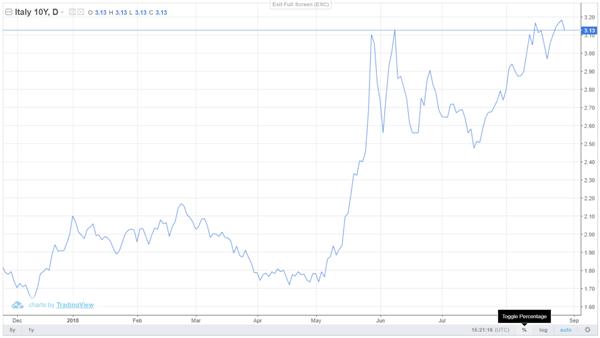

Last but not least, Italy has to be included in any discussion of emerging market chaos because compared to most of the rest of the EU it fits the profile, which is to say it’s financially and politically unstable and is thus always teetering on the edge of crisis. This might be the year it finally drops into the abyss, as its interest rates have risen to levels where the numbers no longer work.

Note that as recently as May Italy was able to borrow 10-year money for less that the US could. But lately it’s having to pay quite a bit more. The only reason its financial markets and banking system even exist in their current form is the artificially cheap money engineered by the ECB’s unlimited buying of Italian bonds. Take that away – which is now happening as the ECB stops indulging what it sees as an unreasonable new Italian government – and interest costs will bankrupt the country in short order. Stay tuned on this one.

So here we are with emerging markets in crisis but US financial markets completely oblivious. There are two reasons for this, one reasonable at least in the short run, the other both baffling and infuriating.

Reason one is that in a world of emerging market chaos, the US – even with an unpredictable government – looks like the safest place to park capital. In other words, Amazon shares and Miami condos, even at record-high prices, are less risky than, say, a Brazilian bank account. Fair enough.

Reason two is that since the 1990s the Fed has responded to every crisis anywhere in the world by bailing out the US banking system, and everyone has concluded that that’s just how the world works. Trouble starts, the Fed cuts rates, and stocks, bonds and houses go up, problem solved. Without the slightest doubt, the Fed will respond that way again should the current EM crisis start to metastasize unacceptably. But will it work this time, with global debt roughly double what it was the last time the world was bailed out by its central banks? And how big will the financial market crisis have to be to shift the Fed and ECB from tightening to next-gen QE?

If events follow this script, we can expect a scary few months followed by plunging interest rates and massive, coordinated asset purchases by central banks. Which ought to be great for gold. Click here for a good deal on coins and bars, and here for secure gold storage.

8 thoughts on "More Emerging Market Chaos – How Long Before It Spreads To The Developed World?"

The only thing that keeps me interested in all of this is that I know eventually things are going to implode and I’d like to see how it begins, but I’m growing weary and losing interest.

I’ve been hearing about “unsustainable” debt levels (in the US in particular) since I was a teen, some 40 years ago and that has been totally discredited quantitatively (e.g., an additional $100 billion in debt used to be sobering.)

Now I’m thinking “bigger”, like figuring that the debt-to-GDP ratio of the US can be as high as Japan’s, and maybe much higher, given that everyone owns dollars. That means the US national Federal debt could be well over $50 trillion before anyone bats an eye.

Even if I’m off by $10 trillion or so, the point is that one could easily argue that the fiat system we have now can last a long time, and for that reason alone “should” be resurrected because it can be gamed in so many ways and for so long a time. The first few generations who could adopt it would benefit, and so it would be very compelling politically.

However, my hope is that the next financial crises will some-how, some-way impoverish the PTB and change the dynamics. The “FAITH” in the fiat dollar/currency system may be the achilles heal that will do it. We shall see, but don’t hold your breath.

I think everything is different now because anything Electronic is so vulnerable. Did you hear about how Bank of America was freezing peoples accounts because of immigration. Well now imagine that China, North Korea, Saudi Arabia, Russia, or even Japan(in secret) developed something to bring down payment systems like SWIFT etc. See how hackers attacked Indian ATM banks.

“Trouble starts, the Fed cuts rates, and stocks, bonds and houses go up, problem solved. Without the slightest doubt, the Fed will respond that way again should the current EM crisis start to metastasize unacceptably.”

When the next recession starts with the Fed already near 0% we’re going to experience our first, “real” recession. If there was a way to avoid this fate Japan would have already done it.

The Fed only controls the US and if anything happens to the US, the Fed is affected.

We’re very close to it. I can feel it, I’m so excited finally I will live to see the biggest everything bubble in history pop. Brace yourselves.