For most of the past few years, emerging market stocks and bonds were among the favorite investments of everyone from hedge funds to pension funds to retirees.

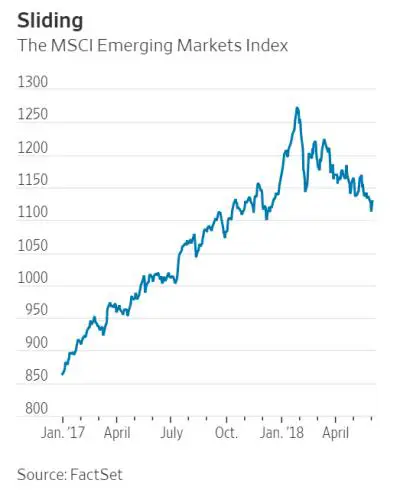

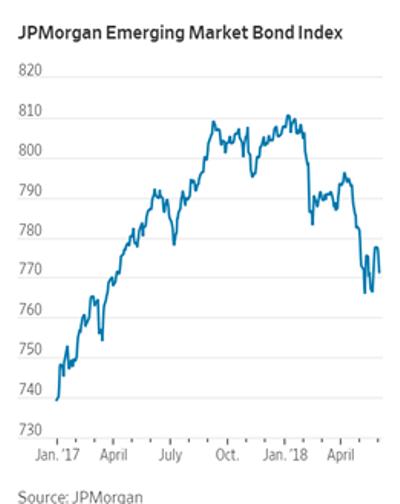

The next two charts (courtesy of Saturday’s Wall Street Journal) show the huge recent run ending in January, to be replaced by a full-on rout.

What happened? Well, it turns out that a big part of the apparent success of economies like Argentina and Indonesia came from their ability to borrow in international markets – frequently in US dollars – and use the resulting cash to build roads, bridges, airports, and soccer stadiums — that is, things that imply visible progress. Visitors came, saw all the “modernization,” went home impressed and hit “buy.”

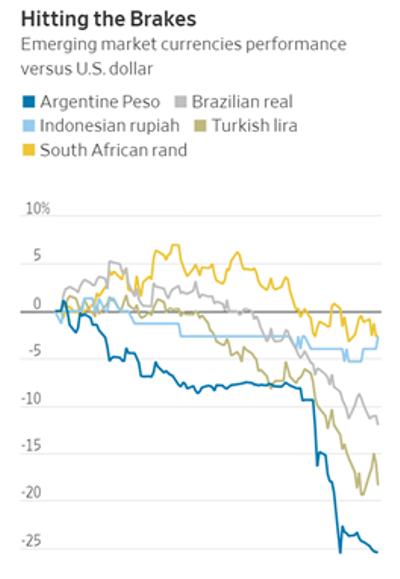

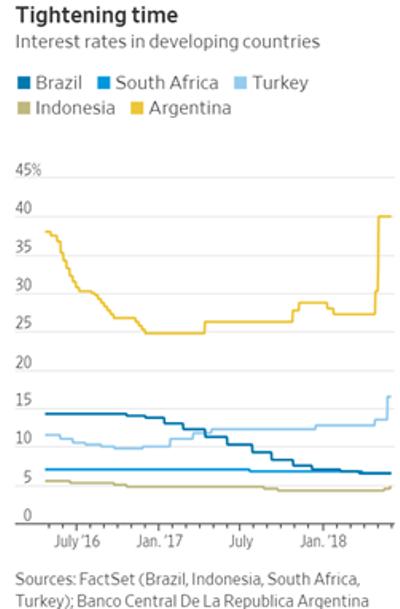

But then US interest rates started to rise and the dollar spiked off of its recent lows. Treasury bonds suddenly started to look attractive relative to EM securities, while all those EM dollar debts began to look onerous rather than wondrous. The hot money decided to leave, putting downward pressure on EM currencies (which makes dollar-denominated debt even harder to pay off) and forcing EM central banks to tighten monetary policy and raise rates.

The result? Contraction where once there was limitless growth, and instability where there was rock-solid continuity. Emerging markets have been here before, of course, and history teaches that it will get worse before it gets better.

History also teaches that trouble on the periphery frequently moves towards the center to threaten developed world institutions that were buyers of all that EM dollar debt. Hedge funds, pension funds, bond funds, global stock funds, and major-bank prop trading desks, are all on the hook for Brazilian, Argentine, and Mexican paper, which means – history again – that US taxpayers are actually the ones on the hook.

So watch for apocalyptic headlines as the 1% softens the rest of us up for yet another transfer of wealth from middle to top.

4 thoughts on "A Spiking Dollar = Emerging Market Chaos, Part 2: The Story In Four Charts"

95 was it; Wile E. Coyote time. ( Wile E. holds up sign reading “Is there a Dollar Doctor in the house?” )

Adding to 6 million currently unemployed Americans, there are at least 102 million that are either unemployed or not counted as trying to join the labor force. This is a new record.

Another new record is the 26.9 million part-time workers. If they have 2 or 3 part-time jobs, they are counted 2 or 3 times in these “good news” numbers.

As the working age population is growing, these percent “good news” stories are not all that great.