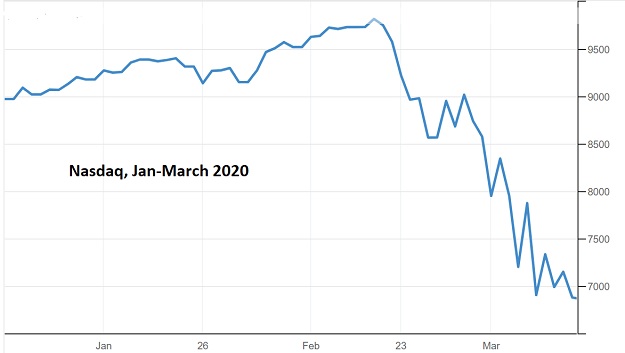

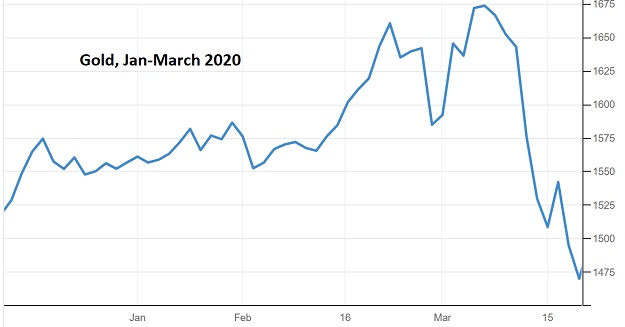

Last March, the financial markets were rocked by the news that covid-19 wasn’t going away. Stocks and gold both tanked, and the suddenly-locked-down economy went into free-fall.

Here’s the Nasdaq …

… and gold:

This flash-crash was brutal but ultimately short-lived, as the world’s governments immediately stepped in with tens of trillions of dollars of new liquidity. By April financial asset prices were headed back up, and for owners of stocks, bonds, real estate, and precious metals, the good times were rolling again.

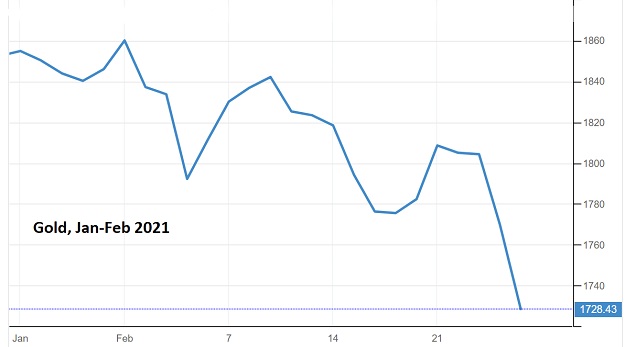

Now fast forward almost exactly one year. The financial markets are being rocked by rising inflation and surging interest rates, which in some ways present an even trickier challenge than covid-19. Here’s this month for the Nasdaq…

… and gold:

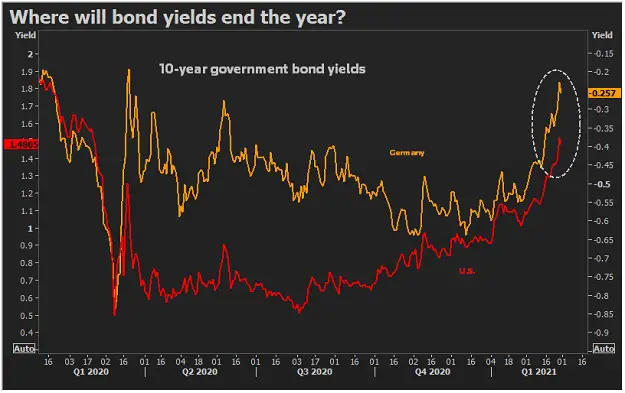

If history is repeating, a few more days of this and the federal government will feel obligated to intervene. But how exactly does it fix an interest rate spike caused by rising inflation? Especially when the problem is global:

Bond markets left smarting from worst rout in years as reflation goes global

From the United States to Germany and Australia, government borrowing costs on Friday were set to end February with their biggest monthly rises in years as expectations for a post-pandemic ignition of inflation gained a life of their own.

Australia’s 10-year bond yield and Britain’s 30-year yields were set for their biggest monthly jump since the 2009 global financial crisis. Long-dated New Zealand yields were flirting with their biggest monthly surge since 1994.

For the United States and some European markets, the bond selloff was on the scale of late 2016, when Donald Trump’s election as U.S. President last triggered so-called reflation bets.

U.S. 10-year bond yields, up more than 35 bps this month and near one-year highs above 1.45%, are set for their biggest monthly jump since November 2016.

Britain’s 10-year bond yield, up 45 bps in February, was also set for its biggest monthly jump since 2016. Thirty-year yields headed for their biggest monthly leap since 2009 after rising 48 bps.

In the euro area, where German Bund yields were set for their biggest monthly jump in three years, the European Central Bank has said it is monitoring the rise in rates closely.

Reponding to inflation with a new infusion of helicopter money is pouring gasoline on a fire. But that’s exactly what the US and many other countries are doing. See House set to pass Biden’s $1.9T pandemic relief package.

The dilemma facing Washington – really the whole world – is that the past four decades of wildly excessive borrowing had left huge sections of the global financial system vulnerable to higher borrowing costs – before the pandemic lockdown. Now huge sections of the global economy are functionally bankrupt.

So either they’re bailed out immediately or they fail.

But bond buyers are responding to the prospect of another year of insane borrowing and currency creation by running for the exits. And – again – a big part of the global economy is too fragile to handle the resulting higher interest rates.

So here we are: “Capital D” Depression if governments rein in their spending and borrowing, and a spike in interest rates followed by a Depression if governments continue on their present course.

This day was always coming, but the lockdowns moved it from “inevitable” to “imminent.” Buy gold (after it bottoms).

————————————————–

It’s Time To Bail On Facebook

The mass migration out of corporate social media is happening for good reasons. If you’re sick of the censorship and concerned about the spying, just say goodbye to Facebook, Instagram, and Twitter, and join DollarCollapse.com on MeWe, the Facebook alternative that doesn’t censor (excessively) or spy on its members. The DollarCollapse page, where content from DollarCollapse.com is posted, is here, and the DC group, where like-minded members can discuss the coming end of the fiat currency world, is here.

We’re also setting up (literally this weekend) on Minds, an interesting new social media platform where members reward each other with “tokens” that can be converted to dollars, bitcoin, or ethereum. This could be a lot of fun. Please consider joining and following DollarCollapse here.

7 thoughts on "Well This Looks Disturbingly Familiar"