Here’s one for the “they never learn” file. It seems the home affordability index in June posted at the worst level in 33 years.

posted by David Stockman on ContraCorner.com

It was more expensive to buy a U.S. home in June than it has been for any month in more than three decades, as record-high home prices collided with a surge in mortgage rates.

The National Association of Realtors’ housing-affordability index, which factors in family incomes, mortgage rates and the sales price for existing single-family homes, fell to 98.5 in June, the association said Friday. That marked the lowest level since June 1989, when the index stood at 98.3.

Worst still, the index has been plunging precipitously during the past year, and now stands a shocking 33% below its June 2021 level.

Yet that’s not surprising given the 54% surge in monthly mortgage carry costs. According to NAR, the typical monthly mortgage payment rose to $1,944 in June, up from $1,297 in January and $1,265 in June 2021, assuming a 30-year fixed-rate mortgage and a 20% down payment.

Index of Housing Affordability, June 2021 to June 2022

You might say that three decades of egregious money-pumping is getting its comeuppance. The last time the housing affordability index was this low in June 1989, the median existing single-family home price was $94,800, mortgage rates were 10.6% and the median family income was $34,128.

By contrast, the median existing single-family sales price in June 2022 was $423,300, while the average mortgage rate stood at 5.6% and median family income was $91,952. What this means, of course, is that over the 33-year period in question, median housing prices rose by 4.6% per annum or 1.5X faster than the 3.1% per annum gain in median household income.

Needless to say, the Fed claims to be doing the opposite—making home ownership more affordable relative to income by suppressing mortgage rates below their free market clearing level, thereby purportedly making monthly payments more affordable.

Yet there has always been a giant fly in the ointment on that proposition. To wit, central bank interest rate repression causes the price of capital assets like homes to rise artificially by fueling what amounts to subsidized demand for mortgage finance and housing.

The resulting giant backfire was captured well by a realtor quoted in today’s WSJ story on the matter. The plain fact is, the Fed’s interest rate manipulations have caused the home ownership market to shrink, not expand:

“People who used to say, ‘Boy, I want to move in and buy a home at $250,000 or $300,000’—we don’t have that kind of market anymore,” said Lysi Bishop, a real-estate agent in Boise. “Affordability has absolutely changed, and that means we’ll have less buyers.”

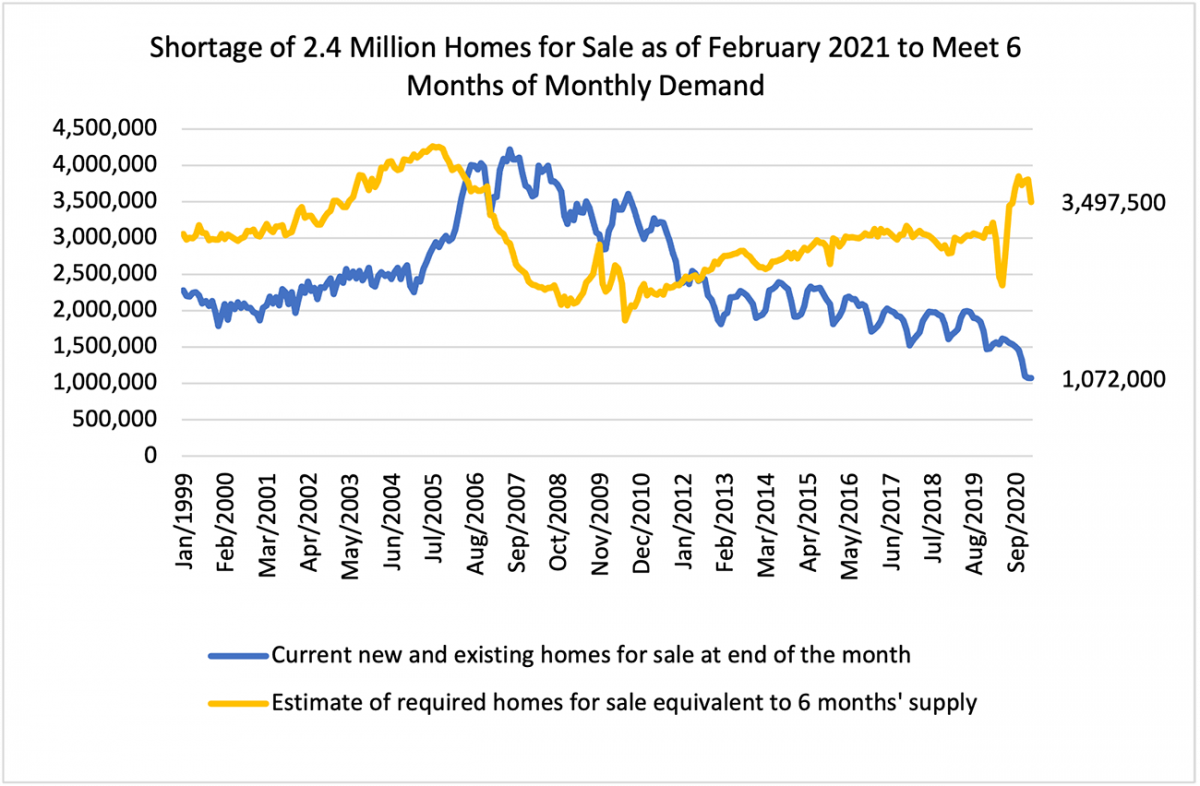

The current excuse for this perverse outcome is that until very recently, the supply of homes on the market was at an all-time low relative to current sales levels. For instance as of the peak of the stimmy-induced home-buying craze in late 2020, the were just 1.072 million new and existing homes (blue line) on the market for sale compared to a theoretical requirement for 3.498 million inventory units on a six-months of supply basis (yellow line). The six month inventory standard represents no particular economic magic, of course, but has been associated with relatively stable housing prices in the past.

Accordingly, the implied shortfall back in 2020 was off-the-charts of history, representing a staggering 2.426 million units of missing inventory and a mere 1.84 months of sales. In turn, that gap tells you exactly why bidding wars turned red hot and that for the first time in memory US homes were selling above list price.

For want of doubt, the chart also shows that in the run-up to the 2006-2008 housing price crash, the gap was only 1.5 million units, representing 3.63 months of sales. Yet that didn’t preclude a violent collapse of the market when mortgage rates finally reached a tipping point: By late 2007, there were 10.3 months of supply on the market, causing home prices to eventually plunge by upwards of 40%.

But here’s the thing. These violent inventory swings and imbalances do no happen by economic immaculate conception.

To the contrary, they are the consequence of the Fed’s yo-yoing of interest rates and the mortgage market in a misguided and manifestly failed effort to lower the cost of home ownership.

Since the 2006-2008 housing crisis, in fact, the distortions have gotten far worse. That’s because Fed-sponsored ultra-low institutional debt rates have caused a massive flow of private equity capital into the home rental market.

Before 2010, corporate landlords were largely absent from the single-family rental home market. But the recession of 2007 to 2009 left in its wake more than 6 million homes in foreclosure. Two dozen or so private equity firms stepped in and scooped them up and then continued to buy more, made easier by a hefty surge in foreclosures related to the pandemic.

As has been long evident, these giant private equity investors converted most of those properties to rentals, taking them off the for-sale market, thereby driving up the price of the existing housing stock and exacerbating the shortage of affordable homes.

Thus, in the fourth quarter of 2021, institutional investors spent approximately $50 billion to buy more than 80,000 homes—18.4% of all homes purchased in the U.S. and nearly 75% of them single-family homes, according to Redfin. More than three-quarters of the purchases were paid in cash.

In Atlanta, investors last year bought 33% of all homes for sale—the highest share in any major city—followed by 32% in Charlotte, North Carolina, and 30% in Jacksonville, Florida. And investors purchased more than 27% of homes for sale in Las Vegas, Phoenix and Miami.

To be sure, were don’t have any beef against institutional capital flowing into the home rental markets, if it is the result of a level playing field and honest interest rates.

But that isn’t the story here. The Fed’s systematic falsification of interest rates and other financial asset value has fostered a no-brainier arbitrage between monthly net rents and the ultra-low carry cost of the debt capital which undergirds the overwhelming share of private equity investment in the homes-to-rent sector.

What this means, in turn, is that massive amounts of capital have been diverted into the existing home market that might otherwise have entered the new home construction sector. That is to say, into inflating the value of the existing housing stock rather than funding new supply.

In this regards, the evidence is hard to dispute. Notwithstanding the lowest interest rates in modern times, real investment in new housing stock was down 25% from its 2005 peak.

That is to say, the Fed has now surely outdone itself. At least the last housing bubble generated a goodly amount of new housing stock.

To the contrary, this time the result was a massive market flow of capital into the existing stock, thereby insuring that institutional investors laughed all the way to the bank, even as an increasing share of the Fed’s ostensible targets—potential new home-buyers—now have their noses pressed up against the glass in the most unaffordable home market in 33 years.

Real Private Fixed Residential Investment, 2005-2022

Originally posted by David Stockman on ContraCorner.com

[URGENT] You’ve Got 1 DAY to Watch This

The markets are chock full of volatility, but there’s also tremendous opportunity on the horizon.

We’re holding a special complimentary live training session about these moves.

Trade with A.I. – There IS a way to predict where the market is headed. Learn how to forecast market trends days in advance with up to 87.4% accuracy (documented and verified).