A recent MarketWatch article notes that:

GE was one of Wall Street’s major share buyback operators between 2015 and 2017; it repurchased $40 billion of shares at prices between $20 and $32. The share price is now $8.60, so the company has liquidated between $23 billion and $29 billion of its shareholders’ money on this utterly futile activity alone. Since the highest net income recorded by the company during those years was $8.8 billion in 2016, with 2015 and 2017 recording a loss, it has managed to lose more on its share repurchases during those three years than it made in operations, by a substantial margin.

Even more important, GE has now left itself with minus $48 billion in tangible net worth at Sept. 30, with actual genuine tangible debt of close to $100 billion. As the new CEO Larry Culp told CNBC last Monday: “We have no higher priority right now than bringing those leverage levels down.” The following day, GE announced the sale of 15% of its oil services arm Baker Hughes, for a round $4 billion.

Of course, since that sale values Baker Hughes at $26 billion, and GE paid $32 billion for 62% of Baker Hughes as recently as last year, which looks to me like a valuation for the whole company of $52 billion, GE shareholders appears to have lost half the value of their investment in Baker Hughes in about 18 months.

But GE is just one of several hundred big companies with CEOs who now have to justify a massive, in some cases catastrophic waste of shareholder cash.

This most recent share buyback binge was dumb money on steroids, with artificially low interest rates leading corporations to borrow big and buy back their stock on the twin assumptions that 1) since the cost to borrow was less than their stock dividend, they were generating “free cash flow” and 2) buying their own stock forced up the price, which would make the CEO look smart.

Both assumptions were only valid while the market was rising. And since most of the buying took place late in a bull market, with share prices at or near record highs, it was only a matter of time before a correction or (more recently) an actual bear market turned that free cash flow into a monumental capital loss and made that smart CEO look not just dumb but criminally negligent.

The examples of corporate dumb money in action are many and varied, but a few are up there with GE in terms of egg-on-the CEO’s face, chaos at the annual shareholders meeting entertainment value. Big Tech icons Apple, Alphabet, Cisco, Microsoft and Oracle, for instance, repurchased $115 billion of stock in the first three quarters of 2018, while devoting only $42 billion to capital spending.

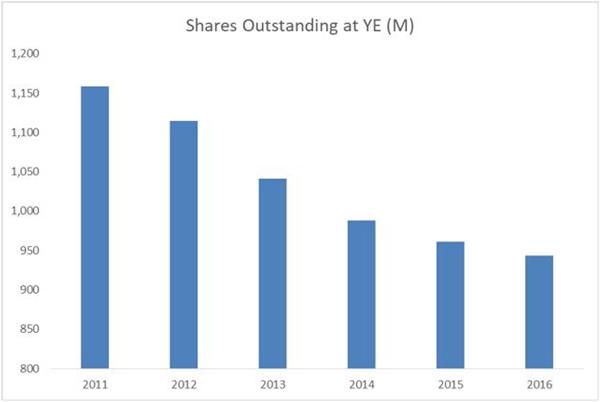

IBM is an even better story. It bought back $50 billion of its stock between 2011 and 2016, cutting its shares outstanding by, well, here’s the chart:

Then, with its stock up (because the falling share total turned declining earnings into growing earnings per share), it just kept on buying. Here’s how the company phrased it in its Q2 earnings press release:

IBM’s free cash flow was $1.9 billion. IBM returned $2.4 billion to shareholders through $1.4 billion in dividends and $1.0 billion in gross share repurchases. At the end of June 2018, IBM had $2.0 billion remaining in the current share repurchase authorization.

IBM ended the second quarter with $11.9 billion of cash on hand. Debt totaled $45.5 billion, including Global Financing debt of $31.1 billion. The balance sheet remains strong and is well positioned for the long term. [Emphasis added]

Then this happened (did I mention that this late in the cycle a bear market is inevitable?):

Now much of the cash that the company “returned” to shareholders has become money that the company lost for shareholders. And – here’s where the macro part of the dumb money story begins – the fact that corporate America has leveraged itself to the hilt to buy back stock leaves hundreds of companies in varying degrees of dire financial straits. In other words, with sales growth slowing and free cash flow evaporating, these over-leveraged companies will have to raise capital to shore up their balance sheets. But interest rates are up, which makes new borrowing a massively cash flow negative proposition. Asset sales, meanwhile, become “fire sales” in a downturn (note the above GE example), so that’s a painful and embarrassing option. What’s left? Why, equity sales, of course.

So – as usually happens at the end of long credit parties – the same companies that bought back their shares so aggressively at ever-higher prices now have to pull those same shares out of storage and sell them at ever-lower prices, creating a mini death spiral in which a rising share count pushes down the share price, necessitating more equity sales, and so on.

Each annual proxy vote becomes a referendum on the once-brilliant CEO’s intelligence, and numerous formerly “well-run” companies end up failing. General Motors, you might recall, declared bankruptcy in 2009. And there is actual speculation that GE might be heading that way this time.

13 thoughts on "Corporate Share Buybacks Looking Dumber By The Day"

John, Great Post! you are spot on about Stock buy backs. Here is what I posted on my blog 5 months ago.

One of the main catalyst of the 1920’s Stock Market Bubble was the corrupt usage of Stock Buy Backs by Corporation CEO’s. After 1929 Crash the government created regulations to make Stock Buy Backs illegal. In 1982 the SEC ease the regulations on Stock Buy Backs. Overtime Stock Buy Backs increased and became the favorite tool of CEO’s to cover declining revenue and profits. Since the 2008 Crash the Stock Buy Backs have reached $5.1 Trillion. Retail Investors and CEO’s are thrilled because Stock Valuations have reached these nosebleed levels. Majority of the Stock Buy Backs are finance by Debt using the Corporate Bond Markets. The US Corporate Debt levels are at historic highs.

https://steemit.com/@skipweston

Thanks Weston, insider selling is the other side of corporate share buybacks. They prop up the stock using other people’s money and then sell their own shares at the inflated prices. Though in GE’s case it does look like rats abandoning a sinking ship. The question now is who’s next.

Do you really remember the vehicle you desire to acquire as well as the apartment you admired the utmost ? Everybody has somethings in our life which we want to meet . We do your best in the direction of it. Still often times we miss a chance, but definitely not any further . This amazing online project made in a way that it will help you you to generate noticeably great income . Operate everyday and give your tasks couple of hrs and make nearly $36000 weekly . It provides you opportunity to operate in your own home house with flexible free time . You could be your own personal boss . It is actually a life changer on line job which will help you obtain exactly what you wish in your life . Right now go and also look at , remarkable things waiting for you >>> https://casegrap.tumblr.com

I actually earn roughly $22,000-$23,000 on a monthly basis from the net. I got rid of my job after operating for the same enterprise for years. I required trustworthy earnings. I was not interested in the “get rich overnight” packages you see all over the internet. Those are actually pyramid plans or things where you really have to sell to your buddies and household members. Working on the internet has many positive points like I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. This is what it is about> https://fotogime.tumblr.com

The hubris has been stunning to witness first hand.

I generally generate roughly $23,000-$24,000 every month through online. I lost my job after doing work for the same organization for a long time, I required reliable earnings. I was not interested in the “get rich overnight” home programs you can find online. Those are all mlm schemes or stuff where you have to sell to your friends and relatives. The most exciting part of working via internet is that I am always home with the little kids and also I go out on family vacation for long time. Honestly,it is actually easier than you would believe. I got the instructions kit and within a month I was making over $4,000 monthly. You don’t have to be technical, but you should be aware how to use the internet. If you can fill forms and browse sites, you can do it easily, You don’t need to sell anything at all. It’s as easy as being on any social media site. Here is what I do https://jochare.tumblr.com

Do you try to remember the vehicle you always wanted to possess along with home you admired the a lot ? All of us have specific things in our daily life which we want to achieve . We put the effort in in the direction of it. Yet often we miss a chance, definitely not anymore . This awesome on line job opportunity created in such a way that it contributes greatly you gather noticeably wonderful income . Function daily and give your work a small amount of hrs and get paid to as much as $25000 weekly . It provides you opportunity to work in your place space with extremely flexible time period . You are going to be your own personal boss . It is actually a life changer on-line job which supports you to ultimately earn everything you aspire in your lifetime . So now go and also try , outstanding things awaiting you >>> https://jetenoue.tumblr.com

I generally earn around $23,000-$24,000 every month using the internet. I got rid of my job after operating for the same corporation for many years. I needed trustworthy income. I was not researching for the “get rich overnight” home programs you can find online. Those are likely to be pyramid systems or stuff where you required to try to sell to your buddies and persons in the family. Working over the internet has many benefits like I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. Click on this page to Read more https://plugroy.tumblr.com

I basically make almost $19,000-$20,000 per month on the net. I got rid of my job after doing work for the same organization for a long period. I wanted trusted earnings. I was not interested in the “get rich overnight” packages you see all over the net. Those are likely to be pyramid schemes or stuff where you will need to sell to your buddies or family members. Working on-line has many advantages like I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. Here’s the most convenient way to start https://downdye.tumblr.com

One yr have passed since I decided to quit my previous job and I never felt this good…. I started doing a job from comfort of my home, for a company I discovered online, several hrs a day, and I earn much more than I did on my office job… My payment for last month was 9,000 $… Great thing about this job is the more free time I got with my family…and the only thing required is simple typing skills and a stable internet connection… I am in a position to enjoy quality time with my relatives and buddies and take care of my children and also going on vacation together with them very routinely. Don’t miss this opportunity and try to react fast. Check it out, what I do… find out here