In interviews, whenever I try to make the case that US policies are leading to the kinds of currency disruptions common in developing countries, I say something like, “For a glimpse of America’s future, take a look at Argentina, where they’re eating cats and dogs because of hyperinflation … wait, no, I meant Venezuela.”

Mixing up countries kind of dilutes the power of the statement, but for some reason I can’t seem to help it.

That might not be a problem going forward, though, since Argentina seems to be joining Venezuela in the currency crisis club.

To understand what happened we have to go all the way back to the Spanish invasion of the Americas in the 1500s. Conquistadores showed up, enslaved the locals and set up oligarchic systems in which a handful of Spanish families owned pretty much everything, backed up by police states that brutally suppressed dissent.

When Latin American countries eventually kicked the Spanish out they kept their oligarchies.

This massive wealth disparity led to continuous cycles of repressive dictatorships alternating with socialist reform governments bent on equalizing things even at the cost of currency destruction — which of course leads back to dictatorship.

So it’s Spain’s fault but Latin America’s problem.

Now, much more recently – and more disappointing – two things have happened:

First, Argentines elected Mauricio Macri, a pro-business reformer, as president. He proceeded to liberalize investment rules and invite in foreign capital. This produced some initial growth and encouraged global investors to buy Argentine bonds. Meanwhile, emerging markets in general were seeing strong demand from abroad thanks to global growth and rising commodity prices. Developing nations borrowed a lot of US dollars and put the cash to work building infrastructure like roads and power plants designed to make their economies more efficient.

So far so good. But with presidential elections approaching in 2019, Macri fell prey to the temptation to juice growth artificially by ramping up government spending and leaning on the central bank to finance that spending with newly created currency — despite the fact that inflation was already in double-digits.

The predictable result: a rapidly weakening currency (the peso fell by nearly 8% versus the dollar in a single day this week) which makes all those dollar-denominated debts impossibly hard to pay off, which puts additional downward pressure on the peso, and so on, until a currency death spiral looks both inevitable and imminent.

Then comes the desperate round of interest rate hikes to protect the currency – in Argentina’s case a benchmark rate that is now over 30% — which reverses the social and economic gains of the past few years by making it impossible for locals to borrow to cover their obligations.

The final stage is a political/economic collapse in which the central bank runs out of foreign exchange reserves and gives up, replacing the old currency with a new one featuring fewer zeros. Civil unrest (as citizens realize that their savings have just evaporated) leads to the replacement of the old profligate government with one that promises not to repeat the same mistakes. And the cycle begins again.

For a glimpse of what else might happen along the way:

Venezuela boosts minimum wage 155 percent to fight inflation

(Associated Press) — Venezuela’s president says he’s boosting the minimum wage by 155 percent to keep up with runaway inflation that’s making it difficult for people to afford daily goods.

President Nicolas Maduro issued an order Monday that brings the monthly wage to 1 million bolivars, or $1.61 on the commonly used black market. It’s the third increase this year.

Despite having the world’s largest proven oil reserves, Venezuela is in its fifth year of an economic crisis worse than the Great Depression.

The International Monetary Fund has said it estimates that Venezuela’s inflation could soar 13,000 percent by year’s end.

Maduro will seek a second six-year term on May 20.He blames inflation on so-called imperialists who he says he’ll overcome once he’s re-elected.

You read that right: Oil-rich Venezuela has a minimum wage of a buck-sixty a month.

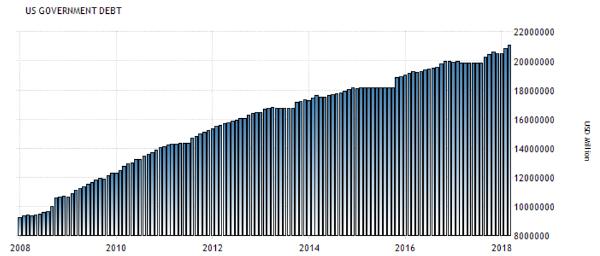

Why should we care what happens in countries that seem to exist in a permanent state of currency crisis? Because the developed world is now making the same mistakes, choosing to finance their way through each war and/or election cycle and worry about the currency implications another day.

For Argentina that day has come. For the US, Europe and Japan — unless you assume that we’re somehow exempt from the laws of economics and finance, that day is coming.

16 thoughts on "Argentina Joins Venezuela In The Currency Crisis Club"

This is a prescient article because it clearly predicts what is in the near future for western economies in general, if not the world. I have come to a similar conclusion that we will soon face a currency crisis of massive proportions.

I have written a book (100,000 words) and have an e-copy freely available on request (peter@underco.co.uk), trying to explain the why and how of our dysfunctional global financial system to ordinary people. I have yet to get a publisher interested although I have emailed 100s of literary agents. The feedback generally advises that the subject is too controversial for them to publish.

One proposition is that of the assumption that the USA and world in general

have been expanding for the last 10 years which I believe is based on the false premise

of GDP.

Since real inflation rates (taking commodity and assets together) far exceed nominal growth rates per GDP formula, we have in fact suffered negative growth or a prolonged hidden global depression for 10 years.

We have actually seen the end of growth as we have known it and evidence is

everywhere to be found, not least of which is energy resource or EROEI. My book

explains all this and much more.

Just thought you should know that we are all being fooled by fudged statistics and QE/ZIRP.

Good observation. I have been writing about this for years. The published CPI is a bogus number to keep a lid on entitlements and for lower COLA adjustments. Calculated the way it used to, it is way higher. Adjusted for the correct CPI, the one experienced by most people on a day to day basis, the GDP was negative for a decade – economic contraction = depression. That is what most (90%) people experienced. The 10% at the top with plenty of assets did OK due to QE/ZIRP/NIRP. However, the 0.0001% at the top who created these policies got most of the gains.

Personally, I love the feeling of vindication I enjoy now. I spoke to many arrogant, spoiled-brat Venezuelans 10-15 years ago warning them that their latest A-hole “president” was going to screw things up and all they could muster was “we’re not like Cubans” (and I’m not nearly Cuban, so go figure.)

All I can say, for those who will listen, is that had those people bought merely 100 or so I oz gold coins back then instead of some ostentatious car they would be living like kings amidst swine in lovely Caracas instead of poor (but still arrogant) immigrants in Miami.

Bruce, I have some Colombian relatives who dislike Argentines because they’re — as you said — “arrogant.” You’d think the recurring national crises would engender a little humility…but of course who are we to talk?

Bruce, Tim and maybe a couple of others: Sorry, was deleting spam and accidentally cut a couple of your comments, and now the system won’t let me restore them. My bad.

I find it difficult to believe that, after 3 currency collapses within living memory, *anyone* in Argentina would keep their savings denominated in the Argentine peso.

Tim, that’s the thing about fiat currency. It always starts out well, and the government creating it always promises to be good. So it fools each new generation into putting their savings into it before it blows up. It also tricks a lot of foreign banks that should know better into making related loans, and they have to be bailed out by their governments with other fiat currencies. The game will continue until the whole concept of unsound money is discredited.

Sorry, John but Tim’s right and you’re wrong. I lived in Argentina for years and Argentinians certainly do NOT keep their savings in pesos. Average Argentines save in U.S. dollars and wealthy Argentines have other strategies for protecting their wealth which I won’t go into here.

Correct! I said the same thing above.

D.J. and Tim, look at it another way: All the pesos that were created in the current cycle are still owned by someone. People accepted them for labor or goods or interest on loans and kept them. We don’t know who these people are — obviously a lot of smart Argentines avoided the trap — but they’re out there, are losing big lately and are not happy.

Most, don’t keep anything in the bank. I’ve been there, and they buy something the very day they earn the currency (can not call it money): i.e. paint, sand. cement, bricks, etc. – something to build hard assets (rental property) which can produce cash flow adjusted for inflation. So. most buildings are under construction for years and years till finalized, and some never see the end. Because of this, banks are ALWAYS are undercapitalized and that creates problems for real investments in economic growth.