Here are some simple steps of due diligence when buying physical gold and silver from a dealer for the first time and why physical gold and silver are a different market from gold and silver ETFs …

by Anna Sokolidou on Seeking Alpha:

Gold and silver are the last refuges of conservative investors. Everyone knows this. The prices of the two precious metals are very moderate right now, however. In my previous article, I wrote about paper gold and the way it lowers the price of yellow metal on the spot market. However, the demand for XAU, one of the forms of paper gold, is different from the demand for actual gold bars and coins. Both gold and silver are undervalued nowadays. Some American investors understand this. So, precious metals dealers actually face shortages. But, gentle reader, if you consider buying physical gold and silver, you should also follow some rules I am more than happy to share with you in this article.

Moderate prices for paper gold and silver

Certain investors might be confused right now and ask me “What kind of demand are you talking about?”. After all, the Fed is getting hawkish, even the ECB sees the need to hike the interest rates. That is quite a bearish situation for the precious metals.

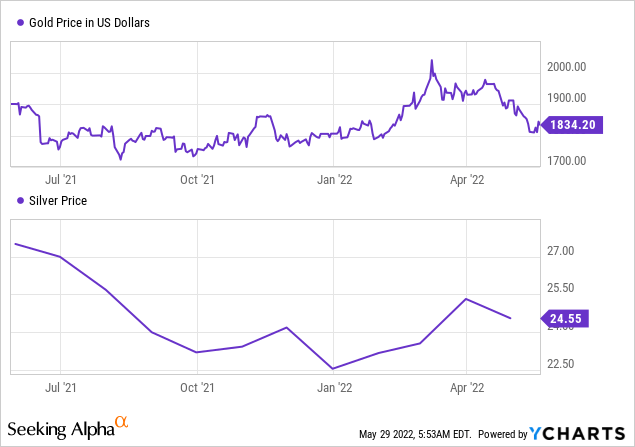

At the end of February and at the beginning of March the gold prices exceeded $2,000 due to the situation in Ukraine and the resulting geopolitical uncertainty. Soon afterwards the inflation rate increased even further and the Fed’s stance got even more hawkish.

Not only were gold prices affected, but the silver spot price also corrected somewhat.

Data by YCharts

That is due to the fact there is lots of paper gold on the market. So, the prices are diluted. In fact, the paper to physical gold ratio varies between 200 to 250!

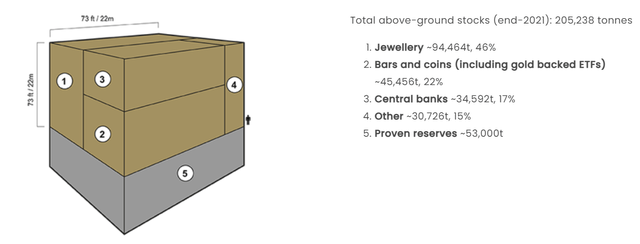

gold.org

That means there is plenty of paper gold in the form of ETFs or XAU, whereas there are limited amounts of physical gold investors can buy. As can be seen from the diagram above, there is 46% of physical gold in jewelry, 17% of gold is stored by central banks and almost a quarter of all gold reserves is still under the ground. So, only 22% of all physical gold is in the form of bars and coins. That is why the supply of the physical precious metal is very limited. There are also some further interesting facts on the trade of paper gold on the LBMA, the UK independent precious metals authority. The volumes of trading are very high, whereas the supply of gold bars and coins is highly limited.

Unprecedented demand for gold and silver in the US

But the demand for physical bars and coins is in fact very high. A clear example of this is the US. On Stansberry Research, there was a very interesting interview with Mark Yaxley, the Managing Director at Strategic Wealth Preservation. He confirmed many investors rushed to gold dealers to invest some of their savings in gold and silver bars and coins. The massive influx of investors is not only due to the situation around Ukraine and the rising geopolitical tensions. Nowadays there are many Canadian investors that decided to move capital to the US.

In my view, that is happening because Canadian banks froze a number of accounts connected to people that have been suspected to be involved in illegal protests, acting on orders from the government. Some banks’ clients decided to move capital to the US in order for their capital to avoid these sanctions.

The macroeconomic environment nowadays seems to be very unsafe with many analysts expecting a recession within a year or two. That is why the gold dealers even face deficits. If conservative investors want to buy physical metals – a very wise solution, in my view -, the key safety measure they can take is to make sure they can distinguish between real gold and fake gold.

Rules to buy gold and silver

To start with, Mark Yaxley also urged investors to be careful whilst choosing gold and silver dealers. These companies have to be large and have a good reputation. This sounds highly obvious but it is something many people simply forget.

Here are the key non-melting or non-destructive methods to test if the gold you buy is real or not. Each of these methods alone does not give the 100% guarantee that your gold piece is real. However, if you apply these methods altogether, you should be almost certain your coin or bar is not a fake.

- I know it sounds very obvious but you should inspect your coin carefully with a magnifying glass. It is very difficult to make the exact copy of a coin. Check the fonts, the details of the image and the spelling. If you have a bar, it normally comes in a packaging that should also be checked for quality. The more sound it looks, the better are the chances the bar is not a counterfeit.

- You should weigh the bar or the coin you would like to buy. It is the best to use a high-specification scale. Remember that it is quite hard for counterfeiters to produce coins that weigh exactly the same as the original.

- Density test – different metals have different densities. Gold and silver have different densities to lead, iron and zinc, for example.

- Magnetism test – precious metals are repelled by magnets. But each metal is repelled differently. If you buy a high-quality machine, it will show you the exact result.

Conclusion

Obviously, gold and silver are good investments if you feel unsure about the current situation. We should not forget the physical metals are in highly limited supply and are demanded by conservative investors. Do not let the current spot gold prices and the Fed’s hawkish stance bother you much. The macroeconomic and political environment is worrying. But if you decide to invest in either gold and silver bars and/or coins, please choose a reputable dealer. Testing the bars and coins you buy using the methods listed above would also leave you with more certainty you are not facing counterfeits.

When the market finally bottoms, make sure you are already educated in how to step in and buy at the lowest lows:

Did you know it’s possible to pull $1,000 or more out of the markets nearly every week? Most people have no idea how to claim these “Weekend Windfalls”, so we uploaded a special MasterClass to show how anyone can get started! This short 20 minute video reveals how you can collect your first payout in 3 easy steps… and why Wall Street doesn’t want you to know about it!

Just click here now, and you’ll be in.