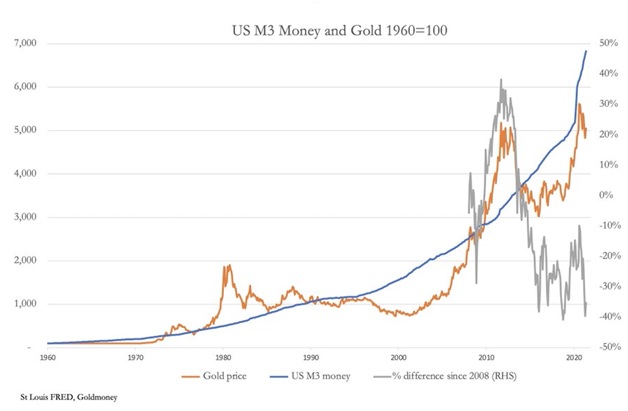

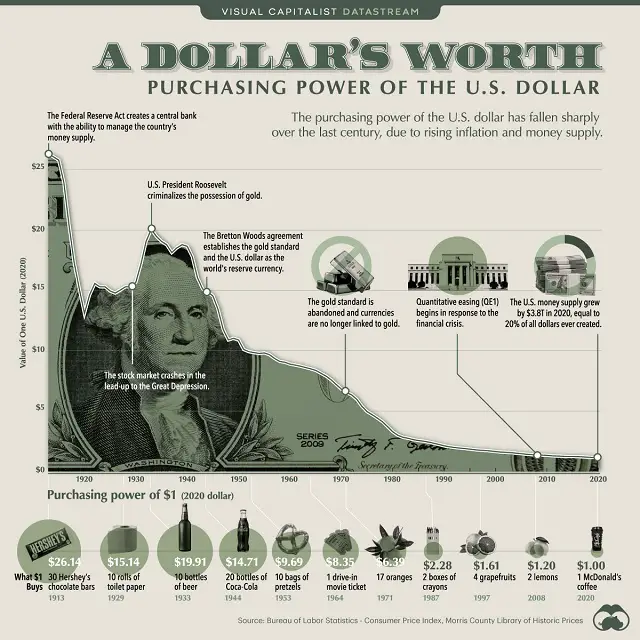

Let’s start with a look at how the dollar has fared since the Federal Reserve gained control of it:

Chain reaction

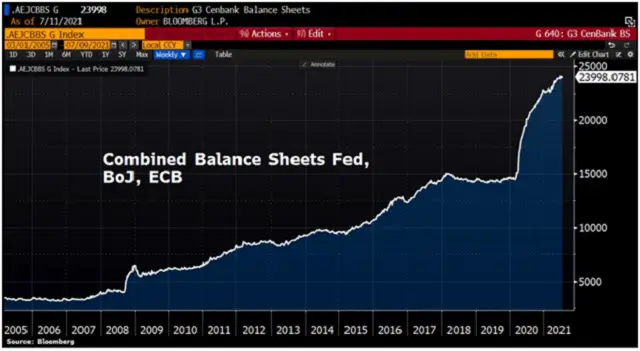

A depreciating currency typically causes a chain reaction in which soaring debt leads to financial instability which in turn forces the central bank to intervene ever-more-aggressively to prevent an implosion. This intervention frequently manifests as unnaturally low interest rates and/or a rising central bank balance sheet (a proxy for the amount of new currency being created):

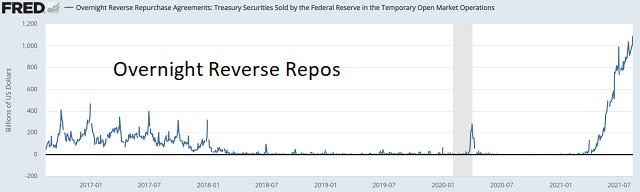

A soaring money supply causes prices to rise and financial assets to fluctuate wildly. This forces the central bank into even more extreme interventions – like whatever it is the Fed is doing lately in the reverse repo market.

Creeping Fascism

When a government’s finances spin out of control it frequently panics and clamps down on freedom of speech, assemply and commerce.

One typical response to this “creeping fascism” might be called the “Boston Tea Party” strategy.

Another, less overt but far more profitable way of rebelling is to shift capital away from financial assets like government bonds and bank stocks that depend on the value of fiat currencies, and into “real” assets like energy, farmland, possibly cryptos, and definitely precious metals.

So let’s sketch out a near-term scenario:

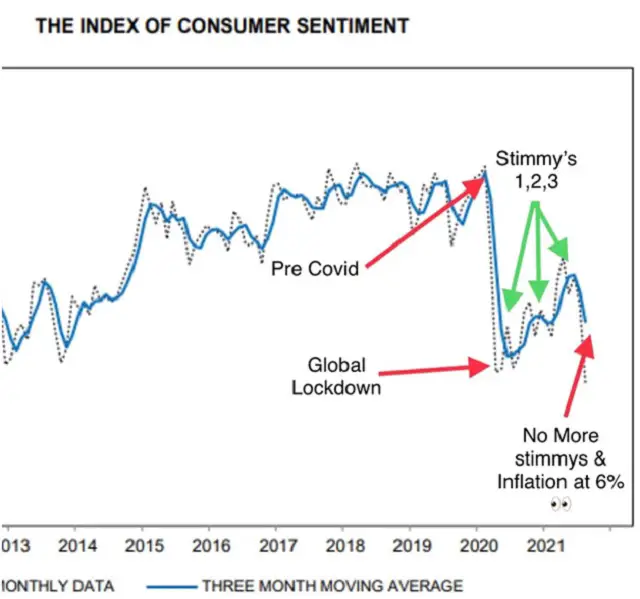

Consumers rein in their spending when stimmy checks stop coming (happening now) …

… but prices keep rising, in part because of broken global supply chains:

And voilà, we’re back in stagflation. Governments then respond in the only way they know, with easier money to relieve the “stag” part of the problem. This ignites a stampede into real assets and sound money.

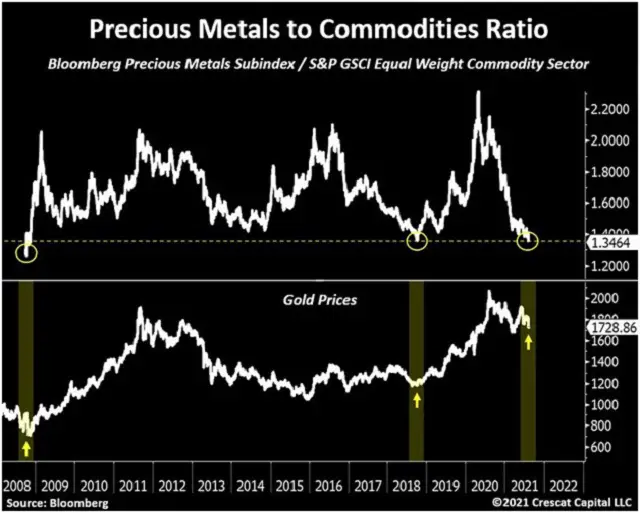

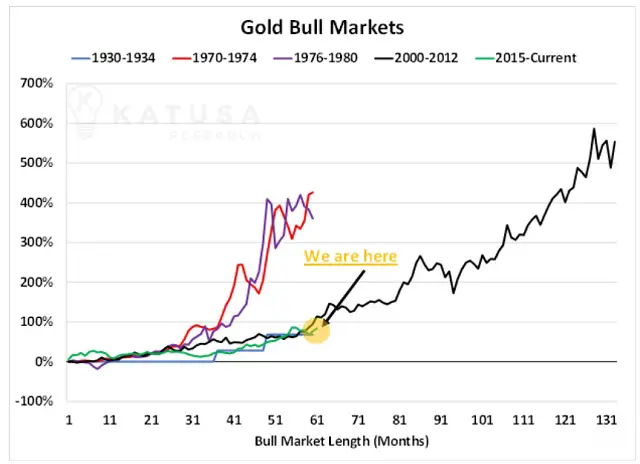

And there sits gold, cheap in terms of the money supply, other commodities, and previous bull markets.

——————————–

9 thoughts on "After 50 Years Of Fiat Currency, Guess What Looks Good"

Good advice. There’s just one problem. What’s to stop the self anointed cabal who’ve created this mess from going 1933 on us, and then some? FDR confiscated bullion. If we go by the propaganda coming out of Claus Schwab’s mouth, among others, this bunch (through their government cronies) to come after not just gold, but all tangible assets, especially land. “You’ll own nothing, and like it.” I’m afraid that the only way we’ll keep our “real” assets will be to invest heavily in guns, ammo, and like minded communities prepared for mutual defense.