While the rest of the world is slowing down and in some cases dropping into actual deflation (see here and here, respectively) the US has, sort of, bucked the trend. Despite a horrendous first quarter in which the economy actually shrank, economists seemed content to blame the weather and simply push February’s lost growth into the current quarter. Goldman Sachs, ever the positive influence, now expects fairly robust 3% growth to be reported a couple of months hence.

But maybe not. The latest retail sales number came in at a positively European 0.1%, and since 70% of the US economy is derived from consumers buying (mostly, alas, unnecessary and useless) stuff, well, that’s not mathematically a good thing if your target is 3%. Here’s more detail from Wall Street Cheat Sheet:

U.S. Economy Enters Second Quarter With This Bad News

“Retail sales were very weak,” Cantor Fitzgerald interest rate strategist Justin Lederer told Bloomberg after the U.S. Department of Commerce released April’s figures. “It’s not a good start for retail sales for the second quarter.” And if retail sales began the current quarter weak, it is also likely that gross domestic product began the April-through-June period with little momentum, as well. In the first quarter of the year, GDP expanded an anemic 0.1 percent, the worst pace since the end of 2012.Consumers were big spenders in the first quarter, propping up growth as they have for much of the recovery. But other sectors of the U.S. economy that have buoyed the recovery in recent quarters slumped in the early months of this year, dragging down growth substantially, with much of the hurt brought on by frigid winter weather. That reality left personal consumption expenditures as the single biggest boost to economic output in the first three months of the year.

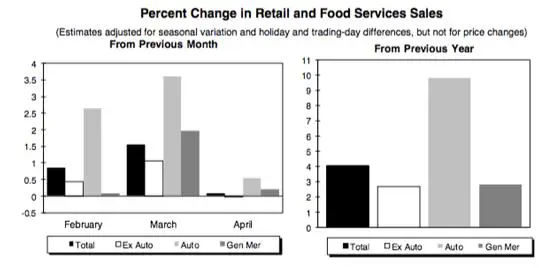

However, consumers spent significantly less at malls and restaurants last month than they did in March, meaning receipts at those retailers were less. Reflecting that reality, retail sales amounted to just $434.6 billion, an increase of 0.1 percent. That growth, which reflects an equally meager pickup in consumer spending, represented a far smaller gain than analysts expected and a far more modest jump than March’s upwardly revised 1.5 percent.

Automobile sales, a nearly perennial driver of consumer spending growth, grew 0.6 percent last month, while sales at clothing stores grew 1.2 percent. However, those gains were nearly wiped away by declines in spending at restaurants, online retailers, and furniture and electronics stores. Excluding the volatile categories of automobiles and gasoline, retail sales fell 0.1 percent in April. As the above spending breakdown suggests, consumers are directing most of their spending dollars to immediate necessities, a pattern that has characterized much of the recovery.

Another part of the deflation-shock story is plunging European interest rates due to speculation that the European Central Bank will react to falling prices by monetizing the debt of basket-case borrowers like Spain and Italy. The US, where the Fed has been scaling back its purchases of long term bonds, was supposed to go the other way with modestly rising interest rates a sign of economic vigor. But not this week. From MarketWatch:

10-year Treasury yield plunges to six-month low

NEW YORK (MarketWatch) — Treasury prices rallied Wednesday along with global sovereign bonds, sending the benchmark U.S. yield to a six-month low as investors reacted to low-rate monetary policy signals from the European Central Bank and the Bank of England.The ECB was said to be preparing measures to combat low inflation, including using negative deposit rates, according to news reports. The Bank of England left its forecasts intact, while signaling that it may be on track to raise its key lending rates next year. The news was largely taken to mean that both central banks would continue to bolster markets with accommodative monetary policies.

On a broader scale, concerns about economic growth prompted the risk-off trade Wednesday, according to Adrian Miller, director of fixed-income strategy at GMP Securities LLC., who called the rally “global in nature.”

“If you continue to get data that questions the market’s expectations that Q2 growth will accelerate, then there is room for downside in yields,” said Miller.

The 10-year note yield sank 7 basis points on the day to 2.550%, the lowest level since the end of October on a closing basis, according to Tradeweb. The yield touched an intraday low of 2.525% on Wednesday.

The 30-year bond yield dropped 7.5 basis points to 3.379%, and the 5-year note yield dropped 5 basis points to 1.569%. Treasurys followed European bond prices higher in Wednesday trade. The 10-year German bund yield fell 4.5 basis points on the day to 1.373%, while the 10-year U.K. gilt yield fell 9.5 basis points to 2.585%. “The break of the 10-year German government bonds under 1.40% is really starting to have a magnetic pull on global rates,” said Goncalves.

Some thoughts

This is not what you’d expect for a global economy that’s five years into a recovery — at least as reported by government statisticians — and where the most important central bank is abandoning its downward manipulation of long-term interest rates. Basic economic theory and common sense both point towards rising rates, assuming that 1) the reported growth of the past few years was real, and 2) Fed tapering is honest and not just a shell game in which buying by Belgium of all places is secretly picking up the slack.

On the other hand, with debt rising pretty much everywhere, the economic headwinds are blowing harder each year and making sustained growth less rather than more attainable. Escape velocity, in other words, cannot be achieved if your rocket fuel is simply more debt.

So let’s say that US Q1 GDP is revised down to -0.5% and Q2 isn’t much better. The US would be back in recession or very close to it, Washington’s deficit would start growing again and the rest of the world’s problems (China’s credit crunch, Europe’s descent into deflation, Japan’s monetary death spiral) would look a lot more threatening than they do now. Wonder how the US will respond…

15 thoughts on "Deflation Shock Coming? Part 2: Even Here"

Not for food.

Nobody asks the right question – which is why in the hell are central banks committing economic suicide with their increasingly insane policies?

Are they stupid? Crazy? Do they have a death wish?

Surely not – so why are they doing this?

Here’s your answer:

HIGH PRICED OIL DESTROYS GROWTH

According to the results of a quantitative exercise carried out by the IEA in collaboration with the OECD Economics Department and with the assistance of the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

Now ask the question ‘what would a sustained increase in the price of a barrel of oil to over $100 do to growth?’

And now you have your answer – the central banks are fighting the END OF GROWTH — which is caused by high priced oil.

And yes how will the US respond once QE and ZIRP run out of steam and stop working?

I suspect these are the last weapons they have in this losing battle….

That is an interesting point, I have been studying the ‘peak oil’ problem and it will have significant growth ramifications.

I am convinced this is the problem – if a 10 buck inflation adjusted increase knocks 0.4% off then oil over 100 bucks is destroying growth.

Remember this – oil started to drive higher in 2001 – and soon after the flood gates opened resulting in the housing crisis…

147 oil hit just before the 2008 collapse….

This is most definitely about high priced oil — we are talking end of growth here… all that stands between us and complete collapse is QE….

“This is not what you’d expect for a global economy that’s five years into a recovery…”

But it is to be expected, or is at least not that surprising, from a “recovery” that is too slow. Remember, the whole point of economic growth is to maintain the growth of the money supply. That is what the fractional reserve banking system relies upon. It needs to be at least 2% per year, on average and economic growth has been less than that since 2009.

Debt servicing essentially absorbs “money” from the economy and lending is supposed to replace it (plus that extra 2% more) . But there has not been enough lending and so things are beginning to implode.

Here in the US, lending has dropped off because of unwilling and/or unqualified borrowers that, ironically, resulted from incurring too much debt during the last cycle. China is just beginning to reach debt saturation, Japan has exceeded it, and Europe is just tired.

In the meantime, for those global investors who don’t want to fight the Fed (or whatever central bank creates the local currency), they simply buy what the central banks buy – which is more and more government bonds. If the central banks want to lower interest rates then the least you can do as an investor to help them out is to create a demand for those bonds. Besides, they wouldn’t want to lower rates unless they think the economy (oops – the money supply) is imploding, so who wants to be in stocks?

I consider the Fed’s “tapering” to be a way of passing the QE baton to the next greater fool, in this case the ECB. After all, if the ECB can’t buy “eurobonds” then why not US Treasuries?

Maybe there won’t be any serious rise in US interest rates until there is a full-blown dollar crisis and rates suddenly explode higher. For now, the Fed is still able to keep the charade going. It convinced markets it was buying fewer bonds even while it quietly increased its bond monetization from $85 billion a month to $112 billion a month during November to January, by laundering the money via Belgium. I guess the bankers have learned a trick or two from their drug cartel customers.

But wait a minute, money laundering is against the law.

I take that as sarcasm since clearly the banks can’t be bothered about issues of legality. But at any rate I was quoting Paul Craig Roberts in using the term “launder”.

I know. I was kidding. But it will be interesting to see how “the market” interprets this. Hey, they supposedly liked QE when it was official so maybe a back door QE is hunky dory too. On the other hand, maybe Brussells was just trying to see how a euro for dollars exchange might work, especially since Russia may be demanding rubles instead of dollars for their energy exports. Whatever maintains the liquidity.

Exactly! If the Fed were tappering the interest on Treasuries would rise. Something is going on under the proverbial table.

Hey, it could be worse, imagine if you were a twenty something US citizen?

Our American citizen youth are already starting off with crippling student loan debt, now congress tied student loan interest rates to the bond market (gee, I wonder why? duh), already over taxed and over regulated, Obamacare forced funding punishment hasn’t even kicked in yet and now US citizen youth will have to get behind immigrant invaders for work.

Immigration is about Obamacare:

Google: Obamacare Loophole Provides Incentive For Employers To Hire Illegal Aliens Over US Citizens.

Google: Companies lay off thousands, lobby for millions more immigrant workers.

HERE’S THE LIST:

Google: Cheesecake Factory, Hallmark, Disney, and Others Now Pushing … Sep 12, 2013

So where are all the student riots? (cricket sounds)