Guest Post by David Stockman from Stockman’s Corner:

Here’s one which should frost the hell out of any honest taxpayer:

President Joe Biden’s Internal Revenue Service (IRS) gave a huge number of prison inmates at least $1.3 billion in COVID-19 stimulus checks, the Washington Free Beacon reported.

There are more than 1.1 million incarcerated individuals who took in the stimulus money, according to IRS data provided to the Free Beacon, as part of Biden’s $1.4 trillion American Rescue Plan. Those incarcerated who received the stimulus money includes roughly 163,000 people serving life sentences without parole, the IRS told Republican Nebraska Rep. Don Bacon in a letter obtained by the outlet.

Arkansas Sen. Tom Cotton had raised concerns in 2021 about the fact that under the plan prisoners would receive money, slamming the idea that someone like Dzhokhar Tsarnaev, the 2013 Boston Marathon bomber, would get $1,400. Tsarnaev ended up raking in $1,400 in connection to the plan, the Boston Herald reported in January 2022.

The point here is not simply that inmates and lifers got $1,400 in free stuff from Uncle Sam, but that Washington’s fiscal culture has gotten so lax that no one even bothered to append an inmate exclusion to Joe Biden’s $1.4 trillion boondoggle.

Nor is this a unique case of fiscal profligacy. Even setting aside the $400-$600 billion cost of Joe Biden’s student debt cancellation plan, the fact remains that every single one of the 43 million student borrowers has received a huge windfall from the payments moratoriums initiated in the spring of 2020. And that includes millionaires and billionaires.

With the latest four-month extension, student loan payments will have been paused seven times during the last 33 months. The nominal budget cost of these pauses since the beginning of the pandemic, therefore, will end up totaling $155 billion.

From the students point of view, however, the forgiveness is even more fulsome, owing to the inflation-caused erosion of principal during the last three years. In the case of average student debt owed by recent medical school and law school graduates, for instance, the effective forgiveness amounts to $68,000 and $41,500 respectively.

|

|

But here’s the thing. All of this largesse was justified by the alleged alleviation of harms from the pandemic, but in the case of most student borrowers under the age of 50 years, the harms were minimal.

That’s evident from the data on the ultimate harm—death. In this context, the normal annual mortality rate from poisonings and suicides is 67 per 100,000 population for age cohorts between 30-50 years. That’s 2.6X the 25 per 100,000 “with Covid” deaths reported by the CDC for the same age cohort during the first year of the pandemic.

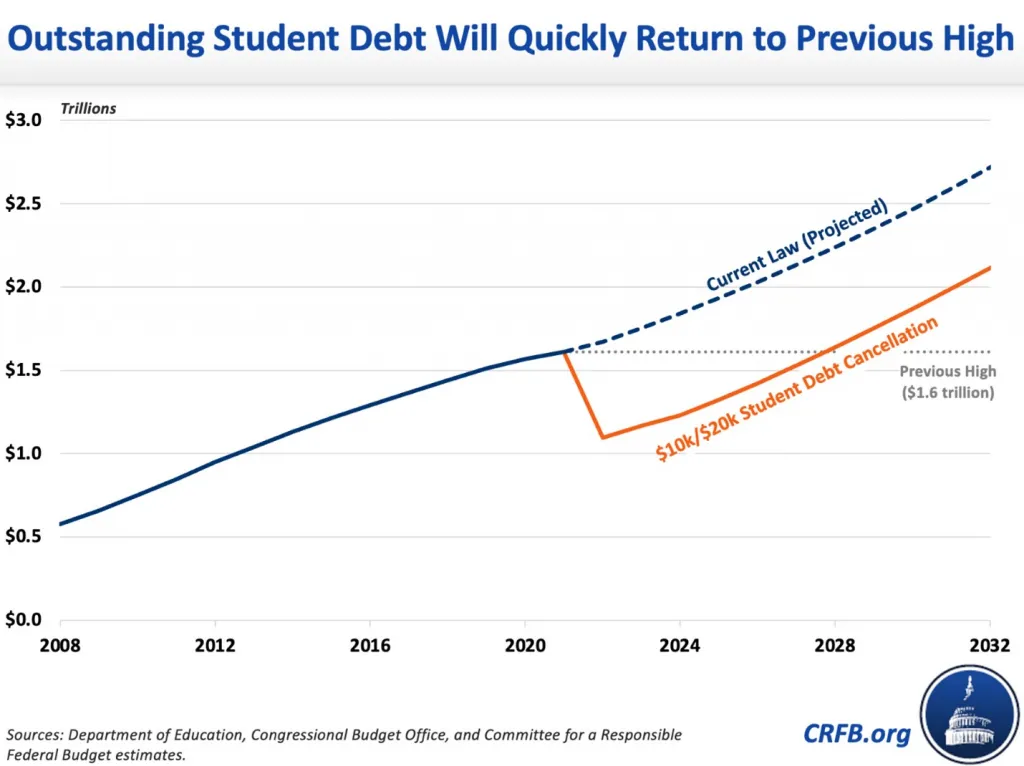

Indeed, the profligacy seems to know no bounds. As the good folks at the Committee for a Responsible Budget (sic!) have pointed out, the $500 billion reduction in the $1.6 trillion outstanding level of Federal student debt from Joe Biden’s debt forgiveness plan will be replaced in a jiffy.

That’s because new borrowing would continue to accrue at at least the previous pace. In reality, it would likely accrue faster due to moral hazard from debt cancellation and the new IDR program (income driven repayment).

Thus, the Congressional Budget Office’s (CBO) projects $85 billion will be borrowed in 2023 and that amount will increase through the decade, resulting in $108 billion in new borrowings in 2032. In reality, debt is likely to increase even faster due to the aforementioned moral hazard effect associated with debt forgiveness, as well as a generous new IDR program (5% of income cap on repayments).

The Fed’s culpability in this breakout of fiscal profligacy needs little elaboration. Since Q2 2007, Federal debt outstanding (red line) has increased by 226% compared to a rise of just 47% in Federal interest expense. (purple line).

In dollar terms, the public debt has soared from $9.97 trillion to nearly $30.0 trillion, while the carry cost of this soaring mountain of debt has risen from just under $400 billion per annum to $599 billion.

In a word, the politicians had their cake and ate it too. What should have been soaring interest expense, which would have crowded out other favored pork barrel outlays, didn’t happen for a blatantly obvious reason.

That is, the Fed had its giant thumb on the scales in the bond pits, thereby driving interest rates far, far below honest, market-clearing levels. In effect, the Fed subsidized the greatest outburst of fiscal profligacy that Washington has ever seen, leaving even the New Deal and Great Society spend-a-thons far in the dust.

Market Value of Federal Debt vs. Federal Interest Expense, Q2 2007 to Q2 2022

For want of doubt, here is the nominal and real interest rate on the 10-year UST over the same 15-year period. In June 2007, the nominal yield on the 10-year UST was 5.03%, and even after discounting inflation the real yield was a somewhat reasonable +2.46%.

After that, it was a race to the bottom. By July 2020 the Fed had driven the nominal yield (black line) to just 0.55%, causing the real yield (purple line) to plunge into negative territory at -1.73%. Thereafter, the story got even worse as rising inflation more than outran small increases in the nominal yield.

Accordingly, as of July 2022, after four months of alleged “tightening”, the real yield on the UST stood at -4.10%, and that’s a generous estimate based on the smoothed Y/Y inflation readings of the 16% trimmed mean CPI. Is there any wonder, therefore, that Washington is happy to borrow money in order to send free stuff to inmates serving a life sentence without parole?

Nominal And Real Yields on the 10-Year UST, 2007-2022

Back in he day, the thing that actually generated a decent measure of fiscal rectitude in Washington was the fear of politicians that farmers, car dealers, hardware store operators etc. back home would react with outrage to soaring interest rates due to Uncle Sam “crowding out” private borrowers.

No more. Since 2007, the inflation-adjusted prime rate on business borrowings has descended straight into negative territory. No crowding out fear there, and no angry communications from businessmen and home mortgage borrowers back home, either.

Inflation-Adjusted Prime Rate, 2007-2022

In short, the Fed’s massive production of fraudulent credit has generated a fiscal calamity. Virtually all incentives to curtail Federal borrowing have been eviscerated.

No wonder Joe Biden had no problem sending free stuff to 163,000 lifers.

Guest Post by David Stockman from Stockman’s Corner:

America’s Permanent Collapse?

Former Goldman Sachs managing director, best-selling author, and Federal Reserve expert reveals to public to what’s really happening in America. (The hidden story, beyond: inflation, rent increases, gas, groceries, political division, or a pandemic.).

The exact reason the financial elite continue to get richer grabbing more power…all while everyday folks struggle to live their daily lives.

Click Here For The FULL Story.