The past decade was a uniquely smooth stretch of financial highway. Pretty much every major asset class – stocks, bonds, real estate, fine art, you name it – did well, making it hard for conventional investors to lose money and easy for them to earn outsized returns.

So why then are US public sector pensions (which own a ton of the above assets) a looming disaster that could trigger the next great financial crisis? Several reasons, ranging from negligence and criminality.

Let’s start with the fact that Wall Street preys on the ignorance of pension fund managers to extract huge fees for little or no excess return. Here’s a video in which pension expert and “forensic lawyer” Ted Siedle lays it all out for Peak Prosperity’s Chris Martenson:

An even bigger problem is the tendency – understandable but still despicable – of state and local politicians to underfund pensions and then lie about it, pushing the eventual reckoning onto their successors.

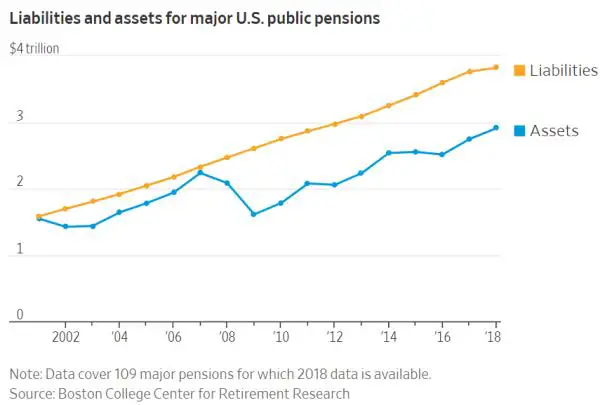

As baby boomer teachers, police and firefighters retire, the required pension payouts are soaring. Combine this with inadequate contributions, and the liabilities of major U.S. public pensions are up 64% since 2007 while assets are up only 30%.

This math is simple enough for even a politician or fund trustee to grasp, but because there’s no immediate penalty for underfunding a pension system, it has become normal practice in a long list of places.

Another, related problem is also mathematical, but it’s harder to manage in a boom-and-bust world: When pension plans suffer a big loss, as they tend to do in bear markets, the next few years’ returns have to go towards making up that loss before plan assets can start growing again. The following chart, from a recent Wall Street Journal article, shows pension fund assets falling behind in the past two bear markets and having increasing trouble catching up with steadily-growing liabilities.

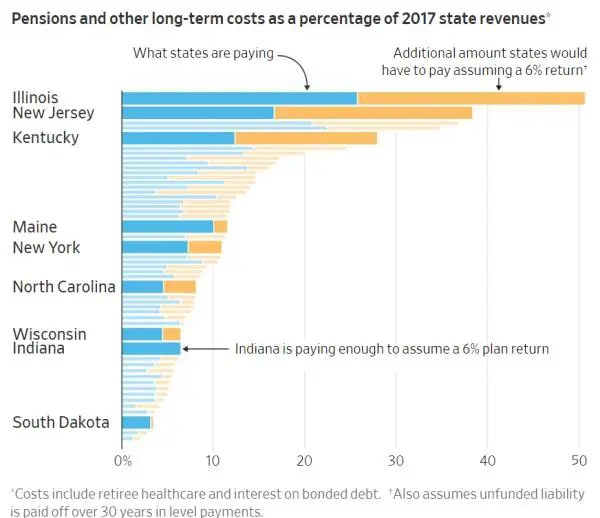

In some cases this puts funds permanently behind the curve and can only be fixed with massive infusions of taxpayer cash or draconian benefit cuts, neither of which are feasible in a system that punishes hard choices. The next chart shows how much more the worst offenders would have to contribute to their plans to get by with honest future return assumptions. For Illinois, Kentucky and New Jersey this will never happen.

What does all this mean? A few things:

In the next bear market the pension funds that are already wildly underfunded will fall into a financial black hole from which they’ll never be able to escape.

Those states and cities – many of which are issuing bonds to cover their day-to-day expenses – will be exposed as junk credits (as Chicago was recently) and will have to either pay way up to borrow or enact some combination of tax increases (politically almost impossible) or pension benefit cuts (legally impossible in many places) which will cause chaos without fixing the underlying problem.

The weakest cities and the states in which they reside will be forced to default on some of their obligations, stiffing suppliers, creditors, and/or employees. This will throw the municipal bond market into chaos as investors, worried that the next Chicago is lurking in their portfolios, dump the whole muni sector.

Faced with a cascade failure of a crucial part of the fixed income universe, the federal government will react the way it did when the mortgage market imploded in 2008, with a massive taxpayer funded bailout.

At which point there’s a good chance of the crisis spreading from pensions to currencies, as the world finally realizes that the bailouts are just beginning, with US states and cities soon to be followed by student loans, emerging markets, and European failed states. So keep an eye on Chicago and be ready to bail when that ship starts sinking.

8 thoughts on "What Went Wrong With Pensions — And Why The Whole World Should Be Worried"

“Madness is rare in individuals – but in groups, parties, nations, and ages it is the rule.”

–Friedrich Nietzsche

I basically generate close to $6,000-$8,000 monthly through online. It really is good enough to simply replace my last tasks salary, precisely taking into consideration I simply just work approximately 20 hr every week in a home office.I lost my job after working for the same workplace for many years, I needed very reliable source of income. I was not interested in programs that promises to make you rich in just few days you can find all over the net. Those all are sort of ponzi mlm marketing schemes wherein you need to first make interested customers after which sell a product to friends and relatives or anyone to make sure they will be in your team. The best benefit of working on-line is that I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. Honestly,it is actually simpler than you would think, all you need to do is fill out a very simple form to get front line access to the Home Profit System. The guidelines are incredibly easy, you do not have to be a computer whiz, however you should know how to use the internet. It’s as easy as being on Facebook. Here’s the process to start —-> https://fwsurl.in/MvcW

I do remember the time when I lost my position several months back from my firm in which I have given too much time and hardwork. I was never into plans akin to achieve your dream “overnight” which later on turned into promotional tactics in which you must firstly get keen clients after that sell a product to family and friends or any individual to make sure that they will be in your network. This online work has granted me freedom to work at home and now a days I can dedicate precious time with my family and friends and get plenty of spare time to go out on a family cruise vacation. This task has given me an opportunity to earn money around $12500-$13500 every 4 weeks by doing simple and easy internet based work. Go and check probably the most incredible work opportunity.>>>>>>>>>>>>> http://sonc.xyz/bs

The internet jobs have become a trend in all over world now. The latest study proves even more than 70% of the people are being part of online work at their home with no difficulty. Everybody likes to hang out with his/her family by getting out for any specific beautiful place in the country or any other country. So on-line earning enables you to accomplish the work at any time you want and enjoy your life. Though selecting the right method furthermore establishing a right destination is our strategy toward achieving success. Already plenty of people are getting such a solid income of $36000 per week by making use of suggested as well as powerful methods of generating income on line. You can start to get paid from the first day once you visit our web-site. LEARN MORE >>>>> throatedturtle.betrunken.org

If you are wanting to get $5472 every month simply by taking advantage of your access to the internet and also notebook computer therefore Allow me to discuss my working experience. 24 months back in the past I was still being employed in independent business enterprise without getting paid decent wage with respect to my effort. That time my good pal revealed to me a story about an online web business that you can try at home through the utilization of net and desk top and best thing is one can do the business any time we desire and end up getting the funds on per weekly base basis. It’s different from a scam which you may view online that promise to cause you to be extra wealthy in a couple weeks or so. Currently after working on this life changing opportunity for 2 years Let me claim happens to be the very best on line business I am going to get a hold of in consideration that by working on this project I am able to get the job done when ever i desire. While I was working for private sector business I had been unable to get some more free time with my family members but now since 24 months I am working on this on-line job opportunity and at the present I am loving the extra time with my family members at home or just by heading outside to any place I want. This career can be as super easy just as looking web sites and utilizing copy/paste paste job that anyone is able to do ->-> eskinswarm.a-loch.de

Spending quality time with friends and family. Going outdoor for a trip and uncovering magnificent cultures without worrying over finance is the best way of living. Ask question to yourself! Is your present profession competent to fulfill all of your goals and provides you with financial stability? In case your response is no, then it truly is time for you to make some important decisions . It is a time for a change. To meet your needs we provide a career which is an online opportunity, where you work from anywhere and for few hours every day and make approximately $14000 per week. Do not wait around for a long time! go and have a look at this excellent opportunity to live your life fully >>> sladderycesspool.europa.lc

After Maxine Waters finishes playing her little game with the banks let her tackle pensions. My government is funny business…..so is yours!