One of the surest signs that a bubble is about to burst is junk bonds behaving like respectable paper. That is, their yields drop to mid-single digits, they start appearing with liberal loan covenants that display a high degree of trust in the issuer, and they start reporting really low default rates that lead the gullible to view them as “safe”. So everyone from pension funds to retirees start loading up in the expectation of banking an extra few points of yield with minimal risk.

This pretty much sums up today’s fixed income world. And if past is prologue, soon to come will be a brutally rude awakening. Most of the following charts are from a long, very well-done cautionary article by Nottingham Advisors’ Lawrence Whistler:

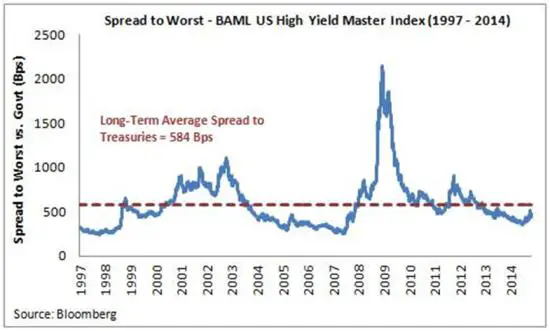

Junk yield premiums over US Treasuries are back down to housing bubble levels:

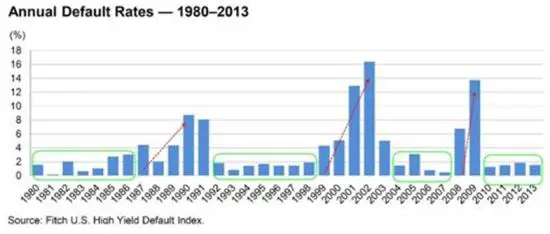

So are default rates:

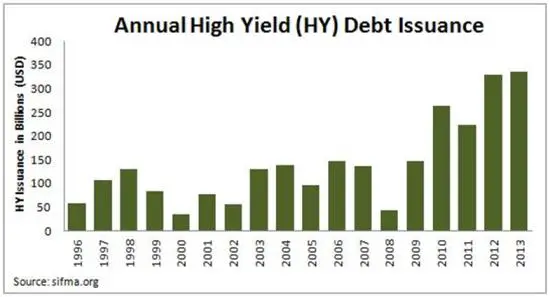

The supply of junk bonds is way higher than before the previous two market crashes:

The issuance of covenant-light loans — the crappiest kind of junk — is rising. On the following chart a higher number means lower quality:

Here’s what happened to the various classes of debt the last time things got this out of whack (junk is purple):

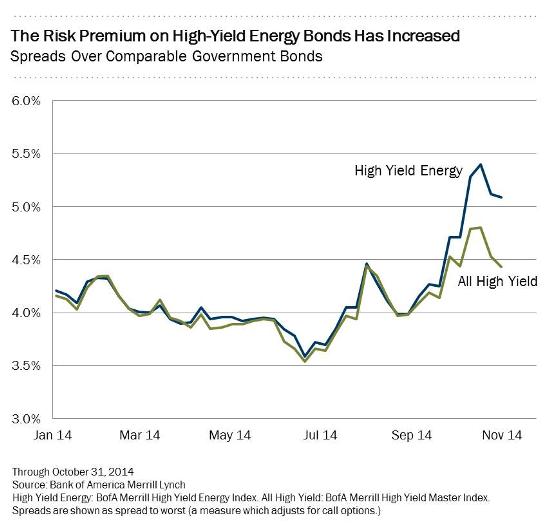

As for what might cause the junk market to crack, one prime candidate is the oil industry. The shale boom has led a lot of energy companies to ramp up production using other people’s money, much of which is coming from junk bonds. Now, with oil down from $100/bbl to around $80, the nice fat coverage ratios on these bonds are looking disturbingly skinny. This chart shows the divergence between overall junk spreads and energy-sector junk spreads.

The weakest of these companies will default in the coming year, and if oil prices fall another $10, perhaps most of these companies will default. This will of course be dismissed as a localized disturbance unlikely to spread to the broader economy — which is exactly what they said about subprime mortgages last time around.

21 thoughts on "What Blows Up First? Part 5: Shale Oil Junk Bonds"

Larger companies are absorbing the smaller companies with shallower pockets, but there is some question as to how long the prices will be kept this low. Companies, towns, and real estate markets need to be flexible and plan for all outcomes. Companies like Aries Residence Suites plan for the future either way by providing for a current need in a way that can be pulled and not affect long term markets for local economies.

I have not been able to find the symbol for the the BofA Merrill Lynch Energy High Yield index symbol. ??? Nay help?

The whole “shale oil” theme is a “scam”. The original investors fell for the very same thing that continues to be rehashed, so they engineered a way to unload it onto the “relatively dumb” money. That’s where we are now. After those new INSIDE investors/suckers realized that projected resources were not the same as extractable ones (at certain price levels) and that current production rates were subject to (downward) change (because the whole process is basically insane and extreme) it only makes sense that more funding could only be obtained by issuing bonds (equity was extracted in the “first round” when new wells geysered, etc.)

But don’t laugh too hard, yet. Between a totally foolish and pathetic Congress, a totally full of shit President, a desperate national central bank, and “TBTF” philosophy in general, this construct may well be supported way beyond its “natural” life.

History is a fascinating spectrum of human nature. There doesn’t seem to be any limits to the lows or the highs, and especially the durations of effort and “pragmatism” to advance certain agendas and IDEALS. That’s not always “good” or “bad”, and it is definitely hard to know in real time.

Funny.. Your website is about the demise of the dollar.. Than its about oil stocks who have plunged along with oil due to a strong dollar

.. Seems you are just looking for negatives..

While you are assuming the strong dollar is the cause of the oil prices I would say “the last guy to drown in the pool is technically the best swimmer (dollar) but did still drown in the end”.

Point is .. You have been complete incorrect on the dollar.. Then write negatively on oil.. You are just a negative person.. Currency value is all relative to other currency; have to have winners and losers.. Not everybody drowns. You seem foolish with such a comment..

Hope you are right.

John, you are 100% correct in your article, particularly with your conclusion that this “will of course be dismissed as a localized disturbance unlikely to spread to the broader economy — which is exactly what they said about subprime mortgages last time around.”

Speaking about bonds and blowing up, what just blew up this morning in Asia was the Japanese Government Bond market which screeched to a trading standstill as yields on short term JGBs dropped to zero.

Japan’s 2-Year Note Trading Stands Still After Yields Touch Zero

http://www.businessweek.com/news/2014-11-19/japan-s-2-year-note-trading-stands-still-after-yields-touch-zero

Japan’s bond markets have just had a fatal heart attack. Japan’s government debt of more than $14 trillion (nearly as much as the US despite Japan’s GDP being about one-third the size of the US) CAN NO LONGER BE FINANCED BY THE MARKETS. That is the END OF THE ROAD for Japan’s 25 years of GROSS FISCAL PROFLIGACY as the only lender of last resort is the BOJ (Bank of Japan) and that will decimate all confidence in Japan and cause the yen to go plunging Perhaps the yen will return to where it was in 1971 at 330 yen to $1 which is really what should have been happening with the yen over the past 25 years as Japan and its economy sank towards the bottom of the fiscal abyss.

I recently had a chance to participate in a real estate syndicated equity offering. I was in the area where the buildings were located, and physically checked them out. Very nice. Then I got the prospectus. Most spaghetti, convoluted structure I had ever seen. “Originator” was going to take 40% of one bldg, 2.5% of the other. SydEq co was putting in a few hundred grand, matched by investor money from the participants for their cut. Option to sell one or bot buildings at any time. The one owned 40% by the originator was the real cash flow cow, the other, larger, would barely hold its own for return. They were borrowing tens of millions in this deal, 5 year rate cape purchased on the 40%, none on the other.

My analysis: buying in was buying a 5 year annuity wit no guarantee of return, and sr. ‘partners’ who could legally loot the deal anytime they wanted by improving their building, and leaving the investors holding the other building.

when I spoke to ‘legal’ and raised my concerns about structure, interest rate risk, etc, I was told “I am not going to argue with a thing you say.” So I asked how their capital raise was going and was told they had hit like 90% by my call, barely a week after offerings were sent. I asked if anyone actually read what they were investing in, and the candid reply was “I think some do, most don’t.”

They knew if they hit the “magic” 7%+ EROI they could corral the sheeple on this deal. And in a “perfect world” it would all be perfect. I have my doubts about 5 years of future perfection…

Do you have a pay pal… because if you do you can get an extra 1200 every week to your income only working on the internet for 2 hours a day.. check out this linkhttp://••►► click Here…..

I’m in on that deal and I would encourage you to participate. We need that last 10% so I can close on my little place on the Med in the south of France. Haha, S-U-C-K-E-R-S!!!