Today the US took its next-to-last stab at calculating First Quarter GDP, and the downward revision was impressive even by recent standards. It now appears that the economy, well, here’s how Bloomberg puts it:

U.S. Economy Shrank in First Quarter by Most in Five Years

The U.S. economy contracted in the first quarter by the most since the depths of the last recession as consumer spending cooled.Gross domestic product fell at a 2.9 percent annualized rate, more than forecast and the worst reading since the same three months in 2009, after a previously reported 1 percent drop, the Commerce Department said today in Washington. It marked the biggest downward revision from the agency’s second GDP estimate since records began in 1976. The revision reflected a slowdown in health care spending.

And this, believe it or not, is still an unrealistically positive spin on the actual numbers. The Consumer Metrics Institute (CMI) specializes in finding the truth in the Bureau of Economic Analysis’ statistical fog, and here’s a telling paragraph in CMI’s longer, must-read report:

And lastly, for this report the BEA assumed annualized net aggregate inflation of 1.27%. During the first quarter (i.e., from January through March) the growth rate of the seasonally adjusted CPI-U index published by the Bureau of Labor Statistics (BLS) was over a half percent higher at a 1.80% (annualized) rate, and the price index reported by the Billion Prices Project (BPP — which arguably reflected the real experiences of American households while recording sharply increasing consumer prices during the first quarter) was over two and a half percent higher at 3.91%. Under reported inflation will result in overly optimistic growth data, and if the BEA’s numbers were corrected for inflation using the BLS CPI-U the economy would be reported to be contracting at a -3.51% annualized rate. If we were to use the BPP data to adjust for inflation, the first quarter’s contraction rate would have been an horrific -5.62%.

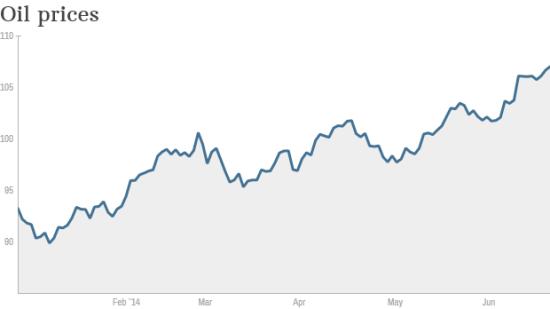

That’s right, the government is assuming that inflation is running at a rate of 1.27%. To anyone who eats (beef, eggs, and citrus prices are up 9%, 5%, and 22%, respectively, in the past year) or drives (gasoline is at record highs in many states) this seems just a tad on the optimistic side. As CMI noted, MIT’s Billion Prices Project, which monitors real-time pricing across the Internet, is rising at a nearly 4% rate, which for most people probably feels more accurate.

So why is Washington using such deceptive inflation numbers when calculating GDP? Because 1) it makes the economy look bigger, which makes US economic policy look more effective and its architects more competent, and 2) they can get away with it. Most media accounts of this and other economic statistics simply repeat the headline number without considering how it was calculated, so what the government says is exactly what most people hear. Only in the sound money community is this debated, and that’s far too small a forum to affect general perception.

But an effective lie is still a lie, and this one is a whopper.

25 thoughts on "They’re Lying To Us, Part 2: GDP"

well here in Las Vegas the economy is shitty and no money is moving , tourist arnt coming from around the world and the people whom are coming arnt spending.

i have found a way to acquire 999.9 currency grade gold bullion and get paid to do it. It is the best route to obtaining real money and hedging against inflation. Take a closer look http://www.raisethekaratbar.com

What’s interesting to me is that these days the truth doesn’t matter – literally.

So Q1 GDP has been revised downward – again -this time to -2.9%, but it seems to make absolutely no difference except that the US stock market went up. Evidently, the government doesn’t need to lie. Even if the revised GDP were reported to be -5.62% I don’t think it would matter.

And, honestly, I don’t know what would.

If the GDP is revised downwards to -5.62%, it would only mean that second quarter GDP will print at 10%. (Unless, of course, global warming kills the economy dead in spring just like it did in winter)

Yeah, it will be interesting to see what is posted for Q2 at least at first. Tyler Druden at Zero Hedge claims that expenditures due to ObamaCare was shifted to from Q1 to Q2 which explains why Q1 dropped again and Q2 will be outsized (like 5%).

The federal economy reports are based upon a ever-more heightened mound of lies … the USA economy is actually bankrupt, only the American population on the whole remains ill-informed or haven’t the grey matter activity to understand that their currency is becoming more worthless every day and that the day will soon come when there will be a total collapse of the Federal Reserve, of the Federal Reserve Notes value as “legal tender whose true value is below zero”.

There will be a day of reckoning … whether that day is tomorrow, next Monday, a week from now or a few months from now I cannot yet determine. My recommendation to all American would-be survivors: Stock up on life-sustaining essentials and immediately learn how to live well-below your financial means … or get a change of address card from the local USPS office so you can have your mail immediately forwarded to a FEMA camp address as yet to be determined just after TSHTF.

I do believe that the the US currency is going to go down. However, it is the weirdest thing. In Indonesia, the US dollar has been going up for a couple of years and is higher than it has been in years. The same thing is happening in Costa Rica, where the dollar is regularly being revised upward against the colon, the CR currency.. So, why would you think that is? And when do you think it will stop.

.

@Gypsy-All fiat currencies are a derivative of either the dollar, the Yen, or the euro. The USA is able to export inflation by paying for imports with fiat paper that was created out of thin air, backed by nothing. We (USA) get the stuff, you (exporter) get paper or electronic credits. The farther you get from the source of fiat, the less it is worth.

We are quickly approaching the end game. This is due to a variety of factors. The two most important are the end of the cheap oil era, and the retirement of the baby boomers, and burden this places on the Medicare and Social Security Trust Funds, which exist in name only. Since both the ‘oil’ and ‘baby boomer’ situations are long, drawn out transitions, it is impossible to pinpoint when the house of cards collapses.

However, with the economy now back in recession, there is a good chance we see the start of hyperinflation later this year.

Since fiat money is created out of thin air why can’t they just wipe the debt the same way by deleting the ledger amount? If the real debt is nearly $280Trillion, what with the “unfunded liabilities” how else will it be resolved? It’s only real in so far the interest earned can be used to pay for stuff. That way the “kick the can down the road” can go on and on. Future generations will no way accept the debt. I can’t see anything changing while ever “confidence” remains, misjudged though it be.

Confidence is a factor, but only one of many. When you put gasoline in your car, or food in your shopping cart, that product represents work done by someone. If you ‘pay’ for that work (done by others) with fiat, confidence is certainly in play. You are, in effect, taking the savings of those food and energy workers. They think they have something of value, but it is ephemeral.

You see, all the trillions of US treasury bonds, US dollar currency, and other US obligations are really not worth anything. The Chinese, Japanese, Arabs, etc. really don’t have any savings.

They know this, but they play along, because they get access to USA retail and wholesale markets. Their workers are employed. But this can only continue as long as the USA keeps buying all their stuff. And with the USA back in recession, following the weakest post WW2 post recession bounce, by far, it is almost over. Theoretically, the fed or the Congress could drop paper money from helicopters or put $1000 in everyone’s checking account, but that is the start of hyperinflation.

Something similar to what you are asking could happen but it is very tricky. When the Federal Reserve (“the Fed”) buys bonds (or any asset) they do it by creating new currency (or digital entries in the purchaser’s account). That means new “money” is injected into the economy that didn’t exist before, but in theory that new money is expected to be returned to the Fed when the bond matures. That is why some people think that that does not really increase the money supply, because it’s “transient “and will soon be paid back to the Fed.

Now, what if the Fed suddenly “forgives” all of those bond obligations that it engaged in? What if it says that you who sold me bonds don’t ever have to pay me back? That would literally mean that you and other bond sellers received free money. That may actually happen on a large scale in the near future. Debts may be expunged by the Fed – the creator of “money” itself – by fiat, and thus settle at least some of the world’s debt problems.

The critical and pivotal question is, would you (as a proxy for most) accept that? If so, then it may happen.

That reflects this particular pundit’s opinion; Bix Weir;

[I can’t load it]Try; https/www.youtube.com/watch?v=QDwRJE-dXxs

Interested in hearing comments about his ideas.

I’m blowed if I can work out what may happen.

“That is why some people think that that does not really increase the money supply, because it’s “transient “and will soon be paid back to the Fed.”

I don’t think the assets on the Fed’s balance sheet have the necessary liquidity to be able to turn around and sell on a dime. They are holding garbage, for the long term recovery-that’s-just-around-the-corner to bail them out.

You’re right. I thought about that after I posted it. The Fed is buying long maturity bonds so even if the principle is repaid it will be at least 5 years. Nevertheless, I have heard some Fed governors say exactly that meaning after “the recovery”. Another argument is that the amount of currency added from QE is small compared to the total amount of credit that has been generated from the base money supply, so QE itself should not make that much difference. The Fed thinks inflation should increase not from QE injections but because of wage wars due to all that employment out there.

Government must remain positive or the economy will collapse. Private investment would go away and a real downward spiral would ensue. The banks are teetering and they will fall before the government does from the fraud they are perpetrating on the public and then the government will have to step in and nationalize the banks that can be saved and go back to regulatory practices that prevented the failure. The dollar will remain strong because the US is still very stable politically in the world. Congress will come to its senses when the ball is in their court and they start bringing the bankers before them in hearings.

‘Congress will come to its senses when the ball is in their court and they start bringing the bankers before them in hearings.’

Given that there are 5 lobbyists for the financial ‘industry’/sector for each Congressman and that, largely, most of the latter are in the pockets of that sector what on earth makes you think that this is ever going to happen ?

“And this, believe it or not, is still an unrealistically positive spin on the actual numbers. ”

Ahhh, that explains why the markets are in a major rally today, the day when every normal indicator was red. There are days when I just don’t understand market dynamics. 🙂

QE4 prepped and ready on the launch pad.

Isn’t all the bond buying by powerful ‘Belgium’ a form of QE4?

Just out of curiosity, I wonder why they didn’t pick Zimbabwe to be the ‘buyer’ of the bonds. I bet they toyed with the idea, but decided that that would be going a tad too far, lol.

Check out Doug Casey Meltdown America on Youtube.

There is something wrong with the data. Exports fell by 11% in Q1, but Imports increased by 2%? How does this jive with “the bad weather” mantra? https://confoundedinterest.wordpress.com/2014/06/25/recovery-q1-real-gdp-plunges-to-2-9-biggest-decline-since-2008/

People do not have the money to spend, maybe the wealth but most people are using CC and are max out now. After 5 years of decrease pay and higher expensive. Have you seen property taxes, insurance and any repairs prices go down?