Somewhere back in the depths of the 20th century, a bunch of governors, mayors, and public sector union leaders got together and cooked up one of history’s greatest financial scams. They would offer teachers, cops, and firefighters extremely generous pensions but would avoid raising taxes to fund the resulting future obligations. Grateful workers would vote to re-elect their benefactors, while taxpayers would appreciate the combination of excellent public services and low taxes.

The beauty of the scheme flowed from its demographics: Most of the original public sector workers were young and therefore decades away from retirement, so the crime wouldn’t be discovered until long after the architects retired rich and revered.

Now, however, those baby boomer workers are retiring and the scam is revealed for all to see. Even in the absence of a pandemic lockdown, mass defaults on state and city obligations would be inevitable in the coming decade. But with the lockdown, they’re coming next year.

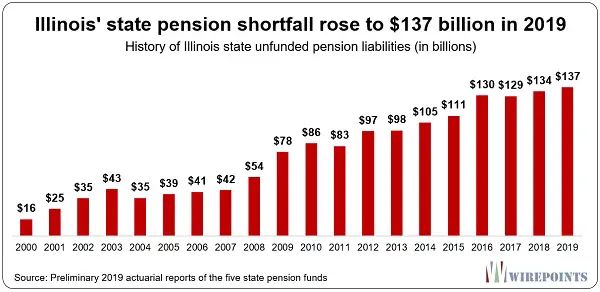

So what do the worst offenders do? What they’ve always done, of course, which is to look for ways to paper over the mess for one more election cycle. Illinois is the poster child for state financial mismanagement, with unfunded liabilities that have grown from virtually nothing to $137 billion in just the past two decades.

So it’s no surprise that its politicians are engaged in some truly ridiculous forms of damage control:

Illinois to sell $850 million of bonds as investors brace for junk status

CHICAGO (Reuters) – Illinois is scheduled to sell $850 million of bonds on Tuesday as investors demand fatter yields for the state’s debt due to increased worries over its deep financial woes, which were exacerbated by the coronavirus pandemic.

Ahead of the competitive sale of general obligation bonds due over the next 25 years, the spread for Illinois 10-year bonds over Municipal Market Data’s benchmark triple-A yield scale has widened by 10 basis points to 281 basis points since Oct. 1.

Howard Cure, director of municipal bond research at Evercore Wealth Management, pointed to “a legitimate fear that the state could go into junk status – although not default on its debt.”

“The state continues to delay tough decisions with a number of speculative revenues as part of its current budget, including additional federal aid, voter approval for a progressive income tax, and more Municipal Liquidity Facility (MLF) debt,” he said, referring to the possibility Illinois, which took out a $1.2 billion cash-flow loan in June from the Federal Reserve’s MLF, could borrow more.

Illinois is the lowest-rated state at a notch above junk due to its huge unfunded pension liability and chronic structural budget deficit. All three major credit rating agencies assigned negative outlooks to their ratings in the wake of the pandemic.

Earlier this month, a Citi research report said Illinois is “almost guaranteed” a credit rating downgrade to junk if a constitutional amendment to replace its flat income tax rate with graduated rates fails to pass on Nov. 3. The ability to tax high earners more would increase revenue by an estimated $3.1 billion annually.

In addition to uncertainty over congressional passage of unrestricted federal virus aid to states, Andrew Richman, senior fixed income strategist at Sterling Capital Management, said Illinois was experiencing a surge in virus cases ahead of its sizeable bond sale. The state reported its highest one-day total of 4,554 cases on Friday.

“Illinois had problems before the pandemic,” Richman said. “Things are getting worse not better.”

Still, John Mousseau, president and CEO of Cumberland Advisors, said the high yields will attract buyers.

“People will buy it. They are yield-starved,” he said.

Taking the scam to the next level

One part of one sentence jumps out of the preceding article: “The state continues to delay tough decisions with a number of speculative revenues as part of its current budget, including additional federal aid …”

The last remaining escape hatch for the worst-run cities and states is a massive (easily multi-trillion dollar) bailout by the only remaining entity with access to that kind of credit, the federal government. After the upcoming election, whichever party ends up in charge will face the specter of bond defaults and mass layoffs in Illinois, California, New York, New Jersey, Connecticut, and Kentucky, among many other places.

A Democrat-led federal government will happily provide the trillions necessary to keep this from happening, while a Republican administration will dither for a while before caving. Either way, the original crime is swept under the rug and the financial pressure is socialized, with all US taxpayers on the hook for previously-local mistakes.

38 thoughts on "This Is How A State Goes Bankrupt, Illinois Edition"

I have a brother-in-law who is a New York City firefighter (another very underfunded pension fund). I tried to tell him that for New York City to pay a firefighter 100K in retirement, they either needed to save 2 million dollars that is yielding 5% or they have to convince the taxpayers to fund it. Of course, we know the city hasn’t saved the 2 million dollars and they yields aren’t at 5%. I think you are right that it will wind up on the federal balance sheet. Welcome to MMT. Perhaps we are about to learn where the limits of MMT are? (Personally, I believe we are already past the point of no return)

Absolutely right. Spot on. Sad. We are doomed to financial perdition.

what a horrible situation these politicians have put us all in, there is no way out and its always all political.