This morning’s jobs report was stronger than expected, which – combined with Amazon’s dramatic increase in its minimum wage to $15/hr — implies rising wages going forward.

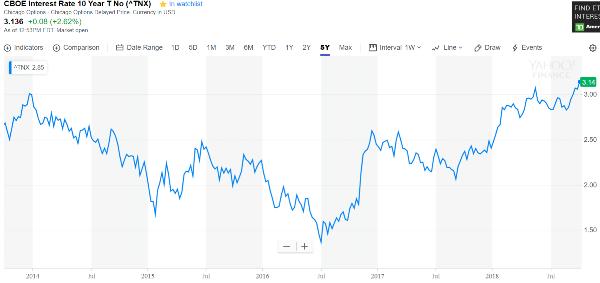

The bond market reacted as you’d expect to the prospect of higher wage inflation, with the yield on 10-year Treasuries hitting its highest level in five years.

This is good news for long-suffering savers and retirees who can finally generate a decent return on their investments. But it’s potentially disastrous for the broader financial system, which is now so over-leveraged that interest rates returning to historically-normal levels pose a mortal threat.

To understand how this works, consider the federal government’s rapidly-rising debt…

source: tradingeconomics.com

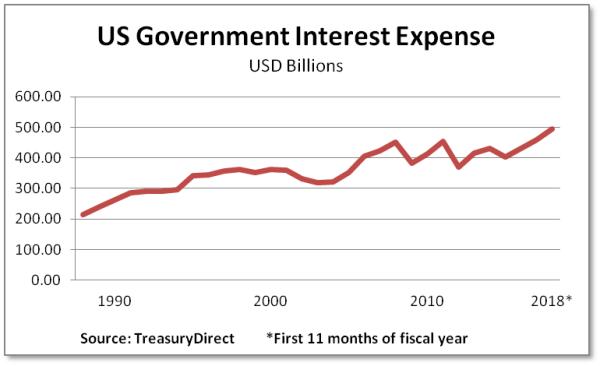

… and the related interest expense:

Notice a few things:

1) There were long stretches in which interest expense didn’t rise. In the 1990s this was mostly due to the surpluses produced by the tech stock bubble’s torrent of capital gains taxes, which allowed Washington to minimize it’s borrowing for a few years. But the decline in interest expense between 2007 and 2014 – while we were running trillion-dollar deficits – was due to the Fed lowering interest rates to levels not seen since the Great Depression. This seemingly free lunch led many in the political/Keynesian class to conclude that they’d discovered a perpetual motion machine: Simply cut interest rates every year and borrowing is essentially free.

2) The recent 25% spike in interest expense in just three years exceeds the percentage increase in government debt because interest rates rose concurrently. So the US is now being hit with a double-whammy of debt that’s both rising and becoming more costly.

3) Now the real trouble begins. As the government’s short-term debt is refinanced at ever-higher interest rates, interest expense will rise even more steeply. Within three years at the current rate of borrowing, US federal debt will be $25 trillion. An average interest rate of 4% — below the historical norm and easily within reach if current trends continue – will produce an annual interest expense of $1 trillion. Interest will be the government’s largest single budget item, raising the deficit and adding to future debt increases. The perpetual motion machine will have shifted into reverse.

For a sense of what this means for the US economy, just look at the countries that are a bit further down this path. Once the “rising interest expense begets higher deficits begets rising interest expense” idea takes hold, there’s no fix, only a choice of crises. Argentina just raised its official lending rate to 60% in an attempt to stabilize its collapsing currency. But how many businesses can refinance their debts at this rate? Not many. So a crash is virtually inevitable.

source: tradingeconomics.com

Turkey, meanwhile, is apparently trying to talk its way out of a similar mess, without success. See Turkey’s currency slides as inflation spikes to its highest level in 15 years.

The idea that the US is immune from this kind of basic math will be tested shortly. And the answer will almost certainly be that the laws of finance apply to everyone, including superpowers.

5 thoughts on "US Interest Rates Are Spiking Again: Why This Is A Huge Deal"

Interest rates rising are a major concern. They can juice our economy by reducing rates or shut it down by increasing them. It is easy to see when the economic crisis will start from the log plot. https://uploads.disquscdn.com/images/107dba305d62e2328497def63bd208ea62585791acf9defa12de061310b20699.jpg

I actually gain about $12500-$13500 a month through the internet. I got rid of my job after operating for the same corporation for years. I needed trustworthy income. I was not interested in the “get rich overnight” home programs you see all over the internet. Those all are kind of ponzi type of multi level marketing systems in which you need to initially make prospects then sell something to friends or relatives or anybody so that they will be in your team. Working online has many advantages like I am always home with the children and also enjoy time with family on different beaches of the world. Check it out what I do> https://pepsapi.tumblr.com

These supposed conservatives we elected are really doing a great job. Does Grover Norquist go out in public anymore? Do you think Paul Ryan and Mitch McConnell will retire to a good position at the Heritage Foundation and continue their lecture on small government?

These supposed conservatives we elected are doing a bang-up-job; really impressive. Do you know if Grover Norquist still goes out in public?