In the energy market, there’s always a revolution going on somewhere.

For most of human history, light and heat were provided by wood and candles. Then we discovered whale oil, and in the early 1800s lamps replaced candles.

Later in that century, kerosene, a petroleum derivative, became the lamp oil of choice, and the whaling industry (thankfully) collapsed. A few decades later, electricity from coal replaced kerosene.

Now the regime is changing again, as ever-cheaper solar power leads analysts to predict that it will “kill” coal and nuclear.

Wind and solar kill coal and nuclear on costs, says latest Lazard report

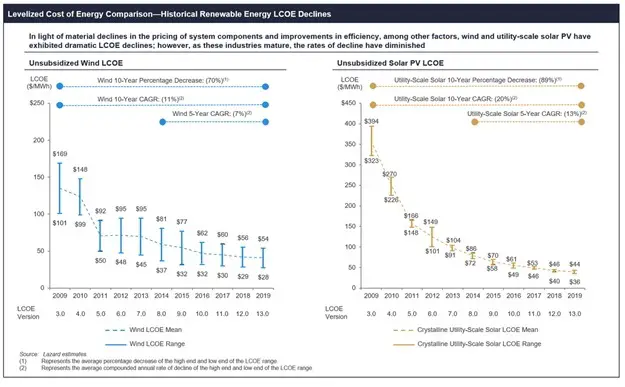

The cost of wind and solar continue to decline and are now at the point where they beat, or at least match, even the marginal costs of coal-fired generation and nuclear power, according to the 13th and latest edition of Lazard’s Levelized Cost of Energy Analysis, one of the most highly regarded assessments in the world.

The new Lazard report puts the unsubsidised levellised cost of energy (LCOE) of large scale wind and solar at a fraction of the cost of new coal or nuclear generators, even if the cost of decommissioning or the ongoing maintenance for nuclear is excluded.

Wind is priced at a global average of $US28-$US54/MWh ($A40-$A78/MWh), while solar is put at a range of $US32-$US42/MWh ($A46-$A60/MWh) depending on whether single axis tracking is used.

This compares to coal’s global range of $US66-$US152/MWh ($A96-$A220/MWh) and nuclear’s estimate of $US118-$US192/MWh ($A171-$A278/MWh).

Wind and solar have been beating coal and nuclear on costs for a few years now, but Lazard points out that both wind and solar are now matching both coal and nuclear on even the “marginal” cost of generation, which excludes, for instance, the huge capital cost of nuclear plants. For coal this “marginal” is put at $US33/MWh, and for nuclear $US29/MWh.

The cost of solar, Lazard notes, has fallen 89 per cent over the past decade, and is still falling at an average rate of 13 per cent a year. The more mature wind technology has fallen 70 per cent over the same period of time, and is still falling at around 7 per cent.

Solar’s take-down of traditional energy sources is interesting for at least three reasons:

First, it’s one of many current examples of capitalist creative destruction, the process by which an old industry is replaced by something better and/or cheaper. This is usually ultimately a positive thing but is emphatically not good for people on the wrong side of the technological divide.

Second, it’s a great example of what happens when exponential change hits a static industry. Coal and oil cost more or less the same amount from one decade to the next while solar falls by 10% per year. No static industry can survive against competition that grows continuously stronger. This also means that analysis based on a snapshot of current relationships will quickly become obsolete as one technology keeps improving while the other stands still.

Third, and most applicable for this gloom-and-doom website, solar killing fossil fuels impacts the “financial assets vs real assets” debate by making oil wells and coal plants – typically seen as “real” in the sense that the government can’t make more of them with a mouse click – less certain to preserve purchasing power during financial crises. It’s now possible that fossil fuel-related assets will lose value even faster than banks and auto makers in the next big downturn.

The energy assets likely to fit the definition of “real” in the future will be solar and wind farms, along with utility grade battery storage facilities. Sound money investors should adjust their portfolios accordingly.

20 thoughts on "As Solar Eats The Energy Sector, It’s Time To Revise The “Real Assets” List"

I am a retired Nuclear worker and the costs for refueling maintenance and funds set aside for decommissioning were only about 2/3 what the article stated for ‘marginal’ costs. He is comparing worldwide costs and no one knows what that means.

I also want to make a comment about the previous article about the demise of entitlements and what to do about it.

The problem with that article and so many others is it’s perfectly logical. I’ve been doing logical things with my money since 2008 and it remains to be seen how well that will turn out. Logically, gold should be a lot higher already for precisely the reasons given by the Birch Group, and others, yet it hasn’t risen in price nearly as much as “expected.” You can explain that a way any way you want but the question then becomes when (or why) will that change (e.g., gold price suppression, people are ignorant of the problem, gold doesn’t pay interest, practical issues with holding physical, the “paper gold” market, etc.)

My original plan was to divide my savings in three ways: physical gold and silver, stocks, and cash & real estate. But around 2011 I went off the rails and sold out of stocks for more cash. So far net-net I’ve done okay with gold and silver (but not great), supposedly have paper profits in RE, but totally missed out on the big asset inflation in equities. I wish I had stayed the course in equities. Logically, the stock market is inflated but it’s been that for years and it’s still going up. All I’m saying is nothing financial has been logical for seemingly forever both good and bad.Therefore I’m still not going to own more than 1/3 of my net worth in gold and silver because they may never bubble up. Cash should “obviously” be trash too, right, all while the dollar continues to strengthen because there’s no other game in town. The central banks still have a lot of capacity to continue the status quo despite logical limitations (like debt.) Helicopter money (aka minimum basic income) still hasn’t started yet, and MMT is becoming more popular if for no other reason than it will keep the train moving for who knows how many more decades. Japan has a much bigger debt to GDP than the US and it’s laughing all the way to bank year after year. Nobody cares about that, so why would they care about the US dollar where EVERYONE has a stake?

In my experience with alternative energy methods, which goes back about 40 years, alternatives to fossil fuels were more of a hoped-for solution in search of a problem. None of them worked very well back then and had many technological scale-up problems (never mind financial ones) and today they work better but they are still inherently limited. I’ll probably be wrong on this eventually but I don’t see any way wind and solar can even come close to powering the cities and infrastructure of industrialized cities and countries. A lot of this talk leaves out some glaring realities like ‘solar is dropping in cost’ but it still supplies only 2%, or that costs are dropping for users because of so much government subsidation. I actually think all of these alternative energy schemes are mainly political, as is the entire climate changing hoax, which it’s a part of.

Start making $90 /day for working on the web from your home for couple of hours each day… Get paid regularly on a weekly basis… All what is required is a pc, access to the web, plus some sparetime… The best thing about it is that now I have more time to spend with my family. I am in a position to commit quality time with my family and friends and look after my children and also going on holiday break together with them very routinely. Don’t ignore this chance and try to respond quickly. Here is what I do wiki.sh/13bhj

You will be really delighted as I am about to let you know about a internet based making money opportunity whereby you can make upto $10500 once per month? In Internet Home business you can make earnings from your home or just any part in the world which has a broadband connectivity. Earning on the internet will give you the freedom to spend time every day with the individuals you care about and there is no need to show up at a location outside of your house. No need chase any person as there are enough persons online already seeking what you are offering. This is what it is about> earn9kpermonth.exzu.com

One yr have passed because I resigned from my last job and that choice was a lifetime changer for me… I started working over internet, for a business I stumbled upon online, For a few hrs per day, and I make substantially more than that I did in my last occupation… My pay-check for last month was for 9000 dollars… Great thing concerning this job is the spare time I obtained with my children . Let me show you what I do… nalablucking.ballern.de

If wind & solar were the panacea, we wouldn’t need to subsidize it with public money and promote it like the second coming of a Jesus Christ. Wind and solar would be self-evident, but they’re not. It’s just the lastest distraction for the herd, looking for a new god. They’ll abandon these ones soon enough.

In the mean time, I guess some good money will be made selling municipalities an over-priced piece of the green new deal.

Great news in any case.

Oh lord. I’m no fan of coal and, while most of them could be solved, as it is now, nuclear has a boatload of problems.

But, come on. You can’t discuss solar and wind as equivalents, because of two rather significant issues with their viability … dark and calm. Bottom line: You can’t DEPEND on them for BASELINE power.

Can they be made cheaper and provide a part of the mix? sure. But unless somebody’s come up with some hellatious battery technology I don’t know about, so you can store the power for later use, you can forget about these sources as true replacements.

John, you’re a smart guy. You know this, so why promote the fantasy? And why not at least mention the baseline power issue? As it is, you sound like some simple-minded “green” believer.

Thomas the batteries are getting cheaper too. The cost of Li ion battery per kWh is dropping by 20% per year.

Where do you intend to source future lithium? Will it be worth going to war over? Might be worth thinking about.

There is no evidence that there is a shortage of Lithium. They are building a lot of new giga battery factories and no one has any trouble obtaining Lithium.

Not now, but if what you advocate comes to fruition, there will be. Tell me how this will essentially differ from oil, uranium, etc.

It is very simple. Batteries can be charged and discharged thousands of times. At the end of their life the Lithium can be recycled. Fossil fuels on the other hand can be burned only one time. Also note that they are researching other (non-Lithium) battery chemistries. Some of these chemistries use minerals (e.g. Sodium) that are abundant on Earth.

As of today there is no feasible way to recycle lithium. Hope is not reality.

Walmart and Amazon are suing because those batteries cause fires. So the tech is still not good enough for widespread use. Wind and Solar can’t yet provide a reliable source of power.

Do these projections for wind include operation & maintenance costs? I recall that Chris Martenson wrote that the concrete pedestals for wind generators are built using iron re-rod that tends to rust and decay in about 25 years. Also, “cumulative O&M costs of wind turbines are significant and can equal 65%-95% of a turbine’s investment cost over the assumed 20 year lifetime of the turbine.” https://www.exponent.com/knowledge/alerts/2017/06/wind-turbine-reliability/?pageSize=NaN&pageNum=0&loadAllByPageSize=true

I see a lot of wind generators that are not turning even on cold windy days when the power is needed. Those generators are tethered because they need repairs. Those repairs are not cost effective. It is a better deal to get more subsidy money by putting up a new one. That shows me that wind is not working at all and I suspect solar has similar problems that aren’t as visible.