Guest post from Quoth the Raven from his subscription substack:

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week, with his updated take on the state of macro heading into 2023.

I truly believe Larry to be one of the muted voices that the investing community would be better off for considering. He’s the type of voice that gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

You can listen to his most recent public podcast appearance on Palisades Gold Radio, from about 3 weeks ago, here.

But for this week, Larry was kind enough to allow me to share his thoughts heading into Q1 2023. His letter has been edited ever-so-slightly for formatting, grammar and visuals.

MACRO RECAP OF 2022

2022 was another extraordinary year. When we wrote our year-end 2021 report, we made the following observations about 2021:

- Covid ran wild

- Inflation ran wild

- Fiscal and monetary policy ran wild

- Markets ran wild

In 2022 we saw extraordinary change across all of these metrics. The Covid problem abated. The US Stock market put in what we believe will be a multi-year top in December 2021and the Fed finally decided that maybe they had been a bit too accommodative with a Zero interest rate policy and QE in the face of exploding prices in everything.

As a reminder of the excesses in 2021, the US Federal Budget deficit was $2.77T, money supply (M2) grew 38.6% in 20 months (a 21.6% annualized rate) and the housing, auto and crypto currency markets were all on fire. In early 2022, the Fed belatedly admitted that they were wrong and that the massive inflation (highest in 40 years) was not simply “transitory”. Recall that inflation was 7.9% and rising when they began their tightening campaign in February 2022.

As macro analyst Mohamed El-Erian said, “the Fed slammed on the brakes, and the economy is in the process of going through the windshield.”

THE FOUR MOST IMPORTANT STORIES IN MACRO

In our opinion, the four most important macro stories of 2022 are the following:

1. Fed tightens and the Everything Bubble Bursts.

2. Russia invades the Ukraine, and the US seizes $600 Billion of foreign reserve assets.

3. Britain announces spending and tax policies which create market failure leading to unlimited QE. (a template for what will happen everywhere)

4. Era of Deflation Ends, Era of Inflation Begins (process started in 2021).

#1 2022 Macro Story: FED TIGHTENS: BYE BYE PEAK BUBBLE

It is helpful to recall just how frothy things were at the end of 2021. The world was living in an “everything bubble” driven by mis-priced capital provided by the Fed. The original crime was Zero Interest Rate Policy (ZIRP) from 2009-2015 and then it was renewed with the Powell pivot in 2018-2019 and the opening of the monetary flood gates in March 2020 in response to the COVID pandemic. Absolutely everything in the world was overvalued based upon cheap money and the excesses were epic.

Recall that at the end of 2021, the DJIA was up 19% (up 3.5x since 2009), the S&P 500 was up 27% (up 4.3x since 2009), and the NASDAQ was up 21% (up 7x since 2009). Housing prices were up 20% y/y and rents were up 17% in calendar 2021. The broader crypto market was the poster boy for speculation and at one point was over $3Trillion in size. Doge Coin, a crypto currency started as a joke had a market cap of $85 Billion. The speculation across all asset categories was outrageous and even caused us to suggest in our Q4 2021 letter that we might be undergoing a “crack-up boom”[1].

Alarm bells must have been going off at the Fed as well, and when they finally woke-up, they raised rates and ended QE with a vengeance. The Fed’s tightening actions, language and pace increased throughout 2022 and, in our opinion, put the final pin in this bubble.

ECONOMIC WHIPLASH

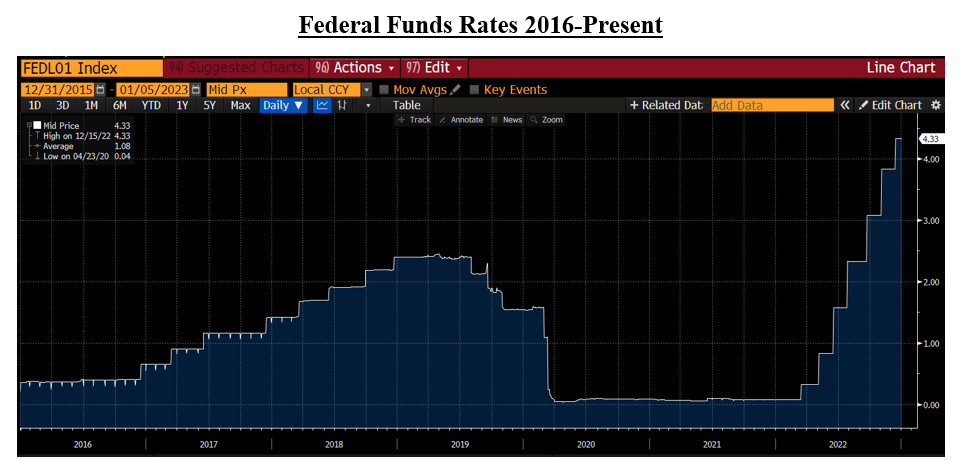

As late as December 2021, the Fed’s dot plot was predicting that the Fed might have to raise the Fed Funds rate by 25 basis points 3 times to a level of 0.75% in 2022. As the chart below shows, the Fed quickly revised this higher and conducted the most aggressive rate hike policy since the 1970’s (4.33% is a lot higher than 0.75%). The first chart below shows the rapid recent increases in the Fed Funds rate. Notice that these came after the original Powell pivot in 2019 and ZIRP throughout the COVID period.

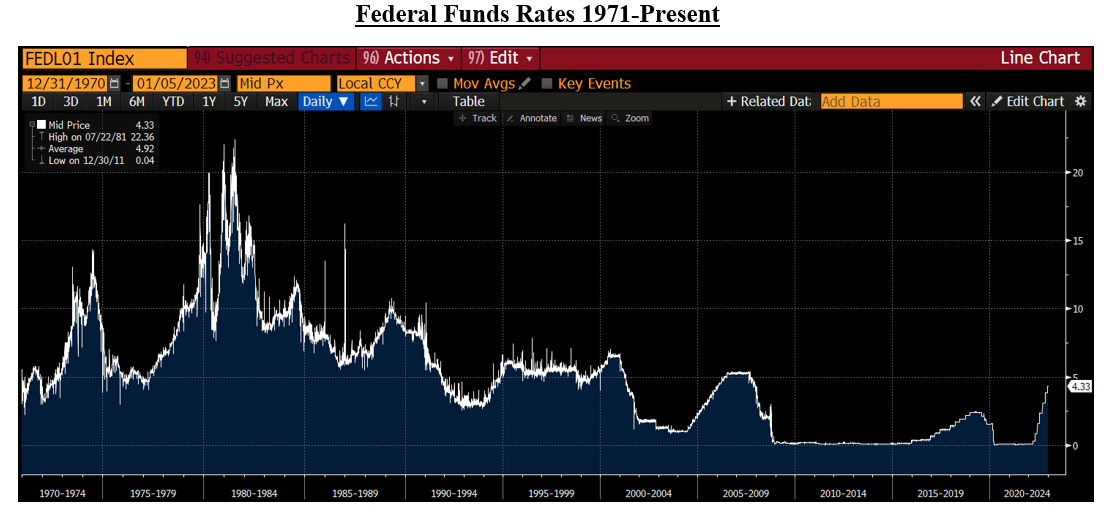

The next chart shows the same Funds rate from 1971 to present. Note how high the rate had to go in the 1970’s to tame that inflationary episode. Also, take note of the period from 2009 to 2015 when the Fed irresponsibly pegged the Fed Funds rate at zero resulting in a massive misallocation of capital and the “Everything Bubble” which has now burst. Unlike the two earlier bubbles that the Fed played a role in creating (Dotcom in 2000, Housing in 2008), this bubble was at the Sovereign Currency/Debt level and the G-7 world has not experienced one of these since the early part of the 20th century. This is why this investing climate is going to surprise so many. Nobody alive has seen one of these things burst.

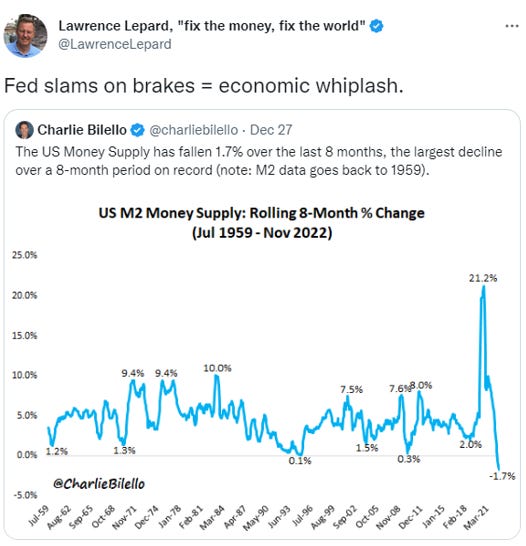

The effect of these rate hikes has been dramatic in terms of the growth rate of M2.

This rapid deceleration in the growth of the US M2 Money Supply is stunning and represents a sharp reversal from the prior spike. In fact, dating back to 1959, M2 growth has never been negative as it is now. As one might expect this has had an immediate impact on the housing and automobile markets:

Housing has also been badly impacted because 30-year mortgage rates have gone from 3% to almost 7% very quickly. As a result, high housing prices and higher rates have crushed affordability.

Note that if the housing market becomes soft and prices fall (we expect this), this will have a large impact on consumer sentiment because houses are the largest asset owned by most families.

In the automotive market, Luke Gromen made the following comments on the market for used cars:

#2 2022 Macro Story: RUSSIAN ASSETS SEIZED – WHAT IS SAFE MONEY?

In our opinion, a truly seminal event occurred in Q1 2022. Russia invaded the Ukraine on February 24, 2022 and the response of the US was to seize over $600 billion of Russian foreign currency reserves. This was an earthquake similar to the Nixon shock when the US defaulted on gold exchange-ability for the dollar. If the US could sanction a country and steal its foreign currency reserves, it brought into question the entire issue of whether the dollar deserves to be the world’s reserve currency.

The results of this theft have been quite clear. Many countries including Russia, China, Saudi Arabia and India have made deliberate moves to trade in their native currencies and to avoid the dollar. The US Dollar as a reserve currency has given the US the ability to live beyond it means and to export inflation to foreign countries. This exorbitant privilege is in the process of being taken away. (For more on this see our Q1 2022 Letter, and in this letter Zoltan page 18).

This dollar theft came at about the same time that the Canadian Truckers Convoy was driving to Ottawa to protest the oppressive COVID restrictions in Canada. Truckers, who were being forced to excessively test, quarantine and stop working, decided to mount a mass protest against their government’s COVID policies. Over 1,000 trucks and assorted vehicles as well as over 10,000 people joined the Convoy. People in Canada who agreed with the Truckers started a GoFundMe account to send funds to support the truckers, raising over C$10 million from over 120,000 donors.

Surprisingly, the response of the Canadian Government was to seize this account and to freeze the funds and bank accounts of anyone who supported the truckers. Much like the US seizure of Russian reserves, the Canadian government took the position that if you supported something they did not like, they could seize your assets.

What both of these examples show is that State Controlled Fiat Money comes with strings attached. If Governments do not agree with your views, they can mess with your finances. The obvious conclusion one draws from these episodes is that bearer money in the form of cash, gold, silver or Bitcoin is attractive when governments overreach.

Following these events, in March last year, former trader for the Federal Reserve Bank Joseph Wang (@Fedguy on Twitter) pointed out the following which has proved prophetic (see Central Bank Gold purchases later herein).

#3 2022 Macro Story: GREAT BRITAIN OFFERS A PREVIEW OF COMING ATTRACTIONS

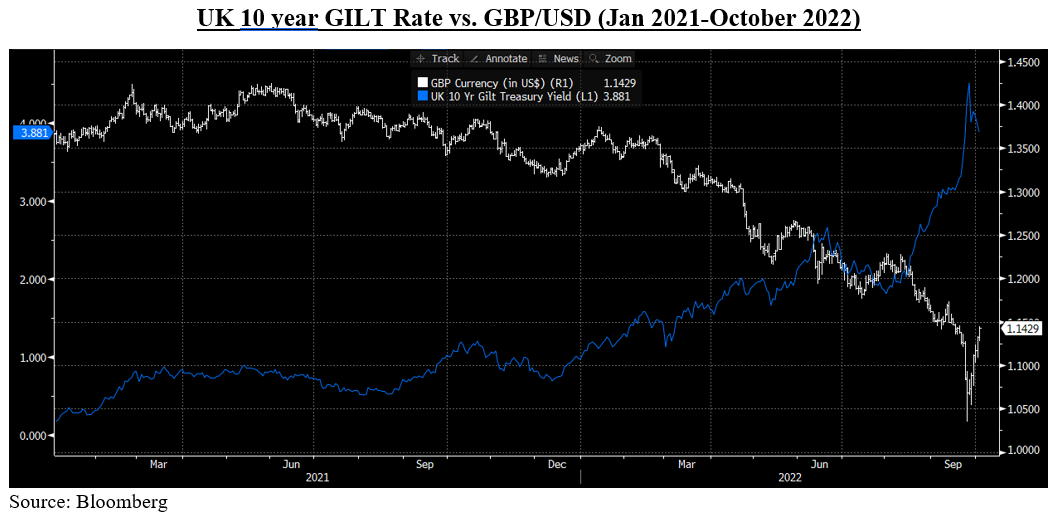

Great Britain is a good preview of how a crisis can unfold when higher interest costs impact a bond market. A new Prime Minister in the UK made a policy error (arguably) by promising tax cuts and increased social spending to cap the costs of higher electricity for businesses and citizens. The UK bond and currency markets had a negative reaction. As you can see in the chart below the Great British Pound (GBP) began to depreciate rapidly (white line in chart below). Simultaneously, interest rates in the UK began to increase quite rapidly (blue line in chart below). What had started out as a trend during 2021 and the first half of 2022 quickly turned into a rout.

In turn, this left UK Pension Funds with massive mark to market losses as their interest rate and currency hedges were reeling and their bond holdings were declining in value.

The resulting Bloomberg Headline read: BOE Pledges Unlimited Bond Buying to Avert Imminent Gilts Crash. Unlimited bond buying? With what? Printed money or QE, of course. When you print currency to pay off your debts you have begun the process of making your currency worthless.

The UK is just a short preview of what we believe will happen globally. You see, ultimately the Central Banks talk tough and even take the steps to fight inflation. But what they fail to account for is that this is not the 1970s with 30% Debt/GDP. Rather, we have a 40+ year levered bubble that has been blown. Leverage has made global markets and economies fragile. Rate increases lead to stuff breaking. And then the Fed “fire trucks” arrive again with freely printed money!

#4 2022 Macro Story: INFLATION IS NOT DEAD

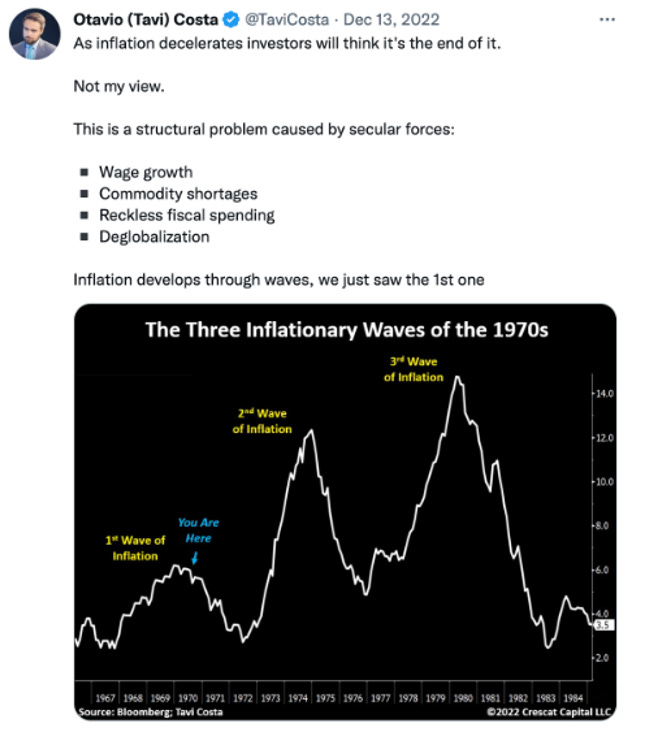

The Fed has been extremely hawkish and Powell has taken the position that he is going to be like Paul Volcker. He has been rumored to say that he does not want to be known as the Fed Chairman who destroyed 40 years of price stability. He has repeatedly assured the markets that he will tighten monetary conditions as much as necessary to bring inflation back down to 2%. We believe this will prove quite challenging, if not impossible, due to a number of factors. Our friend Tavi Costa lays them out below.

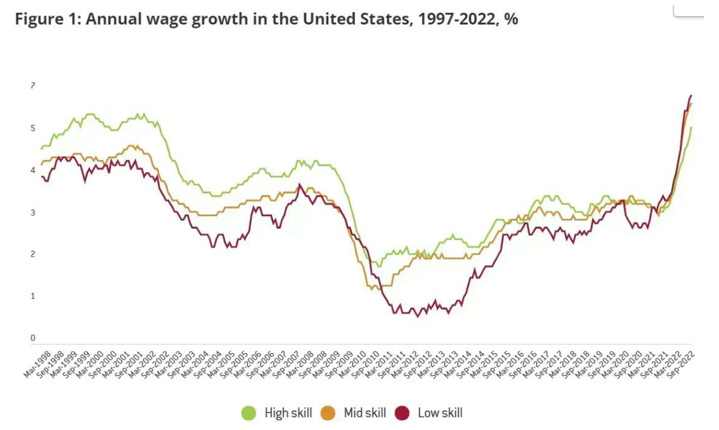

We agree with Tavi and point out that the wage growth problem is particularly problematic. As the following chart shows:

With wages growing in excess of 5% annually it will be difficult to get inflation to return to the 2% target. Anecdotally, the labor markets in certain areas are very tight and 5% wage increases may look tame in the future.

Recent headline inflation numbers have cooled off somewhat, but a large part of that has been driven by the decline in crude oil prices which have fallen from a peak of roughly $120 per barrel in the first half of 2022 to today’s level of $73. Recall that this has only been accomplished by President Biden’s directive to release a record amount of oil from the US Strategic Petroleum Reserve in front of the mid-term elections. This release cannot be repeated, and in fact the US has indicated that they are now refilling the reserve.

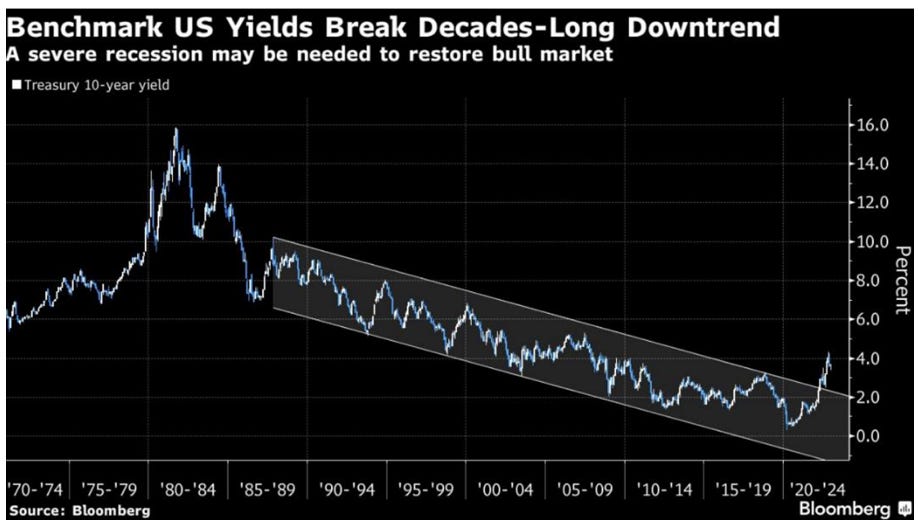

In our view, the inflation genie is now out of the bottle, and we are looking at a long period of time before we return to a stable price structure. We believe that 40 years of deflation reached a peak at the blow off bottom of March 2020 and that since that date we live in a new paradigm. This change in long term trend is nicely captured in the following chart.

We do not believe most investors or market participants fully appreciate the significance of this chart. We now live in an inflationary environment, the implications of this are significant for all investment asset classes and what worked for the last 40 years is not going to work as well in the next 10 years.

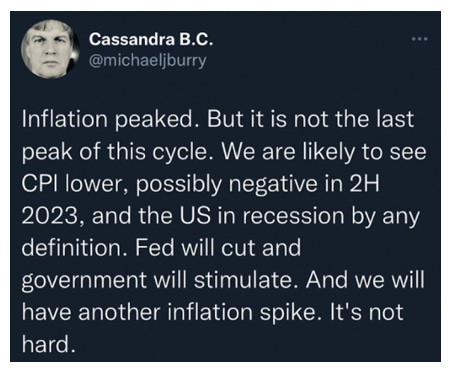

As famed investor Michael Burry recently put it:

Guest post from Quoth the Raven from his subscription substack.

Claim $10,000 In FREE silver In 2023

Thanks to forgotten 50-year-old legislation, often ignored by investment advisors, gold bugs, and silver hounds… You can now collect $10,000 or more in free silver.

Millions of Americans know NOTHING about this… Because it exploits a “glitch” in the IRS tax code that helps protect your retirement… While paying ZERO TAXES & PENALTIES to do it. That’s why you need to see this NOW.