The latest from Michael Pento:

There are a handful of stocks in which institutions and individual investors have recently piled into. This behavior is emblematic of all bull markets once they begin to hit the manic phase. Wall Street falls in love with a few high-growth darlings and takes their valuations up to the thermosphere.

If you add up the market capitalizations of just four stocks, Google (Alphabet), Apple, Microsoft, and Amazon, their combined worth exceeds $5 trillion. If you throw in Facebook, you get the top 5 biggest firms by market capitalization, and they compose an amazing 18% of the S&P 500. Another way of looking at this is that the market cap of a full 282 companies in the S&P 500 now equals the same as the top 5 behemoths.

Again, this is not dissimilar to what has occurred in past blow-off tops. Recall the NASDAQ internet craze in the late ’90s and the Nifty Fifty bubble mania of the late ’60s and early ’70s. In the 694 days between January 11th, 1973, and December 6th, 1974, the Dow Jones Industrial Average lost over 45% of its value, but many stocks in the Nifty Fifty fared much worse. The Dot.com disaster was even more dramatic. It caused 5 trillion dollars of equity to vanish and wiped-out nearly 80% of market value.

The Nifty 50 stocks were the fastest-growing companies on the planet in the latter half of the 1960s and became known as “one-decision” stocks. These were viable companies with real business models but became extremely over-priced and over-owned. Investors were lulled into the belief they could buy and hold this group of stocks forever. By 1972, the overall S&P 500 Index’s P/E stood at 19. However, the Nifty Fifty’s average P/E at that time was more than twice that at 42. When the inevitable crash arrived, stocks that were part of the Nifty Fifty fell much more than the overall market. For example, by the end of ’74, Xerox fell 71 percent, while Avon and Polaroid plunged by 86 percent and 91 percent, respectively.

The years 1994 to 2000 marked a period of massive growth in the adoption of the internet, leading to a massive bubble in equities surrounding this technological revolution. This fostered an environment where investors overlooked traditional metrics, such as the price-earnings ratio. During this period, the Nasdaq Composite Index rose 400%, as its PE ratio soared to 200.

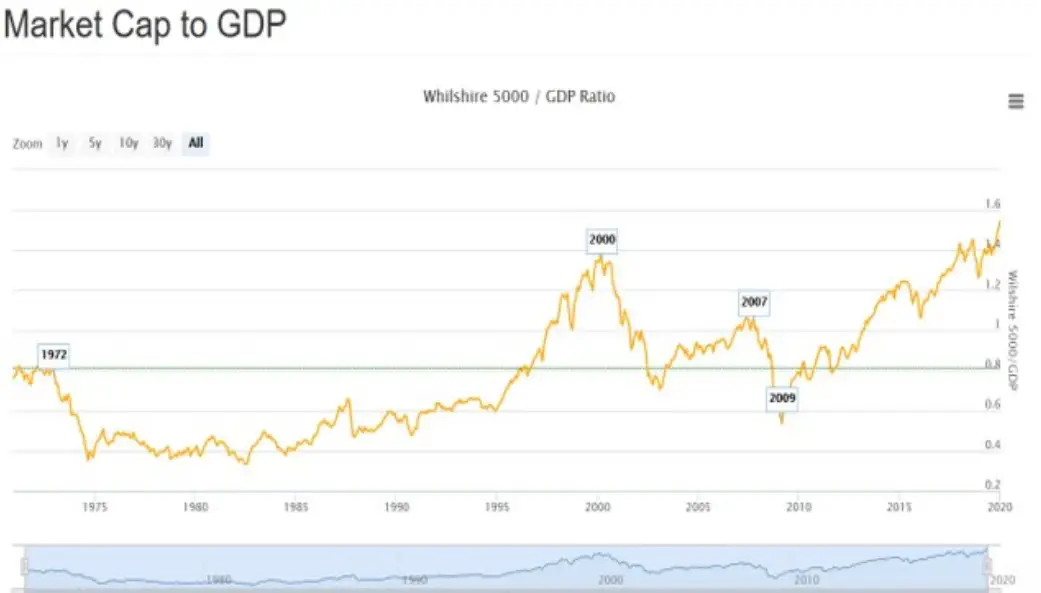

It’s always the same story: near the end of a massive bull market, a relatively small number of stocks get taken to incredible heights by a public that is thirsty for some story to justify such lofty valuations that are far above fundamentals. This can be clearly proved by viewing the Market capitalization of the Wilshire 5000 as a percentage of GDP. Stock valuations have now reached at an all-time high. In fact, they are nearly twice as high as the historical average and even higher than the NASDAQ bubble peak!

Not only this, but there are a record number of IPOs that don’t make any money, and a near-record number of U.S. listed companies that are spewing red ink—just like in past bubble tops.

This particular iteration of a massive equity bubble has seen a huge turn towards passive investments and a surge of money going into ETFs.

A paper done by the Federal Reserve explains that passive funds in 2018 now account for 39 percent of the combined U.S. Mutual Fund and ETF assets under management, up from just 3 percent in 1995 and 14 percent in 2005. According to the paper, passive investing is pushing up the prices of index constituents and there is a risk that rising prices can lead to more indexed investing, and the resulting “index bubble” eventually could burst.

The Potential Problem with ETFs

This brings us to a potentially huge problem with the overall market. A study done by Factset shows that in some instances of the largest market cap stocks that are held within ETFs, they represent more than 30 days of the average daily trading volume of the individual security that is traded on the exchanges. This means, for example, if only 10% of ETF holders decide to sell the security on any given day, it will represent three times the entire volume that is traded on the NYSE. Therefore, what we have is a condition where investors have become overcrowded in a few positions–just like what has occurred in previous market tops. However, this time around the situation is compounded by an influx of new money that has piled into ETFs. These same investments have doubled down on the doomed strategy of piling into a handful of winners.

In 2008 there was just $700 billion invested in ETFs; today, there is just under $5 trillion. ETFs have greatly exacerbated market directions in the past. Their existence tends to propel bull markets higher but, on the flip side, they also have led to flash crashes. To fully understand the dangers associated with buying and holding ETFs—and the overall market in general, especially in a bear market–you have to understand the process of creation and redemption units and how Authorized Participants (AP) function.

APs are the only entities that are allowed to directly interact with an ETF provider in order to create and redeem units. During a bull market, an ETF often trades at a premium to the underlying securities held by the index it tracks. In this case, an AP can buy the individual shares on the index at a discount and exchange them for a new ETF that is trading in the market at a higher price and then sells the ETF in the market for a profit. This process is known as creation, which adds to the supply of ETFs. And, it perpetuates the bull run.

Conversely, during market panics, an ETF will often sell at a steep discount to the shares trading on the index. In this case, an AP can buy the ETF in the market and exchange it for the individual shares on the index from the provider that is trading at a higher price. The AP can then sell the individual shares on the open market. This process is called redemption, and it reduces the number of ETF units.

However, this process has also exacerbated crashes in the past by adding more selling pressure on to the individual shares of the index, which in turn leads to more panic selling for the less liquid ETF market.

Who are these very few lucky and privileged Authorized Participants? You may have guessed it, large banks such as; JP Morgan, Goldman Sachs, and Morgan Stanley.

This is just one more reason that validates the necessity of having a process that identifies when the epoch bear market begins before one occurs…because the next bear market should be one that makes the Great Recession of 2008 seem benign in comparison.

Click here to read Michael Pento’s other articles.

8 thoughts on "Michael Pento: Trillion-Dollar Stocks And The Coming ETF Disaster"

I’ve long understood and basically agreed with the (eventual) dollar collapse theme, but I’ve also been confused about how that would happen. Not theoretically but practically, and I think I have an explanation.

First of all, rhetorically speaking, when there are two opposite points of view then the most likely explanation isx that both views are correct, it just neither view is coom monetary chaosmprehensive enough. Applying that theme to the issue of credit-based fiat currency (e.g., the US dollar) I think there is a very ironic resolution to the nature of its demise (eventual demise agreed by all parties, by the way. It’s not only historical, but logical and mathematical.) There is so much emphasis on the possession of physical gold (and silver) as a sanctuary from monetary chaos, but = ironically – I think the possession of physical cash will also be. The reason I say that is because physical cash (e.g., US dollars) will be the only “proof” and reality of “money” within the fiat currency system.

I’ll try to explain what I mean.

The main “problem” with the existing fiat monetary systems is ever-increasing, mathematically unpayable debt. The demise of such a system is baked in, the only question being how quickly it happens. To explain: debt is actually, literally what “money” is in this system. When a bank lends money it is neither lending in the literal sense, nor what it is “lending” is actual money. Real money is something that can’t be created from nothing, otherwise it would have no value.

Yet consider how most “money” is created today. Whenever money is borrowed it is created from nothing (most of it at least, but that’s a fine point.) Banks don’t lend the money it has from depositors – that’s a misnomer. Banks only need a certain amount of “reserves” to lend/create more money, reserves that ARE based on actual deposits. But banks are typically allowed to lend/create about 3000 times as much as it has in reserves. A bank is typically required to have about 3% in reserves of its oustanding loans. That means a bank that has $100 in deposits (reserves) can lend $3,333, because 3% of $3,333 is $100.

Now, that in itself is not totally terrible for myriad “reasonable” reasons; the problem is that that borrowed money becomes reserves for further lending. Imagine the $3,333 being deposited in a bank (even the same bank it was borrowed from, incredibly). That means an additional $111,100 can be lent (because 3% of $111,100 is $3,333.) It follows, then, that borrowed money can beget even more “money” through the miracle of fractional reserve lending.

My point is this. Almost all of the money in “existence” is based on a pyramid of debt. Furthermore, most of it really doesn’t exist other than digits on a computer screen (literally.) When and if there is a problem economically, the borrower of the hypothetical $111,100 may not be able to repay the lender that has only $3,333 in collateral (reserves,) and that lender may not be able to repay the lender that has only $100 in reserves. The resolution – of course – is the “disappearance” of that money, literally because it can’t be repaid, but existentially because it was never real to begin with.

Another way to understand that dynamic is “money” suddenly becomes really valuable. Anything that can pay those debts becomes valuable, but those debts are – ironically – debt-based currency (e.g., us dollars.) Therefore, physical cash becomes highly valauble, because it’s not “someone else’s liability.” Physical cash becomes the equivalent of gold within that fiat system – at least temporarily – in terms of being the ground zero of money.

This resolves the dilemma I’ve been struggling with. The US dollar (among all the rest of debt based currencies) can (and rightfully should) “collapse” but with PHYSICALL cash you will be relatively okay. Think of it as having a seat when the music stops while playing musical chairs. But I wouldn’t rely on that completely. Physical gold/silver is more reliable, at least historically, but physical cash will be way more valuable than cash in institutions that have leveraged it away. That’s what deflation looks like (aka devaluation.) Imagine trying times when the only acceptable forms of payment for goods and services will be cash (reserves), and precious metals, the king of money. Physical cash will be hard to come by when the collapse commences, and hence be valuable, but financial “assets” and deposits will devalue to the reserve basis upon which they were created. The consequence of hypothecation.

Long office hrs yet still unable to receive everything you really deserve. A trip planned for too long and still unable to travel. Your office work does not enable you to spend much required amount of time with your beloved. For anyone who is dealing with all of this? In that case, now we have worthy solution available for you. A job opportunity which happens to be absolutely online. It implies you can work from anywhere in the world for small amount of hrs which enables you to make around $27000. It is really an incredible possibility to be your own boss as well as live the way in your own terms . Check out this excellent opportunity >>> ajaxperturbed.clan-24.de

Are You Ready to Start Earning Good Income? Be your own boss and make money nearly $500 to $1,500 Per Week. Finally, A True, Good Internet Opportunity For All! Go here to get started. woo.by/gI

I wonder if when the market does correct it will be those who were way to early getting out – or even never climbed back in after 2009 – that end up the best off? That would be something. The S&P would have to fall over 80% to 666 again. Very Biblical, especially if the money changers are road kill on the way down.

Too good to be true? Probably.

hello

I most of the time get somewhere between 6,000 to 8,000 bucks each and every 4 weeks by going online. This is ideal to easily replace my old workplace salary, specially thinking about I just simply do the work around 20 hours in one week from home. I got obviate my occupation after doing work for same corporation for several years, I required very reliable revenue. I was not looking for make money programs that promises to make you cash rich just a few days that you see all around the web. Probably the most thrilling part of carrying out work online is that I am always home with all the kiddies and also spend a lot free time together with my loved ones on various amazing beaches of the attractive nations. Honestly,it is easier than you would think, all you need to do is fill out a simple form to receive front line access to the Home Profit System. The directions have been in very straightforward language, you dont need to be a computer guru, but you should possess skills to make use of internet. It’s as easy as being on Youtube. Here’s the simplest way to start ->->->-> earn11keachmonth.vollidiot.net

It’s not a market anymore, it’s a casino and we aren’t the house, we are the punters, JPM et al are the house and they always win.

the stock market is a piece of ssssit