Not so long ago, student debt was mostly the responsibility of students. That is, you paid for college with loans and then paid off those loans with the proceeds of the good job you got with an advanced education.

These days it’s a little different. The cost of higher education is soaring, the jobs available to college grads don’t pay as much, relatively speaking, as they used to, and the size of loans available to students – though huge – don’t cover the full cost of many degrees.

One might expect these changes to lead more students to work for a few years and save up, or choose a cheaper degree, or eschew college altogether (as a lot of successful people now recommend) and substitute work experience for a diploma.

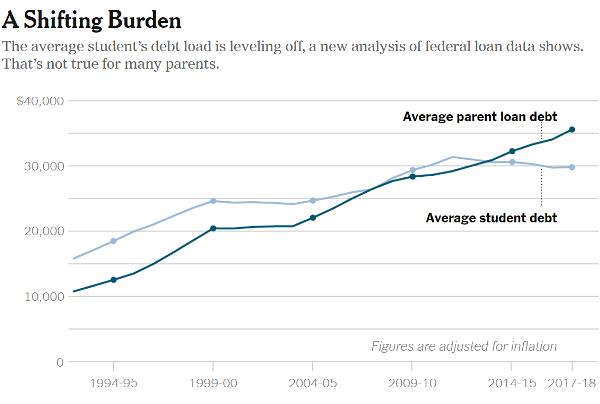

Some of that is happening but apparently the biggest change is that parents have stepped in to cover the difference between what their kids can borrow and the cost of a degree. As the chart below illustrates, until just a few years ago, the average debt of students exceeded that of students’ parents. But post-Great Recession, parents have given up trying to moderate the cost of their kids’ education and started doing the borrowing themselves. They’re now taking on the majority of new debts, and the gap is widening dramatically.

Source: Mark Kantrowitz (SavingForCollege.com)

Retirement Crisis?

So we can add student loans to the list of instances where people who once tried to control their borrowing have stopped trying and are now just going with the flow. Which means several things. First, kids who if left to themselves and the market would probably opt for one of the aforementioned cheaper alternatives are still in high-cost, frequently low-reward degree programs, and are being sheltered from the consequences by well-meaning parents.

Second, the retirement crisis that everyone is talking about – in which people who have never saved a penny are approaching retirement age and looking at 30 years of abject poverty – is being made that much worse by parents taking on new debts at a time of life when they should be aggressively trending towards debt-free/cash-rich.

Third and most important for people who aren’t participating in this game of financial musical chairs, the eventual implosion of the student loan market – i.e., the point at which loan defaults become intolerable – will lead to a government bailout, making student loans everyone else’s problem.

But of course the government won’t raise taxes or otherwise inflict immediate consequences on the electorate. It will borrow the money and create enough new currency to cover the first few years’ interest, leaving the longer-term consequences for later years and other people.

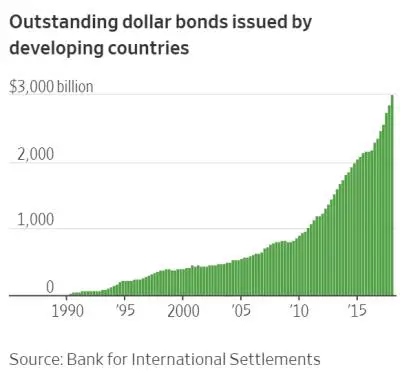

As with all the other mini-bubbles out there, if student loans were an isolated problem in a sea of rock-solid financial behavior they’d be easily managed. But they’re just one of many time bombs set to explode shortly. Auto loans, credit cards, underfunded pensions and increasingly mortgages and home equity lines are all heading the same way domestically, while emerging market dollar debt (which dwarfs the US mini-bubbles) is just as precarious internationally.

The question then becomes, how many of these bursting bubbles can the US paper over before the currency markets figure out that each will be followed by another, for as far as the eye can see?

6 thoughts on "Student Debt Bubble Expands As Parents Do More Of The Borrowing"

I have a friend who was forced into retirement at age 65. He cosigned on student loans for his kids. One owes $150,000 and the other owes $100,000. The kids can’t keep up with the loans, so he has to pay. One is out of college for over 10 years and still working “as a consultant” (temp). He has bad knees and other health problems. He bought into the “invest for the long term” bullshit and lost half his 401K in 2008. He believed that he would have a million dollars when he retired, so he didn’t think it would be a problem to sign for all that debt. His “financial advisor” at the 401K management company still had him invested in high risk junk at age 64.

What a way to go into retirement!

Seniors are spending their childrens inheritance, sometimes on the children, or grandchildren. There are many ways, reverse mortgage, REFI ATM, HELOC, you can spend money you don’t have, but they are also helping their kids who haven’t the same chance to accumulate wealth. It’s just that often times the kids are poor judges of a good way to use that money. That’s where the wisdom of grand parents comes in.

The Colleges were partnered like used car salesmen with banks. Colleges paid for by taxpayers still had the huge inflation in cost. They knew there are NO JOBS for the majority of graduates. Yet, like a used car salesman, they conned students into bad deals.

We need to hold the College Boards, taking between $300,000 to $3M a year in pay, benefits, and retirement to be responsible! Why do they live in mansions with pensions?

How is this different than child abuse? A Hollywood Producer has nothing on these money grubbing self-serving board and administrators.

I contend that we have been in a depression ever since the GFC. The stats are fudged and worthless. Even simple math dictates that that the inflation deflator, when applied to GDP, has to show negative growth for the last 9 years. John Williams has it right at: http://www.shadowstats.com/

It really can’t be honestly argued any other way IMHO. My Chapter 12 – The End of Growth presents much of the evidence. and quotes many respectable sources: e.g. http://ffwiley.com/

I would be happy to send the proof to those who wish to see: peter@underco.co.uk

I have an employee in his early 60s that is well liked by customers. Several months ago I was contacted by a credit agency and now I’m forced to garnish his wages. He had stopped paying on over $60,000 in student loans for a college degree that he never used. He divorced around 10 years ago and today he lives in a rented condo. His health is not great. I believe he represents possibly half of baby boomers. Divorced, poor health and little money. The 2020s are going to be the toughest decade since the Great Depression. The 2030s might be even worse.