Every once in a while the trading action in a given market breaks through its historically normal boundaries and starts exploring new territory. This can mean one of two things: Either something fundamental has changed, creating a “new normal” to which participants will have to adapt. Or the extreme move is a temporary aberration that will eventually be corrected by an equally extreme snap-back into the previous range.

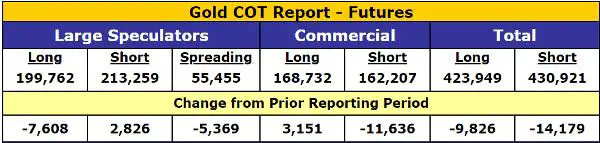

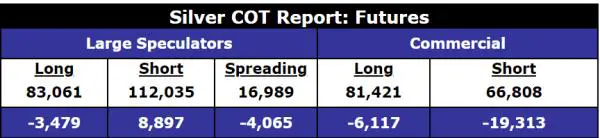

The gold and silver futures markets are posing this kind of question right now, with speculators – who are usually net long – going net short, and commercial traders – who are usually net short – going net long. The following table shows how each group traveled even further into this unfamiliar territory in the past week.

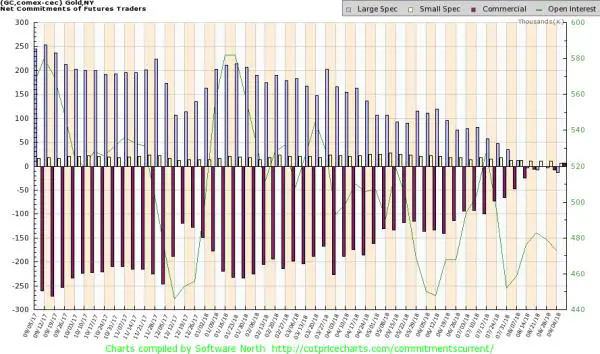

The following chart illustrates how unusual this new market structure is. During most of the past year the speculators (gray bars) have been extremely long and the commercials (red bars) extremely short. Now they’ve swapped attitudes, with speculators betting that gold is going to fall and the commercials taking the other side of that bet.

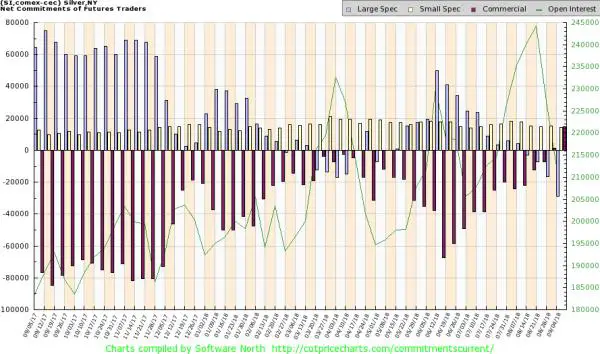

The same process is at work in silver, where the departure from the norm is even more extreme. In other words, the speculators are very short and the commercials very long.

Presented graphically, the far right of the chart illustrates just how unusual the current action is. It’s possible that these two groups of traders have never been in this relative position before.

What does this mean? Either something has happened to realign speculator and commercial trader incentives and objectives, putting them permanently on the other side of their traditional positions, or the past few weeks’ action is an anomaly that will be corrected with an extreme move in the other direction.

Which is more likely? The latter almost certainly, because the commercials’ traditional net short position exists for business reasons. Gold and silver miners frequently sell their production forward using futures contracts to lock in a predictable price, and they place their orders through the banks that make up the bulk of commercial traders. As long as the miners continue to hedge, commercial traders will necessarily tend to be net short. Speculators, meanwhile, traditionally take the other side of this trade (because every trade has to have two sides), which means they have to be net long to make the market work. So at some point the balance has to be restored.

The timing is anyone’s guess, since the current market structure is virtually unprecedented. But when it happens it’s likely to be via a “short squeeze” in which the speculators begin to close out their short positions and find that they have to pay way up in order to do so. The resulting panic will bring a little sunshine into gold bugs’ recently dreary lives.

14 thoughts on "The Paper Gold Market Is Screaming “Short Squeeze”"

The USD-dollar index is coming down: gold

and silver are the mega-trades. COT or no COT.

It’s all an illusion. The CrimNakes have learned how to manipulate the COT report to make it appear a rally or short squeeze is imminent, but watch … just more pounding into perpetuity.

I know very little about the gold market – or anything else really.

But – when I look at the data – what it says to me is exactly the opposite of what you are suggesting.

My admittedly uneducated interpretation of the data you present is that miners are not selling at the current low prices. The consequence is that their short interest has fallen dramatically. As you note this simply means that the speculators end up on the other side of this trade and their long position has shrunk as the miners are not selling to them.

The consequence is that the miners are sitting on a growing pile of metal that they will evebntually have to sell. They need cash to keep running after all. And the result, when they capitulate, will be a further fall in the price.

What am I missing / why am I wrong?

Thanks

The miners could just be selling metal to spot for cash for immediate delivery. If they have sufficient cash flow to service debt they don’t have to sell forward unless it’s a covenant of their loans. They are anticipating higher prices.

The other commercials also anticipate a big move higher and thus are long.

The tables are turned: now the large specs take the short, side. Someone’s gotta.

Your analysis from COT report may be correct, but if the speculators and the commercials were the same forces? Apparently the speculators get their fund from bankers and they are submitted to the orders of the bankers. The COT report itself is the fraud.

Love ya John, but this article gives the impression that the short trades are mostly coming from commercial hedgers. That is not the case. They’re coming from the banksters eyeball deep in the suppression scheme.

This market doesn’t exist for the purpose of price discovery between legitimate buyers and sellers … ie, producers and users/fabricators. It exists to provide a mechanism whereby the banks can short sell goal in an endless parade of bear raids in order to to keep a cap on the price or drive it down … acting at the behest and with indemnification from prosecution or loss for that matter, from central bankers and so-called government “regulators,” as what they’re doing contravenes futures trading laws.

The really interesting question here is with the crooks … the “commercials” … having eliminated their net short position, do they put it back on by gouing heavily short again after price rises or have they pushed theis scheme to its natural limits and will they simply back away? The other interesting question is are the Chicoms selling short under the umbrella of “speculators?” If so, they might not act like a regular short that’s forced to cover and we might see a prolonged aberration in the COT setup.

I have no idea, but whatever happens will be very revealing.

I agree with you, but this has been the situation for quite a number of years now and the COT patterns still have had some validity. The market can always change, though, and someday it has to, because it’s 99% corruption.