After an epic (generation-spanning at the long end) decline in interest rates, the trend has finally reversed. Which means, if history is still a reliable guide, there’s a number that ends this cycle and ushers in the next recession and equities bear market. But what is it?

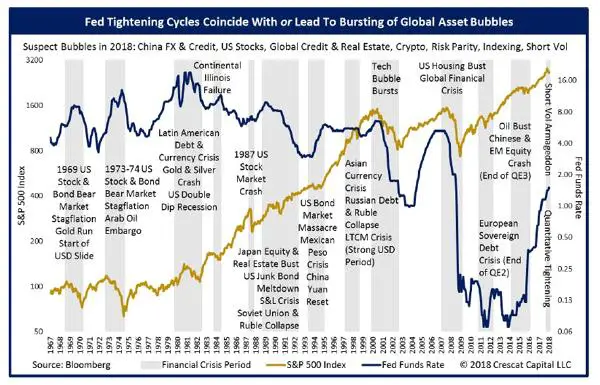

Here’s a chart (from MishTalk via Crescat Capital) that shows the relationship between short term interest rates and economic recoveries. In cycles past the Fed has responded to building inflationary pressures by raising the Fed Funds rate, and eventually the rising cost of short-term loans either caused or coincided with the expansion’s end. Note that in the past it didn’t necessarily take a long, dramatic rate increase. Just a change in direction over a year or two was enough to turn growth into shrinkage.

Meanwhile at the longer end of the yield curve interest rates are jumping as well – also in response to the perception that inflation is becoming a thing again. Here’s the 10-year Treasury bond yield since 2016:

This rate matters in part because it’s how banks price 30-year mortgages. Already it’s having a profound effect. See Mortgage rates are surging to the highest level in 7 years.

Last but not least, the relationship between short and long rates is a number, and might end up being the one we seek. The following chart shows the 10-year Treasury yield minus the 2-year Treasury yield. When it drops below zero the curve is inverted, which has historically signalled a slowdown. So the magnitude of the (apparently) coming yield curve inversion is a big deal.

The frustrating thing for investors (including short sellers) is that, as all three of these charts illustrate, there is no historically magic number that always does the trick. Rates in general have been falling over the past few decades as government financial mismanagement has required ever-easier money to keep the game going.

This means that it might not take a return to, say, the 8% Fed Funds rate of 1990 to blow up the system; a much lower rate – spread out over vastly more debt – might do the trick. Same thing with mortgages. In the healthier past a 6% rate on a 30-year mortgage was low enough to excite home buyers. Now 4.5% is pricing homes out of most Americans’ reach.

So the exact number on the exact indicator that turns a steady expansion and robust bull market in a brutal bear market will only be known in retrospect. In the meantime we’ll just have to pay attention and hope that the end, when it comes, provides at least a little warning.

9 thoughts on "There’s A Number That Ends This Cycle — But What Is It?"

I have some observations and questions:

Currency is all around me, even now, as I read this webpage.

I have had a feeling most of my life, something is wrong with our world.

Something about our economic system just doesn’t add up.

Where does all the money go? To the government? What do “They” do with it?

Every minute, our money is worth less and less.

Most are forced to work more, and more; to compensate for this discrepancy.(Not me ‘cos I retired but I’m still losing purchasing power)

Who is to blame? How does this system function?

Is there a way to profit from it?

Is there a way to protect ourselves from this financial Matrix?

What does the future hold?

I have just started reading an exciting book about understanding Forex which I expect will answer all my questions, and more:

It is Joseph Gelet’s: “Splitting Pennies” – http://www.splitting pennies.com

Looks like it is ‘self-published’ format by Elitie E Services, Inc and so far it is simple and easy to understand – it makes sense. Which says a lot these days – as Bruce says “…it is not well understood”

Worth a look.

Just to add to JRs piece, hopefully to shed a little more insight for analysis, the dynamics of changing (in this case rising) interest rates is not well understood.

First of all, just because prevailing interest rates are rising does not mean that the cost of interest payments for EXISTING loans/bonds will rise too, unless you have a VARIABLE rate loan (e.g., credit card debt). The vast majority of debt is at a fixed rate so the debt servicing costs remain the same whether prevailing rates continue to rise (or fall).

Therefore, the main effect of rising interest rates is on the creation and servicing of new debt. That is what can cause a slow down. In theory, interest rates could triple but if “everyone” decides to stop borrowing more and just focused on paying off their existing debts then rates could be just about anything and it wouldn’t matter because the debt servicing costs wouldn’t change.

But not everyone can stop borrowing more (right Uncle Sam?) because some need to borrow continuously just to service their old debt. Obviously most governments have to do that, and supposedly many corporations are having to do so too, so it will be interesting to see what gives.

FIRE the FED and CENTRAL BANKS, that’s the way to get rid of Deficits ..NOW

game over!

RIGHT ON..NO MORE DEBT 🙂