There are trillions of dollars of bonds in the world with negative yields – a fact with which future historians will find baffling.

Until now those negative yields have been limited to the safest types of bonds issued by governments and major corporations. But this week a new category of negative-yielding paper joined the party: mortgage-backed bonds.

Bankers Stunned as Negative Rates Sweep Across Danish Mortgages

(Investing.com) – At the biggest mortgage bank in the world’s largest covered-bond market, a banker took a few steps away from his desk this week to make sure his eyes weren’t deceiving him.

As mortgage-bond refinancing auctions came to a close in Denmark, it was clear that homeowners in the country were about to get negative interest rates on their loans for all maturities through to five years, representing multiple all-time lows for borrowing costs.

“During this week’s auctions, there were three times when I had to stand back a little from the screen and raise my eyebrows somewhat,” said Jeppe Borre, who analyzes the mortgage-bond market from a unit of the Nykredit group that dominates Denmark’s $450 billion home-loan industry.

For one-year adjustable-rate mortgage bonds, Nykredit’s refinancing auctions resulted in a negative rate of 0.23%. The three-year rate was minus 0.28%, while the five-year rate was minus 0.04%.

The record-low mortgage rates, which don’t take into account the fees that homeowners pay their banks, are the latest reflection of the global shift in the monetary environment as central banks delay plans to remove stimulus amid concerns about economic growth.

Denmark has had negative rates longer than any other country. The central bank in Copenhagen first pushed its main rate below zero in the middle of 2012, in an effort to defend the krone’s peg to the euro. The ultra-low rate environment has dragged down the entire Danish yield curve, with households in the country paying as little as 1% to borrow for 30 years. That’s considerably less than the U.S. government.

The spread of negative yields to mortgage-backed bonds is both inevitable and ominous. Inevitable because the current amount of negative-yielding debt has not ignited the kind of rip-roaring boom that overindebted countries think they need, which, since interest rates are just about their only remaining stimulus tool, requires them to find other kinds of debt to push into negative territory. Ominous because, as the world discovered in the 2000s, mortgages are a cyclical instrument, doing well in good times and defaulting spectacularly in bad. Giving bonds based on this kind of paper a negative yield appears to guarantee massive losses in the next housing bust.

Meanwhile, this is year ten of an expansion — which means the next recession is coming fairly soon. During recessions, the US Fed, for instance, tends to cut short-term rates by about 5 percentage points to counter the slowdown in growth.

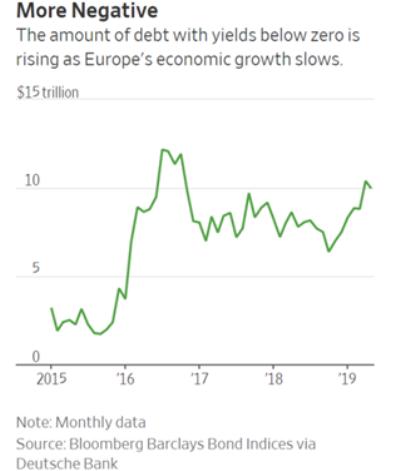

With Europe and much of the rest of the world already awash in negative-yielding debt…

… this imminent slide in interest rates will turn the rest of the global financial system Danish, giving us bank accounts and bond funds that charge rather than pay, and very possibly mortgages that pay rather than charge.

Anyone who claims to know how this turns out is delusional.

7 thoughts on "Negative Interest Rates Spread To Mortgage Bonds"

This could be a watershed moment. If financial sanity is to take hold, people in the future may never see positive interest rates again.

Low interest rates are a sign of excess capital and trust in the financial markets.

If people are paying down their debts,the top 1% gets desperate, and may lend you money at negative rates.

If governments start having balanced budgets they may end up borrowing at -3% so they can spend more than they get in taxes without going futher into debt.

Countries that have their finances in order can already borrow at negative rates. The Germany bond yields are already negative as far as 10 year.

So either we have to deal with negative interest rates or we may see the usury financial system collapse.

A short intro on negative interest rates can be found here:

http://www.naturalmoney.org/short.html

“Anyone who claims they know how this turns out is delusional.”

Wait a minute! … Let’s think about that. If we’re talking about an inverse world then non-inverse world thinking doesn’t apply. In fact, it may simply be exactly the opposite. “Normally” – meaning in our now fleeting non-negative rate world – one can claim that no one can predict the future, but in an inverse world where everything is backwards and upside down, I would submit that the future is positively (no pun intended) predictable.

In other words, technically speaking, IT AIN’T GONNA END WELL.

In the meantime, however, negative interest rate loans are the mathematical equivalent of lower monthly payment loans, and as every salesperson knows most people buy monthly payments. Our inverse-educational system has taught us that instead of considering the total, real cost. Personally, I’m looking forward to negative rates on credit cards but we may not get that far, or am I thinking too conventionally?

Thinking backwards a little bit more, MMTers might start to point out that slightly negative mortgage rates for Danes proves that minus 100% rates for everything would work for everybody. As I said …

I gain 40 $ in less than 1 hour while I’m traveling the entire world. Past few days I worked by my laptop in Rome, Monti Carlo and finally Paris. This week I’m back in The United States. All I do are simple and easy tasks from this one excellent website. Give it a look ====> mousinesslady.name.vu

I actually make almost $6,000-$8,000 monthly on the internet. It is indeed sufficient to easily replace my old jobs net income, particularly taking into consideration I actually do the work almost 20 hr weekly from home.I ended up losing my job after operating for the same enterprise for a long time, I wanted very trusted income. I was not researching for packages that miguide you to make you millionnare within few days you see all over the net. Those all of them are kind of ponzi network marketing schemes in which you have to initially make prospective buyers then sell something to friends and family members or any individual to make sure they will be in your team. The best benefit of working via internet is that I am always home with the children and also enjoy time with family on different beaches of the world. Honestly,it is actually easier than you would think, all you have to do is fill out a very simple form to get front line access to the Home Profit System. The instructions are really easy, you do not have to be a computer expert, however you must be aware how to use the net. It’s as simple as being on Instagram. Here’s the easiest method to start –> revealedmudflow.will-dich.eu

Most recent poll demonstrates that over 73% men and women are involved into web browsing activities. The Online world is growing regularly therefore people are these days having an ocean of earn money on line opportunities from the internet to earn an income. Every person prefer to spend more time his/her good buddies by taking a trip any amazing place in the world. However selecting the right method moreover setting a proper destination is our goal in the direction of being successful. Already a good number of folks are earning such a great earnings of $24k per week by using suggested as well as great techniques for generating great money using the internet. Begin to earn from the 1st day as soon as you look at our website >>>>>twinestruggle.lernt.de

While I was employed by my earlier organization I was in search of reliable work-from-home opportunities where I could gain decent money and also at the same time get sufficient time to put in with my family members and offcourse I am not searching for internet scams that misguide you to make you very very rich in simply few days or so. Finally I discovered a great opportunity and I can’t tell you how glad I am nowadays. The best parts about doing work from internet are: Your Workplace Can Be Anywhere- you’re not bound to your home. You can take care of your job while traveling, enjoying the fantastic outdoors , or perhaps listening to your favorite band at a live show. And you can additionally save on food costs since you’ll very easily be able to whip up your own dinner and coffee when you work-from-home. Your Schedule Can Be Your Own: A lot of the work that can be done remotely nowadays can also be done on a flexible routine. If you do have to work specific hrs, you’re sure to still have some break time—time you can use however you’d like! Even if you have only 10 mins, you can do something that simply wouldn’t be possible in a traditional office: bust those samba moves, play a few tunes on your guitar, or take a refreshing power nap. You’re guaranteed to get back feeling a lot more refreshed than you would after 10 mins at your computer desk surfing Fb. You Can Learn More and Become More Independent:Because you don’t have colleagues just a few feet away or a tech team one floor down, you’ll find yourself growing the skill of searching for your own answers and becoming more proactive to find what you need on your own. Of course you can still ask questions and get help if you need to. However, a lot of the time, you could do a Google search, download and read a free manual. Here’s the means with which to begin >> ACT NOW

I commonly clinch roughly about $6,000-$8,000 each 1 month over the internet. When I was doing work for my past enterprise I was seeking authentic work from home opportunities where I could obtain big money and also at the same time enjoy plenty of time to spend with my family and offcourse I am not in search of scams that misguide you to make you very very rich in simply few days or more. Ultimately I discovered a fabulous opportunity and I can’t tell you how delightful I am nowadays. You Can Learn More and Become More Self-dependent:Because you don’t have colleagues just a few feet away or a tech team 1 floor down, you’ll find yourself developing the skill of looking for your own answers and becoming more proactive to find what you need on your own. Of course you can still ask questions and also get help if you need to. But, a lot of the time, you could do a Google search, download a 100 % free manual. Here’s how you can start out->->-> nalablucking.ballern.de