It’s been quite a month.

In late October Japan, despite a year of fairly aggressive quantitative easing, dropped back into recession and concluded that even easier money was the cure for its ills. It announced a debt monetization plan of almost science-fictional proportions in which the amount of new yen to be created, as a percentage of GDP, will be equivalent to $3 trillion a year in the US. See Reactions to BoJ’s Kuroda’s Stunning, Doubled-Down QE ‘Experiment’

Then the European Central Bank, after years of operating in Germanic tight-money mode, finally accepted that a shrinking money supply was pushing the weaker eurozone countries into depression. On November 21 it threw caution to the wind and began buying up (by the sound of it) pretty much every stray piece of paper that’s blowing in the Continental wind. See

Mario Draghi Says E.C.B. Will ‘Do What We Must’ to Stoke Inflation

Most recently China, whose massive purchases of raw materials became the engine of the post-2008 recovery, discovered that much of the debt incurred to build those entire new cities is about as likely to be paid back as a typical subprime mortgage circa 2007. So it announced a surprise interest rate cut and a promise to do much more if necessary. See China’s surprise rate cut shows how freaked out the government is by the slowdown and Fear Of “Surge In Debt Defaults, Business Failures And Job Losses” Means Many More Chinese Rate Cuts

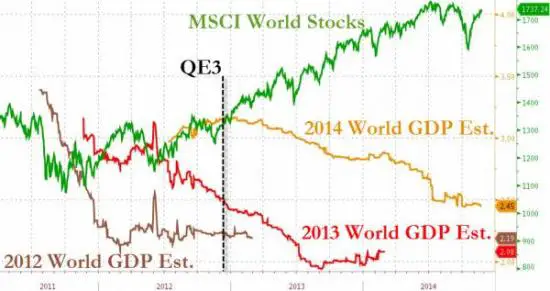

These are not the actions of economies in sustainable recovery but of countries falling into an abyss. Such open-ended offerings to the market gods are explicitly designed to get the juices of stock traders flowing. But so far that’s all they’ve done. Here’s a chart from Zero Hedge showing how each year’s initial GDP optimism has faded even while equity prices have continued to rise.

1) Will stepped-up debt monetization and interest rate reductions succeed where the past batch failed? Not likely, for both practical and theoretical reasons. There’s just too much debt outstanding to allow normal market mechanisms to produce sustainable growth. There’s simply nothing that Italy or Japan can build with borrowed money that will generate a positive return, given how much they already owe. So those descending GDP estimate lines will soon be joined by a new one with the same arc for 2015.

2) Can the US remain aloof from the carnage taking place all around it? Also not likely, since the actions being taking by our trading partners all coalesce around a single data point, which is a more expensive dollar. The US has had a relatively smooth few years because Fed policy was relatively easy and the dollar, as a result, was relatively weak versus the yen and euro. Now both of those trends have reversed in a big way. Here’s the dollar versus the world’s other main currencies over the past year:

Where the previously-strong euro and yen pushed Europe and Japan into recession, a strong dollar will impose the same headwind on the US in 2015. So there’s a decent chance that a year from now we’ll be faced with a world in which debt monetization has failed in three of the four major economies and a strong currency has sucker-punched the last one standing. And the only politically-acceptable response will be more of the same. Why isn’t gold soaring?

36 thoughts on "Most of the World Panics — Is the US Next?"

The jig is up. Russia and China have said NO MORE to deadbeat bum and ma$$ murdering thug, Uncle Sam strutting with his foodstamp “currency” like some Mafia bagman. Watch the rest of the world gather round and start kicking the mobster when he finally bites the dust.

Revenge is sooooooooooo sweet.

Gold isn’t soaring because Gold is shackled by XAUUSD. The paper must die before gold will soar.

My concern about putting a lot of money into gold then it gets revalued by someone like Red China. Farm land might be a better choice?

I also read the Dutch got their 120 tons of gold back from the US but left their other gold in Canada. Funny the Germans waited about two years and got 7 tons back out of 300. Some kind of Shenanigans going on behind the scenes.

I also read about the Dutch repatriating their gold, but I would be careful about believing the story for two reasons. I suspect that it could be a story intended to quell the Swiss’s concern over the safety of their gold held by the NY fed.

So, let’s bring this discussion down to the practical level. If you had a couple of hundred thousand dollars that you wished to protect from bail-in and from inflation, and you don’t want to buy more gold and silver (not because you don’t believe in the PMs, but because you are already over-exposed in that area and have lost very substantially since 2011), and dollarcollapse.com is talking about (1) a stock market crash, (2) rising interest rates killing bonds, and (3) worldwide currencies collapsing, where in the heck can you park your money and either make something or retain purchasing value?

I have the same problem Dennis. I bought a second home in a warm climate for cash but I have to pay taxes and insurance. The jury is out on the wisdom of that purchase. Since then I just stockpile cash.

My concern is that cash may not be a good investment even if one only seeks safety. There is so much talk about “bail-ins” in many countries, including the US (and Canada), and even if that doesn’t happen, horrendous inflation is still a possibility given the huge increases in the monetary supply. In the past you could always buy various currency ETFs (Aussie dollars, Cdn dollars, etc.) to get some diversity, but all these currencies are participating in the “who can inflate their currency the fastest” game. Gold and SIlver would normally impress me, but I’m already too heavily invested in the PMs and they’ve done nothing but go down sine 2011. So if you had some money you wished to preserve, how would you invest it when stock market appears to be topping and the bond market is just so dangerous?

Buy food water gas,etc

What is the current relationship between the US dollar and gold? At last check it was inverse with a correlation of .96. Until interest rates crack, with the rest of the world winning the currency wars, the dollar will be strong and gold will slide.

The dollar has already collapsed, in the last 25 years the cost of gasoline has tripled in price. The cost of food has quadrupled and wages have been stagnant. The housing collapse was due to rising oil prices. Gasoline went up and the poor can not choose not to drive they have to get to work, so they started falling behind on other bills. Staples had risen by a similar amount so the economy was at a breaking point. American workers are not making enough money to revive the economy and rich people don’t spend their money.

You have not made money with your gold investments, you have preserved the value of your money. Inflation and Quantitative Easing has stolen the value of the dollar. If oil was not sold in US dollars the cost of oil would be another 25% higher.

I was mad last year when my old favorite source of cheap protein, tuna, went from 5 3/4 ounces per can to 5 just as it also doubled in price per can from 50 cents to a dollar, for a more than 100% increase, but was utterly dumbfounded yesterday to see it was $1.38 and only a 4 ounce can. Last year I bought it for 11.5 cents per ounce, had I bought yesterday it would have been 34.5 cents per oz. That is a 300% increase in a year.

I can provide HUNDREDS of examples where the prices of items have more than doubled in a year. But the worst of all is rent, while it has only gone up about 40% in two years here that is 40% of the largest expense in my monthly budget. The gross dollar amount of increase eclipses almost all other increases combined.

Five years ago I had money left over every month to play with, now I can’t remember the last month I did not have to take out a payday loan to get through the end of the month ( I get paid once per month). And the BLS/Fed say there is NO inflation, our COLA’s have amounted to less than 5% since 2009. I keep thinking at this rate it will not be long before I have to give up paying rent and hit the road, live out of the car.

It is frightening and depressing, waiting for things to collapse so that the powers that be actually redirect some of that fire hose monetary policy to the people where it could do some good, even if that is temporary. And, I do not understand how families are getting by, I am single and have no dependents or even pets. What are people going to do next year by the millions when they have the added burden of ACA premiums? Are the privately employed getting huge raises to cover all the zero percent inflation that is killing me? I think not, median and average household incomes are lower adjusted for inflation than they were in the late nineties, adjust for Shadow Stats inflation and people have lost about half their buying power since then.

They leave the cost of food and fuel out of the inflation calculations. Every recession in my lifetime has been proceeded by an increase in oil prices. When those of us near the bottom of the income bracket have to pay more for food or fuel something else has to get left out.

I am paying people about the same thing I paid them 20 years ago and the price of every thing has at least doubled in that time. The average worker has lost 10,000 collars in purchasing power. There is not wonder the economy has not bounced back form the 2008 crash

Herkie1 Sorry about your Tuna problem. The actual source of your problem is overfishing and too damm many people. When I was a kid I could find a can of Blue Fin Tuna anywhere. Now that fish is on the verge of extinction. Humans , however, are reproducing at rates that guarantee their own extinction. With the tragic situation that politicians and plutocrats have created, I’m so sorry you may have to due without your Tuna. Suck it up son the worst is yet to come.

“Why isn’t gold soaring?”

The answer is contained in the question.

“Nobody” understands the price behavior of PMs any more, so people are (wisely) reluctant to invest in what they don’t understand. Just because it “should” rise in price relative to fiat currencies for one reason or another doesn’t mean it will.

For that matter, nobody seems to really understand QE either. It hasn’t done what the central banks expected, but nor has it done what any one else has expected either. At least not yet.

Very little “makes sense” in the financial world today. Timing especially seems completely unpredictable.

On the contrary, China (or at least the informed decision makers in China) are more than aware what QE is. They’re buying up any foreign asset that isn’t, metaphorically, bolted down – In a bid to offload inflated paper. Also, I’m not quite sure “Nobody” can be assumed to have little understanding of PM prices. Again, ask your average reasonably informed Asian on whether he’d like to own an ounce of the shiny stuff…

But does the “informed Asian/Chinaman” understand WHY “gold isn’t soaring” under these circumstances? Maybe not. He/she may just trust THAT form of money more than anything else. Obviously, most Westerners don’t.

If rumours of 30>35% premiums currently being paid for delivery of large quantities of physical have any truth, and I can’t prove that either way, then yes, I do believe Asians know why it isn’t soaring. We’ve been reading articles on this site, and others like it, for years. Think we’re the only ones that suspect a PM price ruse? Further, if premiums of that size are being paid then I suspect these same Asians expect either an imminent adjustment in price (In whatever currency you’d prefer to imagine), a shortage for delivery, a governmental decision to move pack to a gold standard, or, indeed, all three.

So spot prices are not soaring because premiums for physical have, thus the total cost is about right? Interesting.

If so, then this will be temporary, because the higher the premiums rise the more likely (but maybe now I’m making too much sense) ETF/”paper gold” owners are going to demand delivery to take advantage.

Frankly, I hope most don’t so they can be counted among the road kill.

Precisely.

What we’re witnessing here, basically, is a gold carry trade. Our banks have been doing it with the Japanese Yen for years. But what the Chinese are doing is with Gold, and in reverse. The Comex or the LBMA cannot counteract with arbitrage as they don’t have any of their own physical left. Never before, aside from the Lehman debacle, in the last few years has the title of this website been so close to fruition. Buckle in…..

fundamentals dont apply here. USD superiority is paramount….if you go against the USD, the USA will invade you and kill you, just like they did Ghaddafi

And we supported those rebels who are now ISIS. And now ISIS is producing their own gold and silver coins!

(Do we have the best govt money can buy or WHAT?)

“Why isn’t gold soaring?”

It’s becoming more apparent that ‘Broken Clock Harry’ Dent may finally be on to something: He’s been prophesying a skyrocketing Dollar and collapsing gold

for several years.

At the same time , the rest of the world is doing currency swaps avoiding the dollar. Harry has been silent about this.

AMEN ~ Jim Rogers sez “Dollar has now dropped to consisting of only 62% of world’s currency”…

Someone should approach Harry about this but the guy has such a swelled head, I doubt if he’d address it.

Believe me, I’ve tried, MANY times and got absolutely NO response!

https://www.youtube.com/watch?v=qtsaokA7yc8

Gold isn’t soaring because of the daily price smashes courtesy of TPTB. Thousands of naked shorts are dumped onto the market at the most illiquid trading times on most days which either hammer down the price or reduce rallies.

Exactly. That it took this long in the thread to state the obvious says a lot.