Not only did the Fed vote to keep interest rates stable yesterday, it did so overwhelmingly — with just as many members apparently favoring lower rates as higher. Now all the people who bought the “rate normalization” promise/threat are backtracking. From today’s Bloomberg:

Expecting a Fed Rate Increase by Halloween? Maybe Reconsider

Federal Reserve Chair Janet Yellen wants you to know that a rate increase is possible at the policy-setting committee’s Oct. 27-28 gathering. Don’t hold your breath.“Every meeting is a live meeting where the committee can make a decision to move to change our target for the federal funds rate,” Yellen said at her press conference Thursday in Washington. “That certainly includes October.”

Economists and investors don’t view an October move as likely. The chart below shows market expectations for an increase before December have shifted down dramatically. The Septemberists pushed their calls to December or 2016, not October, after the Fed announcement that rates would stay near zero.

Here are three key reasons not to expect the first interest rate increase since 2006 next month.

Global Clouds Take Time to Clear

Yellen highlighted global economic uncertainty during her post-meeting press conference, referencing heightened concerns about China and other emerging market economies that have led to volatility in financial markets.“While we still expect that the downward pressure on inflation from these factors will fade over time, recent global economic and financial developments are likely to put further downward pressure on inflation in the near term,” she said in her opening statement.

Those external risks aren’t likely to clear up in the course of the next six weeks.

“The outlook is pretty much unchanged, it really came down to uncertainty, and it’s uncertainty about the extent of the slowdown in China and how that might skew risks to our outlook in the U.S.,” said Aneta Markowska, chief U.S. economist at Societe Generale in New York. “I worry that they might not get that clarity that they want by the October meeting.”Not a “Hawkish Hold”

Ahead of the meeting, many economists expected what they called a “hawkish hold,” in which the Fed would keep rates near zero while emphasizing that liftoff was coming. Thursday’s statement and press conference did not fulfill that expectation. While 13 of 17 officials still see a rate hike this year, neither Yellen nor their forecasts sent a strong signal that an increase is imminent.“The tone of the statement itself was clearly dovish, Yellen’s press conference was dovish, the tone of the” Fed’s economic projections “was dovish,” said Millan Mulraine, deputy head of U.S. research and strategy at TD Securities in New York. Mulraine says he thought that October wasn’t a realistic option going into the meeting and maintains that view, and TD expects the Fed to hold off until next year.

Stephen Stanley, chief economist at Amherst Pierpont Securities, notes in a report to clients that the Federal Open Market Committee’s reasons for holding — worries over the growth and inflation implications of market turmoil and a slowdown abroad — were concerns that will be resolved only with time. “Based on my interpretation of the FOMC statement, I do not see much of a chance of a move in October,” wrote Stanley, who had projected September.

“That pushes off the prospects for liftoff until at least December.”

Today’s Fed watchers are reminiscent of the Cold War Kremlinologists who used to read meaning into who stood where on podiums and which modifiers were used in Pravda press releases. In each case the organization in question is both opaque and — the crucial point — operating with patently absurd worldviews and underlying assumptions. You can’t make sense of the senseless.

Specifically, given the trends now in place, the idea that the world will be more stable and/or faster-growing a month or two hence is somewhere between highly unlikely and completely delusional. To take just three of many possible situations that are far more likely to deteriorate than improve:

Brazil, which is hugely important for the stability of already-unstable Latin America, is in such a mess (interest rates spiking, bond rating cut to junk, corruption scandal that reaches all the way to the top) that it’s responding to a gathering recession with austerity. That is, higher taxes and lower spending. Its currency, the real, is down by 40% versus the dollar in the past year and still falling.

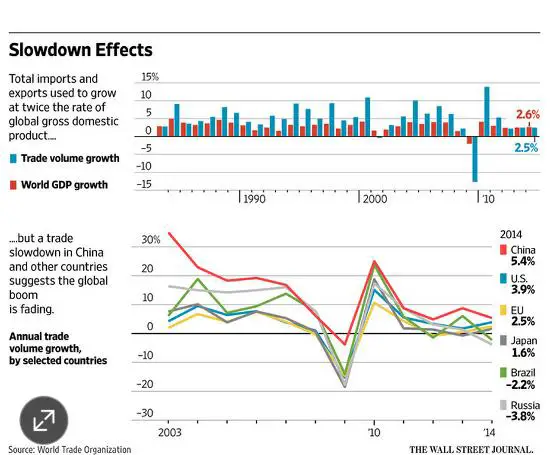

Global trade is flat-lining. Turns out that a big part of the past couple of decades’ rising global wealth came from trade — which in turn came largely from the combination of China’s willingness to borrow trillions of dollars to buy up the world’s raw materials and US consumers’ willingness to max out credit cards to buy Chinese junk. Now both parties have hit a wall and trade growth has entered a long-term decline which will not reverse in the next couple of months.

Growth in US industrial production — that is, factories paying workers decent wages to make real things — is rapidly falling towards zero. This is related to both the decline in global trade and the overleveraged state of US consumers, neither of which is going to improve in the near term.

Add it all up and 2016 will likely see the ascendance of the current Fed minority that favors lower rates and more aggressive currency creation. Next-generation monetary policy, here we come.

20 thoughts on "Higher Interest Rates? Not Next Month, Not Even Next Year, In Three Charts"

You want to hear something really way out?

In my opinion we may very well come out of this in one piece,the rest of the world will take a beating!

When we came out of Bretton Woods after WW2 as the owner of the world’s reserve currency we in effect owned the world’s credit.The only competition we had in the capitalist world came later in a revived Britain & western Europe(EU).Since that time the nations of the world built their economies around central banking & catering to the the nations that had high volumes of consumerism.The USA & Europe,along with some outriders like Canada,Australia & Japan,are the worlds only high volume consumer markets.In the near & medium future the rest of the world is dependent upon exports to these consumer markets,they need to keep the consumers alive just to survive themselves!

I believe that the the EU is on it’s last legs & going down!

Wars,starvation & dislocations in the 3rd world along with overpopulation & proximity to Europe will cause a flood of migrants to overrun Europe.The EU is in deep financial trouble even without this invasion from Asia & North Africa. When the financial markets shortly collapse Europe will go into a deep recession.When this happens the only consumer markets of any size left standing will be in the USA,Australia,Canada & Japan.

The exporting nations will be forced into feeding the remaining consumers at any cost,they have no other peaceful solution!

America is the economic center of the world & the outlying provinces will need to feed the center for their own survival!… Unless they can figure out an alternate economic model that doesn’t depend on retail consumerism.

What depresses me most about all of this is that everything moves so slowly. The entire Western industrialized world may be entering a 20+ year period of deflation like Japan has experienced since 1990. The monetarists and financial authorities may not like that but it’s not that bad for everyone else. Japan is a perfectly prosperous place. It just isn’t growing “fast enough.” So what, or – rather – don’t hold your breathe for any fireworks anytime soon. We could be reading pieces like this at this site 10 years from now and collectively laughing/crying about how we thought the end was ‘nigh. Maybe it’s best that human events are so slow, but it’s also why people don’t learn from history. Nobody can remember the details for such a long, drawn out period. Economic growth may be “slow” but it’s not zero or negative, and even 1% per year growth given such an enormous system base is still a lot. Personally, I see absolutely no evidence of a recession or economic stagnation no matter where I go. Quite the opposite, in fact. There may be a lot of problems/”injustices” with the current monetary system but one advantage it has is the ability to “extend and pretend”, prolong, “kick the can”, buy time, etc. almost indefinitely. The irony is, that is almost a testament to its stability!

Is it wrong to want an inherently corrupt system to fail when so many people would be hurt if it does?

“It’s the DEBT, stupid”

We don’t have a choice,the parasites in the financial sector,…the Gordon Gekko’s of the world will keep feeding until they kill all of us,even themselves at the end!

Somewhat like Gollum in the”Lord of Rings,….crazed with greed!The Gollums on Wall Street are worse because they are unopposed & unrestrained!

Any more downward pressure on inflation and I will be living in my vehicle!

Why?

The Fed should of raised rates by a quarter point. I think it would have actually boosted confidence and maybe the markets too. Now people are thinking things are bad. It’s all about confidence now, once that is gone, look out below.

If markets were expecting a rate hike, I think you would be right. But I read on Zero Hedge yesterday that the odds of a rate hike were still being priced at a 30% chance on Wall St, so that would also have been a shock. They just painted themselves into a corner with no good options, I think.

I used to like ZH but they have so many banners, ads, and popups and such that my computer will not open that site. Or, it will not stay open, just disconnects from the net. Too many long running scripts.

The Fed knows a lot we do not, they have access to everything the government does and more that is related to econ/finance. They know that inflation is being GROSSLY understated, especially in food/housing and insurance, the two/three largest budget items in most households.

At least of those that do not already own a house.

They desperately want to raise rates because of this, and they know the future direction is hyperinflation even if commodities do collapse. After all, commodities are only one input into finished products, and as the dollar races to the bottom (perhaps along with other currencies so it is hard to spot, does not mean they are not racing to the bottom) it will get ever harder to service debt and make a profit.

Corporate debt is gigantic, and as business stalls, wages remain flat to declining, the only way to service all that debt is to raise prices, that cuts into already busted household budgets struggling to pay rents and food etc.

They paper over a lot and outright lie about the data, but we are indeed in a downward spiral that is picking up steam.

The whole financial setup is made of illusions,it’s not a good situation but it is all the financial sector has to work with! It’s all they have.

If they raise the rates the hedge fund speculators will panic & the whole deal will collapse! They are buying time & hoping for miracles.

Love the analogy with Kremlinologists!

I was convinced for many weeks leading up to this that there was no way they were going to raise rates. In the last couple of weeks, though, it became so obvious that it was *way* too late to raise, and a rate rise was NOT priced in, that I started to worry they’d raise now just because their predictions are always wrong, and they were sure to be dumbasses.

I guess in this case, either holding or raising were both the wrong thing to do, since one would cause a crisis and the other implies the Fed is seeing evidence of a growing crisis. Either way, not good.

I actually think helicopter drops (money straight to average people) would have been far less harmful an intervention than the one we’ve had. Money straight to bankers doesn’t benefit anyone but the bankers, whereas helicopter drops to the working and middle classes would boost broader economic activity. Much of the working class does *not* have debt because they don’t have access to credit, but they will spend every extra dollar given to them because they have unmet basic needs, like for appropriate work clothing or higher protein foods or medicine or dental work. Krugman doesn’t seem to be aware that there are “broken windows” littering the world of the poor but unfortunately “demand” includes the ability to pay.

Get ready for capital controls in fact it’s arriving as we speak. I’d like to be a fly on the wall when people start finding out they can no longer move their money at will. Of course we can move money into accounts we just won’t be able to redeem or take a cash payment when we want. The investor will no longer be 50% of the equation but will have to do as he/she is told. Frankly the moment your money passes from your hand into theirs it becomes their money.

A word of advice to all is to redeem , cash out or whatever it takes while YOU still have some latitude to do so. Imagine calling in a redemption and being told you’ll have to wait ten days , in the meantime the value of your funds continually sinking. The Gates are being erected and their purpose is Stop/Loss , your interests be hanged.

I have presumed all along that we won’t have any rate hikes. The psychobabble out of the Fed is offered to sound like they actually consider such action, they don’t. Everyone understands that to increase rates means to trash the stock market bubble they have so carefully crafted. No Fed chair or FOMC member will vote for that. Won’t happen with the market as fragile as it is. Next year, not a chance for the Fed to risk a significant move down in an election year. Deal.

The gates for QE5 are now unlocked. Stand by for emergent “crisis” to (re)justify extraordinary measures.

In the meantime, buy yourself some more junk silver.

Used to buy silver. Physical not that worthless paper promise to deliver crap. But, I refuse to pay a $3 over spot premium when they only offer 50 cents over to buy. When the collapse does come, and it is coming, silver will be HUGE, it is the poor man’s gold, and gold will be useless if you don’t have adequate silver to “make change” with. But, even copper will have value as a monetary metal to “make change” for silver. So, as commodities collapse it might be worth having a pile of copper sheet in the garage. I did at one time, though I bought it because I wanted to use it for a wall covering on an ugly wall, was a lot more work than I thought so I sold it back to the scrappers at half the price I paid for it. 🙂