1. Being overweight in any portfolio position is a recipe for disaster. Never put more than 10% of your speculative portfolio into any one stock.

In the past, I know I haven’t entirely followed that rule myself, but you can only get real success in speculations with risk mitigation and by letting your winners ride (think Northern Dynasty and Alterra as recent examples).

Putting all your eggs in one basket could pay off in a big way (if you’re absolutely correct), but you’re exposing yourself to greater risk.

I didn’t always follow this rule. It’s no secret that in the past I put as much as 35% of my net worth into one stock. But the global financial crisis and heart surgery knocked sense into even the thickest of skulls.

If your speculative portfolio is worth $50,000, don’t put more than $5,000 into any one company. Especially if this is a small-cap company.

2. Never buy your intended position in a stock all at once. Buy in tranches. I’ve met many, many successful traders and fund managers all over the world. I’ve yet to meet anyone (or any software algorithm) that has mastered timing a stock perfectly, on a consistent basis. So, take the risk out of timing by buying your desired position in tranches.

If you have $5,000 to invest (from your 10% allocation to 1 company), then split that up into tranches. A good rule of thumb is 4 equal 25% positions (so in this case, 4 positions of $1,250). If you are really excited about the stock, buy your first two tranches. Then sit back and wait for Mr. Market to give you a sale and buy more of the stock at cheaper prices. This way, if the stock rises, you’re along for the ride. If it goes down, you can scoop up shares for a discount.

Again, I learned this rule by actually improving my purchase techniques with time. It took years to build up my Alterra position. I also plan on doing the same with my number one conviction story right now. I have to buy in tranches to accumulate a position and I have to sell in tranches too. Start to buy your position in tranches and the issue of timing your entry and exit perfectly will not weigh so heavy on your mind.

3. If an investment causes you to stress to the point you can’t sleep – sell. If you are overly distracted by any of your positions and it causes stress, discomfort or you’re losing sleep… Sell enough stock to alleviate the situation. Life is too short to worry about a stock position. Enjoy the present and have fun.

If your stress level is high on a continual basis and is becoming intolerable, then you have to reflect on one of two things:

1) You’re over-invested, or

2) Speculating just isn’t for you.

If it’s the latter, that’s OK. Life is short, do things you love and you will not just have fun but be successful. You’ve now come to the point of self-awareness and what works for you. If you’re mortgaging the house, playing with vacation money, or your kids’ tuition, then you’re playing with fire. Only speculate with money that won’t change your lifestyle if you lose 100% of it.

4. Give your speculation some time to play out. Being patient and investing like an alligator is extremely difficult. Over my nearly 20 year career, I’ve seen many people (including myself) become impatient and make irrational moves. Here’s an example from personal experience:

I met an analyst on-site in early 2006 and we bonded. Site visits do that at times, especially when the plane is stranded in an unexpected 4-day snowstorm that no one was prepared for.

We stayed in touch over the years. He moved on from the firm he was an analyst within 2008 and joined Verde Potash.

I believed in this individual and without doing a site visit I purchased 4 million shares at CAD$0.25. I trusted him, knew of his strong technical background and the company was trading at a discount to cash, so I was getting the management and the project for free. The company had C$0.29 cents cash per share, so I felt good about my $1 Million bets.

I had many meetings with management and then I planned to do a site visit of my own to the main asset in Brazil. (2009 was crazy for me as I spent over 300 days on the road and gained 40 pounds as a result of bad habits such as drinking beer with geologists at night on the road, and not working out regularly. But you would be amazed how much market intel you get from drunk geologists at midnight).

Anyways, Verde Potash management laid out a specific time frame and business plan that they assured me would hit if I stuck it through with them.

Well, the first milestone was delayed. Then the second. Remember, early 2009 was a very rough market for resource stocks. I didn’t have the time to go out to the project and see for myself.

But a close and trusted friend of mine (thanks Miles!) stated he knew the project and that it wouldn’t work. I was skeptical after that and frustrated with management for missing the milestones.

I lost sight of the main reasons I’d taken the position in the first place. Then the third milestone was missed and I sold. I netted just under a 100% gain. You would think a near double isn’t bad in a very tough market.

But I screwed that one up. As it turned out, I missed an enormously greater score. Within 14 months, the stock was trading north of C$10 a share.

Were the delays management’s fault? No. I was impatient. Even though nothing changed, and I trusted management, I let one friend’s perception of the project change my view.

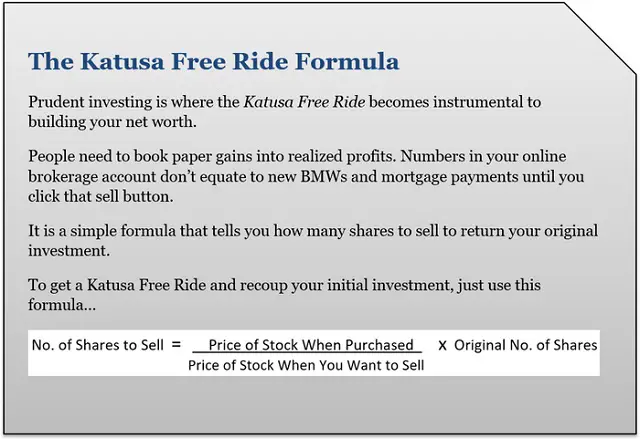

5. Crystallize a profit using the Katusa Free Ride Formula. When you have a profit, risk mitigation is key to protecting your downside and leaving the opportunity of huge upside available to you.

Remember, you don’t just buy in tranches, but you must also sell in tranches.

Click here for more

——————————–

The best way to make money in cryptocurrencies is NOT to buy the coins. Here’s what you should do instead

6 thoughts on "Marin Katusa: 5 Points You Need To Print And Staple To A Wall"