Mazumdar provides insights into what makes and breaks junior mining companies and how to find profitable operations. This article is from May 31, 2022, but you can use these insights to investigate and evaluate any junior mining operation.

posted by Joe Mazumdar on Exploration Insights:

The year-to-date has included a lot more travel for me than the past two years combined, with site visits to the Iberian Pyrite Belt of southern Spain, the porphyry copper belt of the central Argentinian Andes, mafic-ultramafic hosted copper deposits in northern Brazil, and the low sulphidation epithermal gold district of southwestern Nevada in the US.

The number of live mask-less conferences has also picked up, another sign of a return to some normalcy. But markets are anything but normal, so the turmoil of the past several weeks has prompted me to update the gold industry’s investment clock.

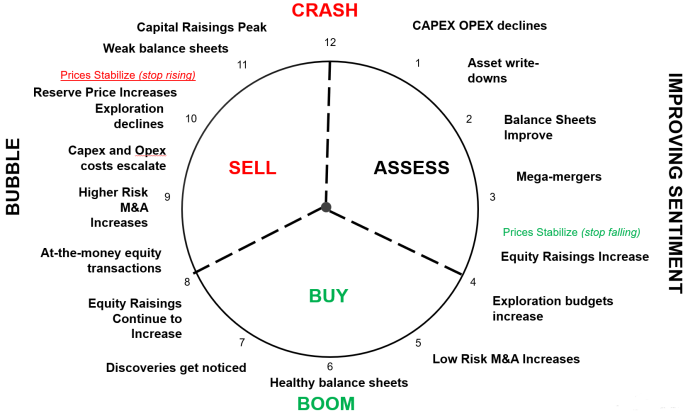

The gold sector investment clock focuses on exploration, equity financings, M&A trends, balance sheets, costs, and reserve prices. (Source: Exploration Insights adapted from Lion Selection’s Lion Mining Clock and Cupel Advisory)

To gauge investors’ position on the clock, I reviewed the current state of several financial markers:

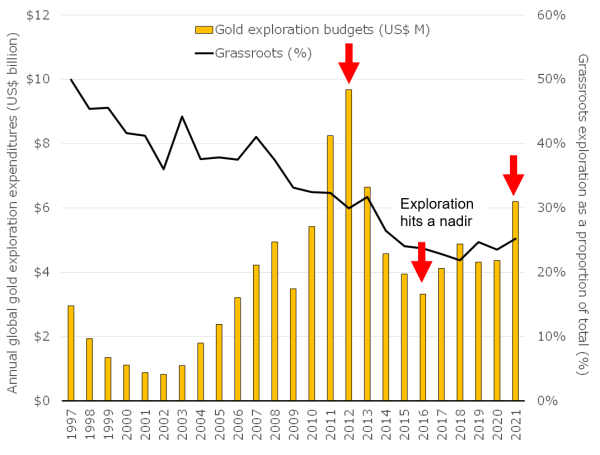

- Exploration expenditures – My hunch is that we will see a decline for the remainder of 2022, as juniors, who control a large proportion of gold exploration expenditures, may have trouble raising capital, and some producers may have to curtail their exploration budgets due to rising costs.

Annual global gold exploration budgets from 1997 to 2021 [yellow bars] with proportion directed to grassroots exploration. (Source: S&P Global Market Intelligence and Exploration Insights)

- Riskier M&A transactions – Other data that help diagnose the gold sector’s state are the parties and assets involved in mergers and acquisitions (M&A), especially concerning the transactions’ risk levels. Most M&A transactions since the mega-mergers of 2018-2019 had been well-founded deals. But at the end of March, I documented the acquisition of a few flawed projects that had taken place earlier in 2021 and had left me scratching my head as I couldn’t unravel their ‘hidden’ value.

No brain, no heart, and he’s much too shy. (Source: Exploration Insights)

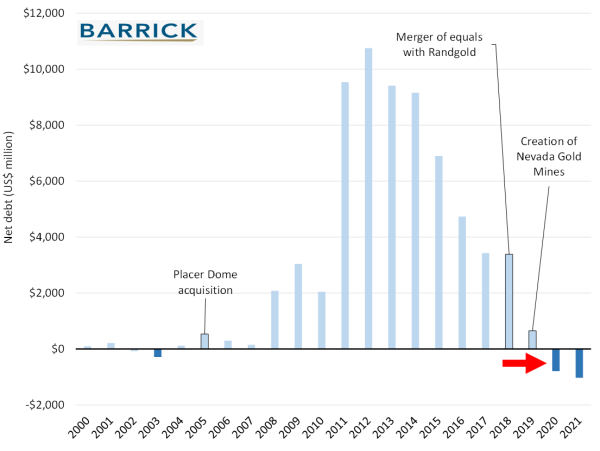

- Healthy balance sheets among major precious metal producers – Unlike previous precious metal cycles, major producers’ balance sheets are currently healthy as proxied for by their net debt positions (long-term debt minus working capital). For instance, Barrick Gold’s net debt position, which peaked at over US$10 billion in 2012, has since gone negative.

Barrick Gold’s end-of-year net debt position [long-term debt minus working capital, blue bars] since 2000. The lower the number, the better. (Source: Barrick Gold, Investing.com, and Exploration Insights)

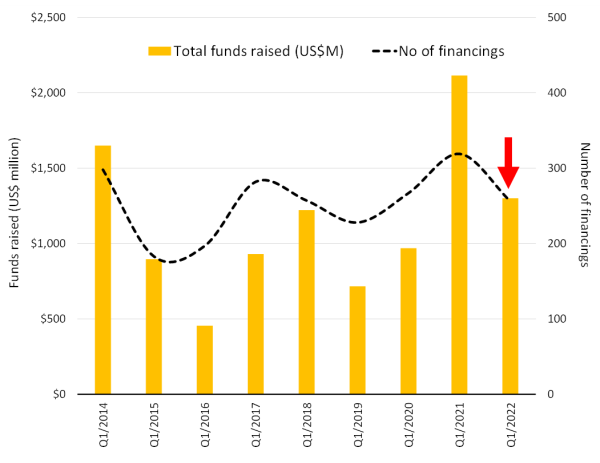

- Equity financings for gold juniors may have peaked – To avoid the seasonality related to gold equity financings, I reviewed the amount raised by gold companies in the first quarter over the past nine years. In Q1 2022, they raised ~40% fewer funds than in Q1 2021. Moreover, US$140 million of the funds were directed to a metallurgically-challenged, low-grade open-pit gold project in Nevada operated by Hycroft Mining and supported by followers of a theater company – AMC.

Comparison of total funds raised from the equity markets and number of financings by gold companies in the first quarter of the year since 2014. (Source: S&P Global Market Intelligence and Exploration Insights)

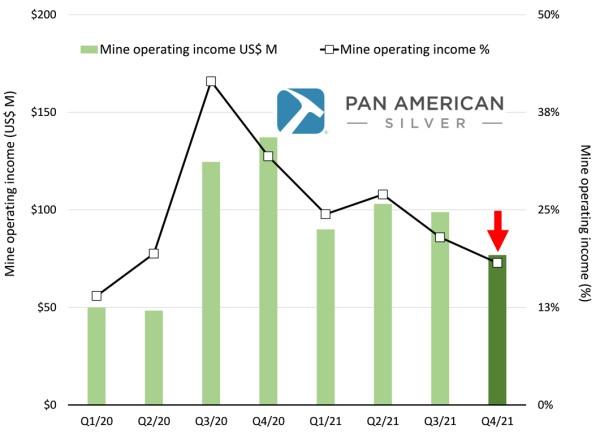

- Operating margins for producers are getting squeezed – Precious metal companies have underperformed the gold price due in part to rising costs, which shrink operating margins in a flat-gold price environment.

As recently as Q3 2020, Pan American Silver Corp. had a mining operating income of ~40%. But a combination of operational challenges and higher input costs pushed its operating margin down to 15-20% in Q4 2021.

Pan American Silver Corp.’s quarterly mine operating income [green bars] and as a proportion of revenue [black line] since 2020. (Source: Pan American Silver Corp., Investing.com, and Exploration Insights)

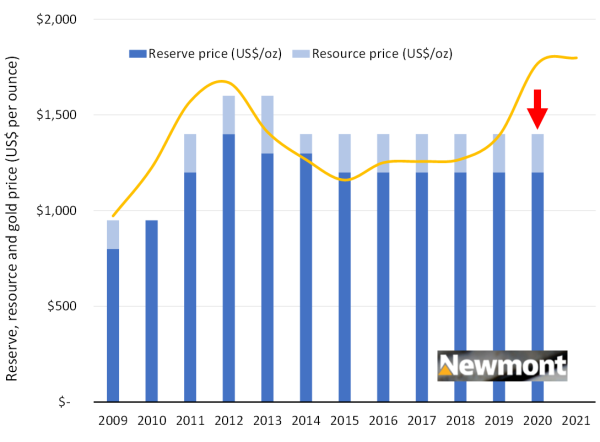

- Reserve prices for majors are still low (for now) – Over the past 13 years, Newmont Corp.’s (NEM.NYSE, NGT.T) reserves have been booked annually employing an average price per ounce ~US$200 below the gold price, and only on two occasions (2014 and 2015) did it surpass the gold price. In 2020 (and 2021, if reserve price assumptions did not change), the reserves were ~US$600 cheaper than gold, the largest delta of the past decade.

Reserve and resource prices [blue bars] versus the gold price [yellow line]. (Source: Newmont Corp., Investing.com, and Exploration Insights)

Considering the current global state of affairs, including China’s Zero COVID-19 policy, supply chain disruptions, hiking inflation rates, and the Russian invasion of Ukraine, my review of the various financial trends that affect the gold market (above) indicates that we are positioned around the late afternoon to evening, or between the BUY (BOOM) and SELL (BUBBLE), sections of the investment clock:

In conclusion, for junior companies, the sector will require more quality M&As to improve the sentiment toward precious metal equities.

And for investors like you and me, there’s a unique opportunity to pick up favorite precious metal juniors that may have seemed too expensive in the past.

Timing is critical when purchasing and selling stocks, especially illiquid junior explorers. However, to gain an edge, it is also key to choose companies underpinned by:

- high margin assets,

- in mining-friendly jurisdictions, and

- operated by highly experienced management teams

Originally posted by Joe Mazumdar on Exploration Insights.

The economic consequences are irreversible

This is an inflation emergency. The impact of war is rippling across the globe. It’s driving up prices more quickly than anything we’ve seen in our lifetime. And it’s barely begun. What impact will this change have on your money? How may it disrupt your financial future? How can you prepare starting right now?

To help give you an immediate answer, we just released an urgent emergency briefing.