From J Taylor’s Gold, Energy, and Tech Stocks newsletter:

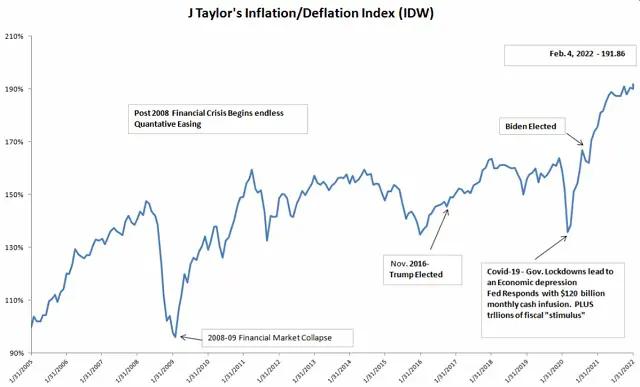

Stocks, commodities, silver, and gold were all up. My Inflation/Deflation Index hit a new high as well.

And so, not surprisingly, interest rates also rose considerably this week. The 10-Year U.S. Treasury rose to 1.916% this week on news that the jobs report was substantially stronger than anyone expected, although according to an article on Zero Hedge today titled “Here is what’s behind Today’s stunning Payrolls Beat,” it was a statistical anomaly that will end up leading to much lower numbers in the weeks to come.

Whatever the case, the “don’t worry be happy crowd” were all in their glory on Friday as everything except bonds rose in value. No doubt most drinkers of the Fed’s Kool-Aid believe that inflation is under control and so rates will not continue to rise. It is, after all, the rise in the rate of consumer prices that has thrown a wrench into the continuing orgy of America’s elite.

But according to Deutsche Bank’s “Chart of the Day of the 20 US economic cycles since 1914, this is the strongest recovery in commodity prices on record at this stage: it eclipses the two 1970s cycles largely due to the spikes back then occurring beyond year three of the 1970-and 1975-expansions (and also has a broader commodity composition beyond energy). In other words, this is not your grandparents’ 1970s inflation shock: it is way worse (for now).”

Adam Taggart interviewed hedge fund investor Bill Fleckenstein this past week, asking the question we all want an answer to, and that is, how and when will this current Fed-induced market and economic pathology end? Bill’s view is that the timing is difficult if not impossible to predict. However, he did lay out a path he thinks is most likely to unfold. He believes that the Fed will not be able to tighten enough to break the back of inflation without creating a major stock market debacle, which would also tank the economy and crush prices. He thinks the jig will be up when the market comes to realize the Fed has lost control and has no choice but to keep pouring gasoline onto the financial markets leading to a financial market melt-up and hyperinflation.

The bond vigilantes (and foreigners?) will massively sell treasuries, sending interest rates to the moon! Bill didn’t predict this, but my view is that since the U.S. economy cannot survive anything like normal interest rates, a monetary reset of some kind will have to take place. Got Gold?

——————————–

New Cash Law Will Be Disaster for Savers

New law has expert warning seniors and retirees to beware. There’s a darker truth behind this political event…

2 thoughts on "Jay Taylor: This Week Had “Inflation” Written All Over It"