When an entity needs to borrow ever-greater amounts of money to survive, the markets – that is, the people who are being asked to lend the money – eventually rebel. This rebellion takes the form of rising interest rates as lenders demand a higher return to compensate for the extra risk, and falling credit scores as rating agencies are forced by the markets to face reality.

Then one of two things happens: Either the borrower gets its act together, finds the cash it needs internally and stops borrowing. Or the rising cost of new borrowing sends it into a death spiral that ends with some form of default, restructuring, or dissolution.

Illinois – and its basket case of a city Chicago – are deeply into this process and show no signs of pulling out. Both city and state need ridiculous and growing amounts of money to cover their ballooning pension obligations (which the courts won’t let them cut), and now have to pay rates that make a course correction mathematically impossible. Here’s the latest:

Illinois’ upcoming $500 mln bond sale gets near-junk rating

(Reuters) – Moody’s Investors Service on Thursday rated $500 million of bonds Illinois plans to sell this spring one notch above junk, citing the state’s big unfunded pension liability and chronic budget deficits.

The credit rating agency assigned the state’s current Baa3 rating to the general obligation bonds. Illinois’ first bond issue this year will be sold competitively with the proceeds earmarked for capital and information technology projects, according to a state official familiar with the sale. A pricing date was not available.

Moody’s said the rating outlook remains negative, “based on our expectation of continued growth in the state’s unfunded pension liabilities, the state’s difficulties in implementing a balanced budget that will allow further reduction of its bill backlog, and elevated vulnerability to national economic downturns or other external factors.”

It warned the rating could be downgraded to the junk level if Illinois’ unpaid bill backlog increases, pension funding is reduced, or if the state is unable to manage impacts from a future recession, trade war or reductions in federal funding for Medicaid.

Illinois, the lowest-rated U.S. state, sold $6 billion of GO bonds in October to reduce an unpaid bill backlog that ballooned to a record $16.67 billion last year. It also sold $750 million of GO bonds in November to fund capital projects and information technology.

Investors are demanding higher yields for Illinois bonds than for GO bonds issued by other states. Illinois’ so-called credit spread over Municipal Market Data’s benchmark triple-A yield scale has widened from 177 basis points in early January to 208 basis points as of Wednesday.

———————–

It’s So Bad in Illinois Its Bonds Pay Like a Reviled Jersey Mall

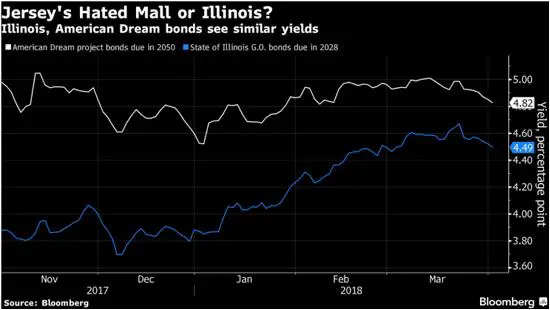

(Bloomberg) – Illinois’s finances are so troubled that investors can make nearly as much money betting on the worst-rated U.S. state as they can on the American Dream mall project, perhaps the most despised structure in New Jersey.

An unfinished, multicolored hulk in the Meadowlands beside the Turnpike, former Governor Chris Christie called it “the ugliest damn building in New Jersey, and maybe America.” Yet bondholders are asking to get paid nearly as much to own Illinois’s debt as they are demanding in return for holding the long-delayed mall’s unrated revenue bonds — a consequence of the state’s perennial budget distress that’s left it teetering near junk grade.

The yield on Illinois general-obligation bonds that mature in 2028 averaged 4.5 percent in March, compared to an average of 4.99 percent on unrated bonds due in 2050 sold for the American Dream mall project, the shopping and entertainment center that’s years behind schedule, according to data compiled by Bloomberg.

This, remember, is during a long recovery in which most taxing authorities are raking in more than the usual amounts of money. If Illinois is near junk today, what will it be rated in the next recession when its tax take falls and its borrowing expands? Junk, apparently, which is another term for “non-investment-grade.” Buyers at that point will no longer be investing; they’ll be speculating.

For an idea of what this means, consider a pension fund, let’s call it the Public School Teachers’ Pension and Retirement Fund of Chicago, that invests in stocks (which fall during recessions) and high-grade bonds (which pay miniscule interest). Because currently employed teachers aren’t paying in enough to fully fund each year’s required increase in plan assets, the plan has to borrow to cover the difference. But because it’s a junk borrower, the interest it has to pay is higher than what it earns on its investment-grade bonds. So it generates a negative spread, increasing its underfunding from already-catastrophic levels.

With baby boomer teachers retiring en masse and demanding what they’ve been promised, what was once an accounting issue becomes a cash flow issue, in the sense that there is literally not enough cash to pay current bills. And that’s the end.

It’s not clear what happens next because states technically can’t go bankrupt. But whatever it’s called, the result will be some sort of default. And the market’s reaction will, as with all big failures, be a sudden burning interest in who’s next. That search will turn up plenty of cities and a few states, and we’ll have the catalyst for the next crisis.

31 thoughts on "Illinois Enters Its Death Spiral"

It’s just more proof that “the gov’t” (at all levels) has been lying about everything. And all those public employees in Illinois thinking they have a pension once they retire… Anyway (and if it makes you feel any better) the entire US dollar complex is in the same boat and will soon fail too. And that’s (arguably) from too much war, creating too much gov’t spending, which has lead to too much debt. So whatever it is that Illinois will soon be facing, go ahead and multiply that number by an unimaginable number in the trillions which will trigger the same fate for the entire country (and then the world). Oh and remember what I said in my first sentence because once this happens the gov’t will continue to lie and their lies will grow and be on steroids. And many Americans will still believe them. Wash, rinse and repeat?? Personally I don’t think so but one thing about it – we’ll all be seeing together, won’t we…(and that’s NOT a question).

They will wait for the fed govt to bail them out, which will set a bad precedent. They could set in motion to change the constitution, or to fire police, teachers, firemen, and all non-legislative expenses, but they won’t. This is high stakes chicken. I wouldn’t emigrate – if the government disintegrated, what would be the real harm, other to people depending on money from them. On the other hand, if they raised taxes severely, of course that’s when the problem starts.

Just wait until January 2021 when Kamala Harris or some other Marxist is president and they will use US Federal taxpayer money to bail out state government employee pension funds. Why? That is one of their two big voting blocs: 1) A permanent underclass of poor people who the Demorats keep subjugated and poor and 2) the parasitic government “worker” class.

Count on it.

Kamala Harris is not eligible to be POTUS!

Place a special tax on all ex state politicians who voted for this overspending. Cut their pensions first. Eliminate their pensions. Seize their assets. Put them in jail. Hang em high.

Take your pick.

Good luck getting any part of that Larry. Haven’t you figured out yet that the socialists are NEVER to blame for any of this mess, it’s always the Republicans and Libertarians?

Here’s how this works…..California has been on the brink of bankruptcy for 20 years, Illinois for 5 years.

Illinois;Hello,is this the Federal reserve bank? ….Fed; yes it is……Illinois; we need 10 Billion dollars before the end of the month or we are going to have to default….Fed; OK hold on (typing keystrokes 10…000…000…000……..and hit send button) OK its on its way…. Illinois; Got it, Thank You, see ya next month!

That is certainly the way it has worked for the US, which is why the FED is sitting on a “balance sheet” of 4.5 trillion bucks that is as phony as a 3 dollar bill.

Problem is, the rest of the world is operating the same way….one huge game of BS, there is no honest money anywhere. And each is scared to call “BS” on any major player for fear their dirty laundry will be exposed in the process. China has been accumulating gold hand over fist for years now….my guess is when they have enough hard money, they will call an end to the game, revalue gold to the sky, and come out the winner.

The IMF bylaws prohibit a country from tying their currency to gold. Then America and economists convince all the countries to inflate together, which is fun (more money for the govt, the first users of the new money). This prevents people from finding a sane country to invest in. Buy gold – its the only safe haven.

A BLUE STATE.WHAT YOU EXPECT.NOW WRITE AN ARTICLE ON THE US.JUST AS TERMINAL

Why doesn’t the state of Illinois seize all private property and hand it over to pensioners? We live in a Democracy and they voted for it.

Pensioners would quickly abandon the state with their fluid assets.

Pensioners don’t want farms and furniture – they want cash to pay medical bills.

But the government will have to seize all of the private property and sell it to ??? to have money to pay those medical bills.

If they can’t cut the pensions, why not try a 50% tax on all state pensions to make up the shortfall?

Now THAT’s smart!

Since Reagan the genius strategy has been spend and cut taxes, or war and cut taxes. Never raise them, no that only begins to pay back the spending and that is unacceptable always and forever…until the end, we are stuck on stupid.

The reality is the bonds (and paychecks or retirements) are totally worthless – the realization may take another 12 days or 12 months.

This is true for around 23 states at this time.

Perhaps the Land O’Lincoln should consider selling all of its residents into slavery? They voted for this mess…..let them reap the whirlwind.

lol…

They’re just farther along the spiral down the toilet. All because elected politicians refuse to do all of their job and match spending to revenue and vice-versa.

donbelmont easy