For the past few years, homeowners just about everywhere have been able to finesse life’s problems by thinking “at least my house is going up.” This home equity accretion allowed them to buy stuff on credit, safe in the knowledge that even as they maxed out yet another credit card their net worth continued to rise. They felt smart and confident, in other words, and so continued to behave in ways that the modern world defines as normal and natural.

But now that’s ending. Home prices have stopped rising in many places and in a few canaries in the financial coal mine have begun to plunge. Here’s what “plunge” means for Australians:

House prices ‘falling by over $1,000 a week’ in Sydney and Melbourne, Deloitte says

The boom time is over and we’re now officially experiencing the “house price fall we had to have”, according to Deloitte Access Economics’s latest business outlook.

It has found what many had been predicting: prices are dipping as interest rates are rising, with our biggest cities feeling the winds of change most keenly.

“Our house prices here in Australia had streaked past anything sensible by way of valuation,” said Deloitte partner Chris Richardson.

“Now, finally gravity has caught up with that stupidity and prices are falling.“In Sydney and Melbourne, housing prices are falling by over $1,000 a week.”

Prices had surged across the country over the past five years as historically low interest rates have driven Australians to load up on debt, while investors had also cashed in.

Not if, but by how much

Housing forecasts have gone from disagreement over whether home prices will fall to debates about how much they’ll decline.“There are more falls to come, particularly in Sydney and Melbourne, because the prices there got silliest and you’re seeing a range of pressures on it.”

Mr Richardson names three particular factors putting downward pressure on prices.

1. Banks are raising interest rates: “Even though the Reserve Bank has done nothing.”

2. Banks have become cautious: “You’ve seen the banks being more careful with the loans they’re giving. Those loans are slower and smaller than they used to be.”

3. Less money from overseas: “Foreign buyers are a bit more cautious.”

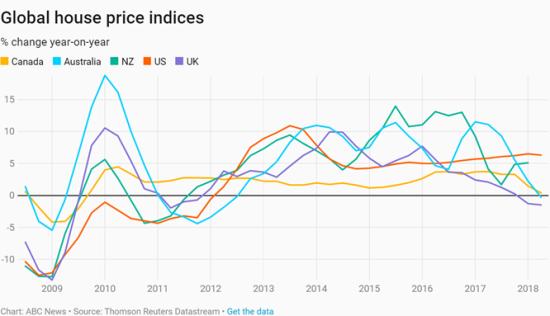

The Deloitte report reflects recent data from Thomson Reuters, which shows changes in the rate of residential property price growth, year-on-year.

A falling line in this chart doesn’t necessarily mean prices are dropping — simply the rate of growth is slowing — but if it drops below zero then prices are technically falling.

The above chart shows that the UK — which had an epic housing boom along with, not coincidentally, one of the world’s most extreme consumer credit bubbles — now has falling home prices. Australia just tipped into negative territory with Canada right on the cusp.

In each country, a reverse wealth effect is kicking in. Homeowners are seeing their home equity – aka their net worth – stop growing and in some cases drop by shocking amounts. In Australia it’s $1,000 a week, which is enough to darken the mood of pretty much anyone not in the 1%. A consumer with a dark mood is an unenthusiastic shopper because new debt accelerates the decline in net worth.

As home prices fall, so therefore does “discretionary” spending. Australians will continue to eat and to air condition their bedrooms, but they’ll cut way back on vacations, new cars, etc. And the debt-based part of the economy will suffer. This will cause stock prices to fall, knocking another leg out from under the average citizen’s net worth and making them even less likely to splurge. And so on.

Credit-bubble capitalism depends on mood, which makes it fragile. That fragility is about to be on full display pretty much everywhere.

9 thoughts on "Here Comes The Housing Bust “Reverse Wealth Effect,” Australia Edition"

The interventions of APRA have reduced the risk of speculative investment lending, and in turn have reduced house price growth.

The RBA has emphasised that while the supply of credit has been tightened, investor demand for mortgages has also slowed. APRA data reinforces this, showing the annual growth in investor lending actually peaked in June 2014, before the announcement of a recommended growth limit.

But even where the RBA has pointed out the role of declining demand, its own analysis showed that areas with high levels of rental stock had been relatively dampened by recent financial regulation.

Dampening investment and reducing speculation for an asset people live in is not a bad thing. Arguably, it should have been done years before their first intervention.

Hi,

Long time reader and occasional poster.

I’m an Australian property investor and I think I can give you an honest assessment of property downunder.

The article is accurate, prices are falling in Sydney and Melbourne and as the article acknowledges they are coming off ridiculous highs. The other capital cities where the boom wasn’t as pronounced are flat or glide path falls.

In Syd/Melb the property market mood has changed significantly, auction clearance rates are down 25% and buyers are now squatting on vendors waiting for them to relent. Thing is, most vendors still have high value expectations so those main markets are somewhat of a stalemate.

However, one thing Americans do not understand about Aussies is our unwavering belief in, and desire for property. Yes, prices will continue to fall, my guess another 5-15% and yes marginal borrowers will default (Current default levels are near historical lows of their range) but it will take 3-6 years for the change in psychology John suggests to manifest. Thing is our interest rates are stable, unemployment low and so the price declines are just bubble excesses being blown off. Nobody down here is panicking, most informed people knew those markets were overpriced and it was the FOMO crowd that gave those markets their last push. We’ve also had our prudential regulator (APRA) pressure banks for the last 2 years to tighten lending standards and I can attest to that personally and it was this restriction of interest only loan credit that has prompted falling prices and reduced the risk of bubble excesses.

There may be some reverse wealth effect as John suggests but the effect on our economy is grossly overstated in the article. What your articles don’t reflect is an infrastructure boom that is now in full swing as the housing building boom subsides. The infrastructure boom in Sydney is genuinely a once in a lifetime event, being crowned with the building of a second airport in Sydney during next decade. This infrastructure building is designed to dovetail into declining residential building to maintain the economy. At least that’s the plan.

Me, like a lot of people have lost $$$ in Sydney but I’m not worried at all, I buy and sell into the same market and I know while decline is imminent, Australian property is a long term investment that is supported by great fundamentals, especially overseas migration.

From my POV the biggest risk in OZ isn’t the housing market, it’s a US recession which transmits falling trade levels and GDP, leading to local recession and this is much more likely than the worst scenario painted in the article above. Thing is, if that happens, property prices here may drop far more precipitously than present.

A few years ago I visited Brisbane in Queensland, Australia.

SE Queensland is like Oceanside, California in 1970. Basically paradise.

If I had to go broke that’s the place to do it.

– Three videos on this topic (from a canadian website):

https://jugglingdynamite.com/2018/10/09/60-minutes-bricks-and-slaughter-exposing-australias-housing-crisis/

I actually earn approximately $23,000-$24,000 every month using the internet. I lost my job after working for the same corporation for a long time. I needed reliable earnings. I was not interested in the “get rich overnight” packages you notice all over the internet. Those all are kind of ponzi sort of mlm schemes wherein you need to first create leads then sell a product to friends or relatives or any individual to make sure they will be in your team. Working on-line has many positive points like I am always home with the children and also enjoy time with family on different beaches of the world. Here is what I am doing> https://pepsapi.tumblr.com

I actually make close to $17,000-$18,000 per month via internet. I lost my job after working for the same enterprise for years. I required reliable source of income. I was not thinking about the “get rich overnight” home programs you can see online. Those all of them are kind of ponzi sort of mlm marketing plan wherein you have to initially make prospective buyers after which sell a product to friends or relatives or anybody to make sure they will be in your team. Working on line has many positive points like I am always home with the children and also enjoy time with family on different beaches of the world. Here’s the easiest way to start https://fixpop.tumblr.com

I regularly make nearly $12500-$13500 every month using the internet. After doing work so wholeheartedly, I ended up losing my job in my company where I have given many years. I really needed a reliable income source. I am not into “get rich overnight” deals you see all across the net. Those are all kind of ponzi multi level marketing programs in which you need to first make interested customers and then sell a product to friends and family or any person so that they will probably be in your team. Web work has amazing benefits like I am always home with my family and can relish a lot of leisure time and go out for family vacations. Here’s the most convenient way {to https://geofact.tumblr.com