Just a few months ago, real estate was on fire. Prices were blowing past records set during the previous decade’s housing bubble as desperate buyers bought whatever was available at above the asking price while homeowners, confident that prices would keep rising, held out for the next big pop to sell. Notice on the following chart how the ascent steepens at the beginning of this year.

Then, as if someone flipped a switch, the trend shifted into reverse. Not just in the US but nearly everywhere. This list of recent headlines tells the tale:

Housing demand sees biggest drop in more than 2 years

Hamptons property sales slow as caution spreads to the wealthy

Home Prices Are Falling in One of America’s Richest Suburbs

First Time Ever, More Chinese sellers than buyers

Vancouver Suffers Its Worst July for Home Sales Since 2000

Record Drop in Foreigners Buying U.S. Homes

Australian home prices take biggest dip since 2011

The End of the Global Housing Boom

Manhattan Real Estate: Prices Plummet, Sales Tank

What’s happening and why is it happening now?

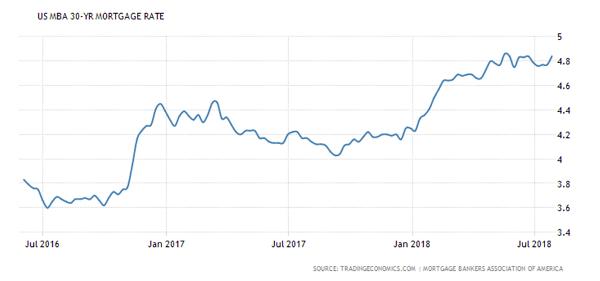

Several things came together pretty much simultaneously to turn houses from must-have-at-any-price necessities into completely optional and maybe not even desirable: First, prices rose beyond the reach of all but the seriously affluent. The gap between the price of the average home and the size of the mortgage the average local buyer can afford has been rising for years, but recently in the hottest markets it has become a chasm. Meanwhile, mortgage rates have started to rise, increasing the monthly payment on a given house dramatically.

If you live in San Francisco or Sydney or Vancouver, chances are you can’t afford to buy a decent house – not even close. And if you can’t you don’t.

Second, the eruption of trade wars between the US, China and Europe has made foreign houses less straightforward for Chinese and Russian millionaires. As a result, fewer of them are making all-cash, price-is-no-object offers on overseas trophy properties.

The reverse wealth effect should terrify holders of stocks and bonds

For the past several decades it’s been the explicit policy of governments and central banks to use low interest rates and more recently direct purchases of stocks and bonds to push up the price of financial assets. The goal was to make holders of those assets feel rich and smart and therefore more inclined to borrow and spend on frivolous stuff that would boost GDP. This is called the wealth effect and it’s been firing on all cylinders in the age of QE and ZIRP. But all that borrowing – by individuals to buy houses (and SUVs and 70-inch flat-screens), corporations to buy back their stock – and buy out each other – at record high prices, and governments to build unnecessary roads and bridges and invade each other – has left a lot of debt lying around that has to be paid off with future cash flow.

Let a huge sector like housing turn down and the wealth effect will shift into reverse, as every homeowner in the world watches their biggest asset shed the leveraged profits that had made them feel rich and smart. Now they feel poor and dumb, and suddenly risk-sensitive. So they pull up their stock portfolios and find a bunch of price charts with a disturbing resemblance to that of their house. Armed with the sudden revelation that trends can reverse, they decide to lock in some of their Apple and Google profits. Millions of others make the same decision, and high-flying tech stocks start behaving like wounded ducks.

And just like that the markets’ emotional tone shifts from carefree buy-the-dip to terrified sell-the-rip. Capital gains tax revenues dry up, government deficits soar, and the river of cash flow that was earmarked for servicing a mountain of debt slows to a trickle. And it’s hello, 2008.

20 thoughts on "Global Housing Bubble Is Popping. Here Comes The “Reverse Wealth Effect”"

“Prices were blowing past records set during the previous decade’s housing bubble.” Hmmm… That’s true in nominal terms but not in real terms. With median household income having grown by approximately 30% since, house prices on a nationwide basis still have some way to go to blow past the records set during the late 2000s housing meltdown in real terms.

That’s not to say that house prices aren’t set for a correction, they are. I expect a 15%-25% correction over the next 2-3 years in terms of national prices. That said, equities will probably experience a larger correction over the same timeframe.

What are you smokin’ boo? Median household income increased by 30%? On what planet? Wages have not kept pace with inflation much less increased in any real sense. The only thing keeping the economy afloat is credit and multiple gigs on a part time basis by those still choosing to work. Take a peak at shadowstats and wake up and smell the coffee. The economy is about to auger in and only the .1% will survive.

It will ALL collapse and no one will be left standing.

When I was a kid in the 1970s my dad purchased our middle class home for 2X his annual income. This means two things.

1) Homes are really expensive today.

2) Every housing bubble that my city may have experienced since it’s founding had collapsed and disappeared by the time I was born. Every. Single. One. That’s why my dad could easily buy a home for just 2X his income.

Don’t forget he had to put down 20%. Because lending laws required banks to only lend out 80% of the value of their assets. During the 90s that law changed. Banks can lend out over 100%

Blame the democrats aaaaand the banks for our 10 year bubble and pop real estate market.

The details of 1970 are interesting but not necessarily important. Only to know that as of 1970 forces had existed that already destroyed every housing bubble that may have ever occurred in my city. Realistically speaking every city in the English speaking world.

Are u speaking of the elimination of gold backing the dollar?

Homes cost roughly 3x income in Canada, Australia, NZ and the UK in 1970. All housing bubbles since the beginning of time had already crashed and disappeared across the English speaking world. That’s a 100% failure rate.

There are still plenty of very nice places in the USA where you can get a house for around 3x household income if you stay out of the top five or six most-expensive metro areas.

Like where? Opelika, AL? No place you can find a reasonable job. I assume from this comment that you are advocating people move to places like Chernobyl. Who’s paying you to spew this drivel?

The REAL CHANGE society needs is the change in how housing is valued. It heavily favors the banks and wealthy.

All land should cost the the same per square foot regardless of its location. Then add in the value of the house. LITERALLY. Equity should be decided by improvements to the home not your neighbors selling price. This method is why we keep having bubbles.

When you say “should cost”, I have to ask why. How do you know all land is equal? Sounds like central planning “wisdom” to me.

Because dirt is dirt and for residential purposes is the same. To the federal reserve who actually owns it in perpetuity they could care less about the structure. Since the beginning of time LAND was the item of value. The house was not. In CA they build you a neat-o looking home on a 1/16th lot for 700k+ then sell an older home on 1/4 lot for 289k just a mile away. You don’t see the error here?

A structure or a LOCATION is worth whatever someone is willing to pay for it. What I do see as a problem is LEGAL TENDER LAWS, which gives central banks their unfair (opposite rules for the same species) advantage. It’s the very problem with the government concept in general. Politicians and their mercenaries (cops and military) operate on opposite MORAL rules from those of us NOT in their club. This is the big folly I see. UNIVERSALIZE ALL RULES NO EXCEPTIONS, no politicians. Let markets determine value.

Which is fine except those who are not wealthy don’t share where same advantages the wealthy do. New high end developments in prime real estate locations have better schools, roads more police presence and cleaner environments compared to the rest of us.

The police aren’t our enemies nor are the military. The enemy is central banks and career politicians like Pelosi and her ilk.

interest rates were much higher in the 1970s than they are now, which is why a person can afford a house that is 3 times their income now whereas in the 1970s 2 times one’s income was harder to manage, See https://www.valuepenguin.com/mortgages/historical-mortgage-rates