Guest post by Jordan Roy-Byrne from thedailygold.com:

Gold’s performance in real terms is important for two reasons.

First and foremost, it tends to be a leading indicator of the Gold price. That is instructive when Gold is rebounding but has yet to gain real traction or momentum.

Secondly, when Gold strengthens in real terms, it indicates mining margins are likely to strengthen.

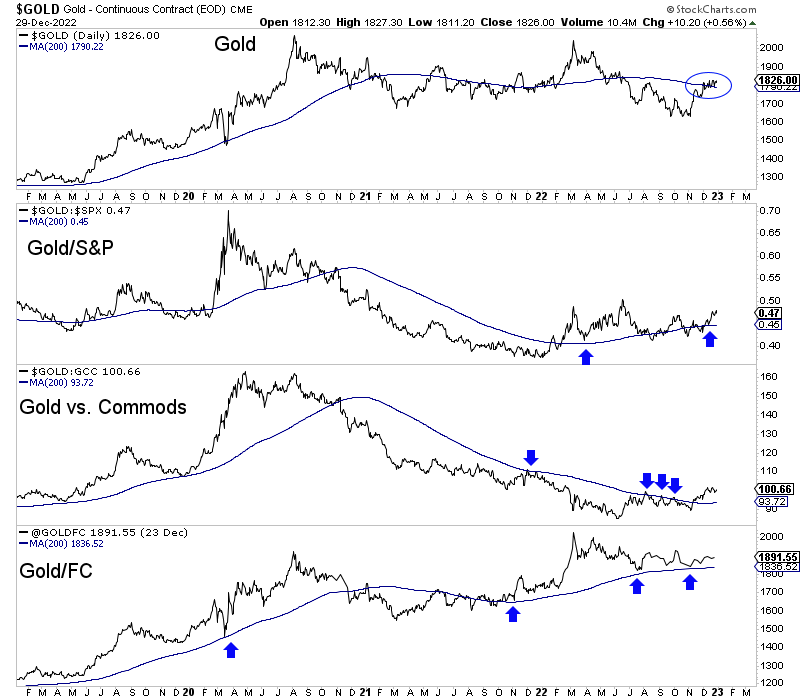

In the chart below, I plot Gold and then Gold against the various asset classes and foreign currencies at the bottom. Gold against bonds is omitted, as it has been in a strong uptrend for a few years.

Gold is trading around its 200-day moving average, but the moving average’s slope conveys some indecision. Also, Gold faces stiff resistance at $1840.

Meanwhile, Gold against the stock market, commodities, and foreign currencies is trading above upward-sloping 200-day moving averages. Gold against the stock market is close to a 52-week high, and Gold against commodities recently hit a 10-month high.

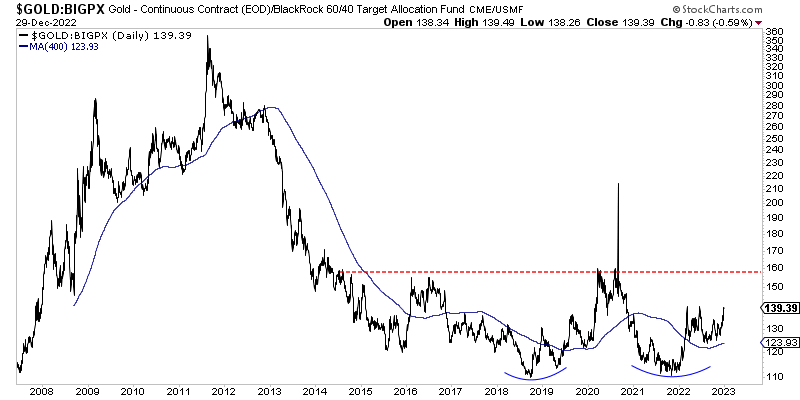

This next chart gives us an indication of when generalist investors will favor Gold.

We plot Gold against BIGPX, a BlackRock fund that mirrors the 60/40 portfolio (60% Stocks, 40% Bonds).

This is Gold against the conventional investment portfolio, which is within 1% of a two-year high. When it breaks above 160, it will explode higher, indicating growing mainstream adoption of Gold.

An analyst who only looks at Gold would think it is performing okay. It has rebounded but is struggling around resistance.

However, we see the bullish potential when looking at Gold in real terms.

The next leg higher in Gold against the stock market and 60/40 portfolio should signal that nominal Gold is on its way to retesting the all-time high.

Despite the positive developments and underlying strength, many investors remain skeptical and subdued as to what could develop in 2023.

Pay attention and take advantage of the present values. Otherwise, you will pay up after miners and juniors have rallied another 50%.

Guest post by Jordan Roy-Byrne from thedailygold.com.

Do you know which numbers really enhance your trades?

You might be surprised to learn that they aren’t on an earnings report or a quarterly statement… Instead, they’re living in the stock prices themselves! I’m Tom Busby, founder of the Diversified Trading Institute and with my “Little Black Book”, you can learn how to harness the power of these key numbers today and enjoy a stronger trading account tomorrow!