Early 2019 looked like a great set-up for gold, but failed to live up to its billing. A nice December-through-March run took the price back to the $1,350 resistance that had repelled it four times in the past five years. And that was that. No penetration and fast spike into the $1,500s. Just another failed attempt.

source: tradingeconomics.com

Now comes the “sell in May and go away” part of the annual cycle, as Asia’s wedding season ends and demand for gold jewelry dries up.

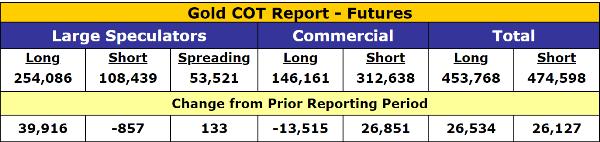

But the news is not all boring. Futures are saying something a bit more positive. The story, in a nutshell, is that speculators bought into the early 2019 “great set-up” thesis and piled into long contracts. Here’s a late-March commitment of traders (COT) report showing speculators more than 2:1 long and commercials (who take the other side of speculators’ trades and tend to be right at big turning points) more than 2:1 short. This kind of structure usually ends badly, and the latest episode was no exception.

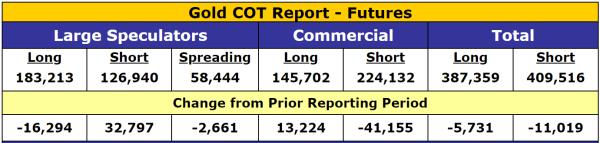

But as gold has fallen this month, speculators have fled and the futures structure has turned more positive. The most recent COT report shows speculators cutting their net long position by a huge 49,000 contracts and the commercials cutting their net shorts just as dramatically.

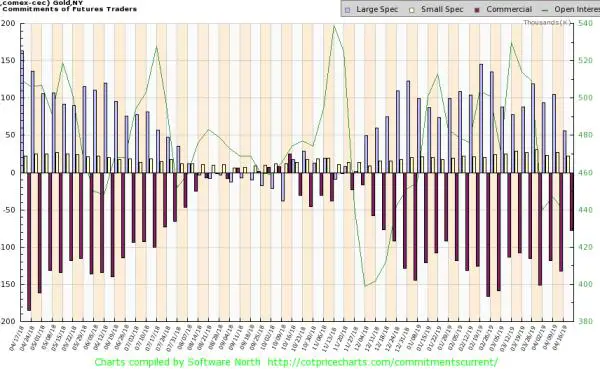

Here’s the same process in graphical form. See how the speculators – the gray bars pointing upward – were actually a bit short (meaning the gray bars drop below the middle dividing line) in late 2018. That’s both unusual and extremely bullish (because remember, speculators are usually wrong when they’re most certain). Then, with gold rising in early 2019, the speculators shifted gears aggressively, going extremely long, which is bearish.

Now, with gold falling again, the speculator longs are shrinking back towards zero. One more week like the last one (very possible since gold is still dropping, which should further spook the speculators), and the structure of the futures market will be bullish once again.

Will it be enough to offset weak seasonality? Maybe. In any event it’s a bit of good news in a stretch that frequently needs it.

3 thoughts on "Gold: Seasonality Bearish, Futures Turning Bullish"

I do remember the period of time when I lost my occupation couple of months back from my company where I have given too much time and hardwork. I was certainly not into policies similar to make money “overnight” which later turned out to be an online marketing strategies in which you will need to firstly get very interested customers and then sell a product to friends and family or any person in order that they will be in your network. This internet based job has presented me freedom to work-from-home and nowadays I am able to spend valuable time with my friends and family and get enough free time to go out on a family travels. This task has presented me an opportunity to make earnings something like $21,000-$22,000 every month by doing simple web-based job. Go and check out probably the most stunning work opportunity.>>>>>>>>>>>>> http://foryou49.com

It’s said repeatedly by the best traders that sentiment is the number one factor in deciding to buy and sell. To me the sentiment for gold (and silver) is about as low as it gets so it’s a good time to accumulate. But I think gold and silver prices will remain low as long as the current system continues. It will be fascinating to see how low the hatred for Trump will take things. The Russia collusion hoax didn’t work and I doubt doubling down on “obstruction of justice” or impeachment will either, but letting the stock market tank, and all that implies, probably would end the Trump era, but at enormous collateral costs (besides the political ones already). A lot of personal damage would have to be suffered by most. It will be interesting to see how fanatical things get.

Affiliate job opportunities have become a trend all over the over world now. Latest survey illustrates even more than 72% of the people are doing work in on line jobs at home without any problems. Everybody likes to spend time with his/her family by getting out for any beautiful place in the world. So internet based income enables you to carry out the work at any time you want and enjoy your life. Still discovering the right method and building the proper objective is our goal toward success. Already plenty of people are making such a fantastic earnings of $13000 every single week by taking advantage of recommended as well as powerful ways to making money online. You can start to get paid from the 1st day after you check out our web-site. TAKE A TOUR >>>>> throatedturtle.betrunken.org