Written by Bryan Lutz – Editor, DollarCollapse.com

—

This past week, some money managers have been drinking a little too much of the Fed’s Kool-Aid… And are making speculative, risky bets they shouldn’t be. They’ve been seduced by false hope from soft economic data in the bond market and manufacturing sector, and hints of lowering or decreasing interest rates from the latest FOMC meeting minutes.

The real message isn’t getting through here:

Get Sober: The Fed is not here to help you make risky bets. Especially when the US is carrying more debt than ever, inflation soared to a 40-year high this year, the US housing-bubble is starting to burst, and there’s no sign of energy costs about to drastically get reduced in the future…

Unfortunately, some people are convinced the Fed is here to help them “get rich quick” with an addiction to short-term thinking.

To these folks, I have one thing to say: stop gambling with the financial future of so many innocent people. Start listening to that voice deep in your gut that knows the economy and the USD are on a one-way trip…NOT in a positive direction.

Bloomberg reported:

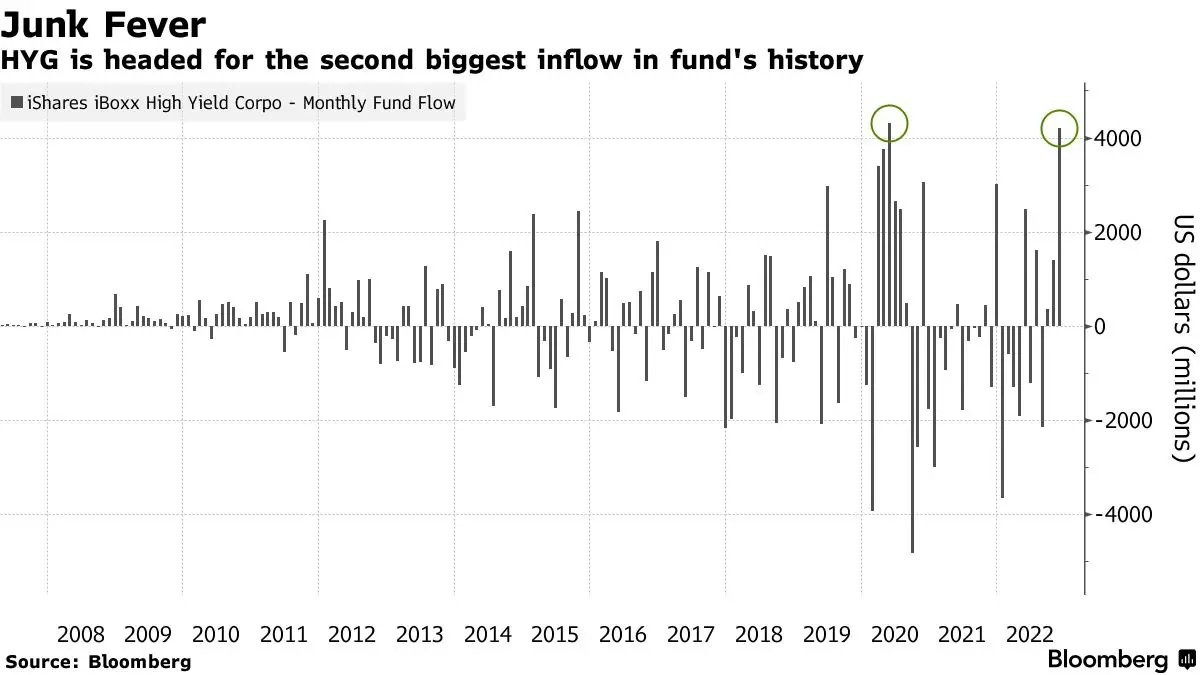

“High-yield corporate bonds have had their best two months of inflows on record, attracting $13.6 billion of exchange-traded funds inflows in October and November, according to data compiled by Bloomberg. Exchange-traded funds that track growth stocks are taking in the most cash versus funds that buy value stocks that have been among the winners of high inflation.

Bets on a more moderate path of rate hikes were catalyzed this month by the cooling of October’s consumer price index. This week’s Richmond Fed Manufacturing Survey came in slightly below expectations and added to the peak inflation narrative.”

IE..

More Evidence of Risky Bets in the Bond Market and Manufacturing Sector

Unfortunately, some money managers seem to think otherwise, having been seduced by optimistic economic data and FOMC meeting minutes. The truth is, the Fed won’t bail them out if their bets fail, and if they do they’ll print more money, further spurring on inflation. One thing is for sure, we are the end-game for the USD. Still, it seems like Wall Street will never learn. They keep taking everything with a short-term outlook.

Bloomberg reported:

“A rush to corporate credit is favoring the riskier edges of the market, with junk bonds drawing their biggest passive inflows on record. Equity exposure among quants has turned positive and that of active fund managers is back near long-term averages. The inflation bid is crumbling, with the dollar heading for its steepest monthly decline since 2009 and benchmark Treasury yields down 30 basis points in November, 2022”

An Openness to Reducing or Pausing rate increases? “Give me another hit!”

The Federal Open Market Committee (FOMC) meeting this week signalled an openness to reducing or pausing rate increases. This marks a shift from the previous path of tightening, which was spurred by the cooling off of October’s consumer price index and a slight underperformance in the Richmond Fed Manufacturing Survey.

You can see the sentiment change at this week’s meeting of the Federal Open Market Committee(FOMC). The outlook signalled an openness to reducing or pausing rate increases, helping push some assets forward. And trigger the greed saliva to start pouring out of some money manager’s glands.

Bloomberg reported:

“Sentiment from the more dovish Fed minutes is carrying over,” said Esty Dwek, chief investment officer at Flowbank SA. “Any indicators of softening growth are all playing into the softer inflation narrative, which is another support for the Fed arriving toward the end of its cycle relatively soon…

…The latest policy minutes suggested that more moderate tightening would be appropriate, close on the heels of Federal Reserve Bank of Cleveland President Loretta Mester saying she doesn’t have a problem with the central bank slowing down the pace of rate increases soon.”

It’s easy to be seduced by false hope from soft economic data in the bond market and manufacturing sector, coupled with hints of lowering or pausing interest rates from the FOMC meeting minutes. However, it’s important to understand that the Fed is not here to help you make risky bets(or anyone else managing your money to make speculations in uncertain times) – despite what some money managers may think.

Sober Up Already… Why it’s better to play it safe than trust the Fed

Despite hints from the Fed to soften its tightening stance and signs of a cooling inflation environment, it’s still best to play it safe with your money. The odds of speculative bets succeeding are far from guaranteed, and the Fed won’t be there to bail out any losses if things go wrong, and if they do, they’ll need to print more money. When that starts happening you can bet hyper-inflation won’t be far behind.

It’s better to be conservative and understand the true message of unpredictable markets: cautiously manage risk, no matter how enticing some of these speculative moves may look. When it comes to your investments, playing it safe is always the better option.

How to Own Tens of $Billions in Gold for Just US$1 Per Share

A brand new gold bull market has arrived as nervous investors continue to flock to the safety of the yellow metal.

Yet, the biggest gains won’t be in gold…they’ll be in select gold stocks with proven ounces in the ground.

This soon-to-be-known gold company provides investors with exposure to over 30 million ounces of gold…worth tens of $Billions…at a ridiculously low US$1 per share.