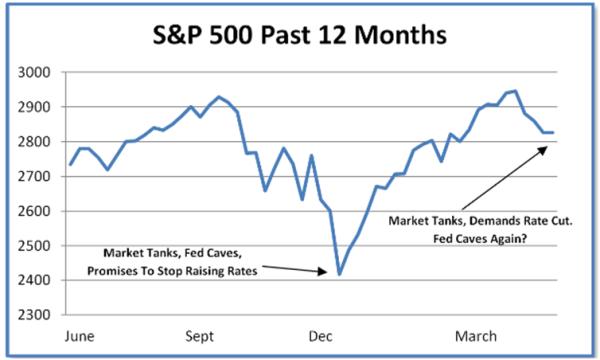

In late 2018 the US stock market tanked, in effect holding a gun to its own head and threatening to pull the trigger unless the Fed stopped raising interest rates. The Fed, painfully aware that an equities bull market is an existential threat in today’s hyper-leveraged world, quickly caved, promising no more rate increases if the market would just put down the gun.

This worked for a little while. Stocks jumped to new record highs and unicorn tech IPOs started pouring out of Silicon Valley. Normal, which is to say booming, markets were back.

But of course it couldn’t last. An overleveraged economy is not just addicted to new credit, but to ever-increasing levels of new credit. So stable interest rates won’t stave off withdrawal. From here on out only steadily (or steeply) falling interest rates will delay the inevitable crisis.

That’s the signal the financial markets are now sending the Fed, as stocks begin to roll back over …

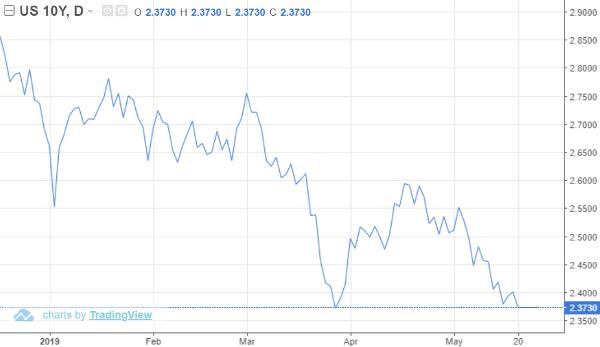

… bond yields tank …

… and demands grow for not just patience but acquiescence. Now the question is not if but when the Fed responds with the required cut.

At the moment – mostly because the stock market hasn’t fallen very far — there’s still some resistance to lower rates:

Federal Reserve is reluctant to cut interest rates, latest minutes show

(CBS News) – According to minutes released Wednesday, Fed officials noted that economic prospects for the U.S. and global economy were improving, while inflation had fallen farther below the Fed’s 2% target.

Some officials “expressed concerns that long-term inflation expectations could be below levels consistent with” the Fed’s target of 2%. However, officials still believed a return of inflation to the Fed’s 2% target was “the most likely outcome,” according to the minutes.

“Patience persists,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note. “Most, perhaps all, FOMC members are content to leave rates on hold for some time yet.”

At its last meeting, the Fed kept its key policy rate unchanged in a range of 2.25% to 2.5%, where it has been since the Fed hiked rates for a fourth time last December. That end-of-year hike contributed to a nosedive in financial markets as investors began to worry that the central bank was in danger of sending the country into a recession.

In January, the Fed did an about-face in response to a worsening global outlook and other risks to growth and began signaling it would be “patient” in changing interest rates. While Fed officials had projected in December two more rate hikes for 2019, they now expect to hold steady for the year.

The most recent minutes indicate that, despite recent economic improvements, the Fed remains cautious and prefers to act slowly.

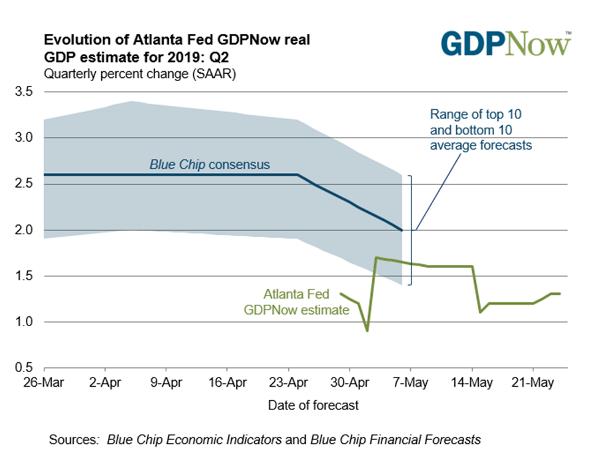

But patience is a luxury afforded by stability, and that’s already changing. The Atlanta Fed’s GDPNow report, for instance, shows both the Fed’s and the Blue Chip Economist consensus for Q2 growth at levels that are too low to generate positive year-over-year corporate profit comparisons. Falling earnings will probably cause falling stock prices, leading the Fed to conclude that cutting interest rates is the only way to head off a global financial contagion.

This cycle – recurring financial instability forcing the steady ratcheting down of interest rates – will continue until lower rates become the problem rather than the solution. Which is another way of saying until there are no more solutions.

3 thoughts on "Financial Markets To Federal Reserve: Time To Start Cutting Rates"

I ordinarily income roughly about 6,000 $-8,000 $ every 4 weeks from the net. While I was employed by my past organization I was seeking for legitimate work from home opportunities in which I can receive lots of money and also at the same time get sufficient time to spend with my family members and offcourse I am not searching for scams that misguide you to make you very very rich in just few days or so. Eventually I found out a brilliant opportunity and I can’t tell you how glad I am nowadays. You Can Learn More and Become More Independent:Because you don’t have co-workers just a few feet away or a tech team 1 floor down, you’ll find yourself building the skill of looking for your own answers and becoming more proactive to find what you need on your own. Of course you can still ask questions and also ask for assistance if you need to. But, a lot of the time, you could do a Google search, download a 100 % free manual. Here’s the right way to start> nalablucking.ballern.de

First of all, I question the “fact” that the markets fell roughly 20% by December 2018 because of threat of another interest rate hike. It seemed to me there was too much consensus about that way too quickly. As usual, no investors – institutional or retail individual – were “polled” about that, it was just assumed or made up like “fake news” by the likes of Maria Batiroma (who I actually like.) No one one questioned it, or mentioned the old statistical observation that “correlation does not mean causation.” I haven’t heard one single person talk about selling in the Fall because of the Fed’s interest rate hikes, or not buying into the markets in December.

I attribute the DOW plunge to more fundamental forces, almost too many to list though JR gives a good starter, including the trading algorithms. Furthermore, I attribute the v-shaped recovery after the Fed’s capitulation to be because of the coordinated “plunge protection team” and not ordinary market activity.

Therefore, I think things may be hitting the wall already. The “eventuality” point is here. I actually think the real reluctance to more QE by the Fed is they think/know(?) it won’t work, and that would create – especially if JR’s analysis is correct that markets “think” that would help – a real panic state. After all, ”everyone” – rightly or wrongly – thinks now that lower Fed target interest rates would maintain the status quo if not be another mini boon, but what if that’s not the effect this time? This situation is like an example of “normalcy” bias in which everyone is so inured by the new normal after 10+ years of unprecedented liquidity and ever-higher everything (except PMs) despite every rational reason against. So why wouldn’t more of the same have the same effect?

It’s a little crazy to think that a sudden change of 25 basis points in interest is the difference between easy street and Armageddon. For one thing any change of interest rates affects very little immediately, or – more precisely – existing debt, which is a whole lot greater than incremental debt. Existing bond rates don’t change until the bond matures. The market PRICE of bonds/debt increase if prevailing rates fall (and rise if rates drop) but that does not affect the COST of that debt.

To me that means two things. First the fact that so much debt is being bought (especially in the US Treasury market) during so much alleged economic strength portends a different truth. The capital gains to be made by a quarter-point decrease in the Fed rate is minimal compared to the alleged gain in the equities market, if that is what “the markets” are expecting. Secondly, the fact that so much debt is being bought – and has been all year – has effectively lowered the Fed rate by lowering the market rate. In other words, the “Fed put” has essentially already happened. The chart of the 10 year Treasury rate has already fallen from about 2.85% in January 2019 to about 2.37% in May, or nearly half a percent lower, and yet the equities markets are deflating.

I say we’re already at the end of interest rate control by the central banks. If I’m right, and equities start to really tank again, the Fed may join the BOJ, ECB, and BOC in being last-resort purchasers of just about everything but bitcoin. I’m just sayin’.