It’s one thing to hear someone claim that the world is spinning out of control. But it’s a lot more impactful to see the underlying trends laid out visually.

With that in mind, welcome to a new weekly series that highlights the charts, tables, and images of our descent into financial madness.

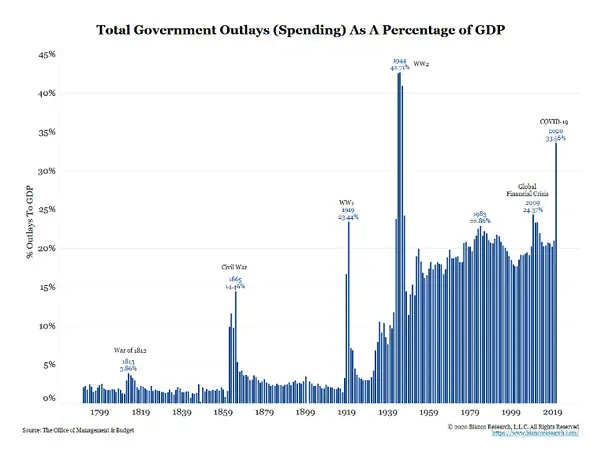

The small print on this first chart is a bit hard to read, but the story is clear: Government spending as a portion of GDP spiked during previous existential crises like the Civil War and World Wars I and II. But this year it rose to a level that exceeds all but one of those past calamities.

In other words, the US government is spending money like our survival is at stake, only this time the enemy is not a foreign army. It’s a disease and, crucially, our response to it. Given the number of states, cities, and industries that have been bankrupted by the lockdown, 2021 is likely to see an even bigger spike in fiscal stimulus.

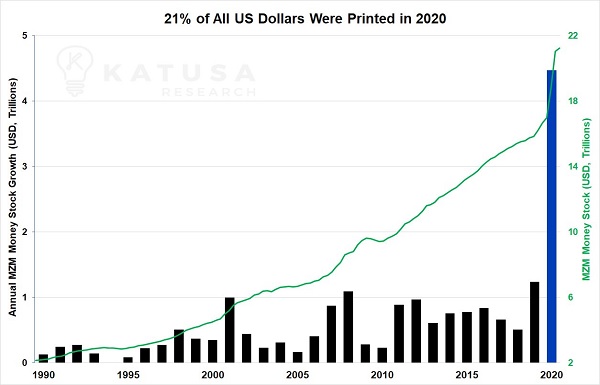

The next chart, courtesy of Katusa Research, shows how all that government spending translates into currency, as the US money supply soars by 21% in a single year.

The stock market has happily surfed this wave of new money, with Big Tech and other momentum stocks going crazy. Electric car maker Tesla, a favorite of daytraders and hedge funds, is now more valuable than Berkshire Hathaway, the flagship company of iconic investor Warren Buffet, despite generating about one-tenth of Berkshire’s revenue.

But the mania isn’t limited to just speculative bubble stocks. Even as the earnings of the S&P 500 companies (red line) have cratered during the lockdown, the amount investors are willing to pay for each dollar of earnings (the P/E ratio, blue line) has soared. Mr. Market is apparently looking beyond the bleak present to a future utopia in which corporate earnings hit new record highs and never look back.

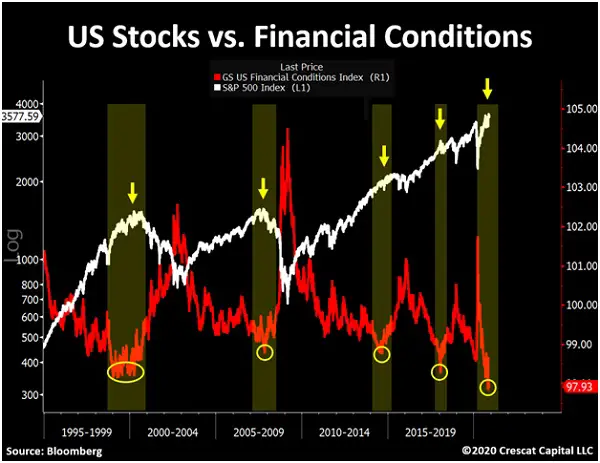

Here’s how Crescat Capital, the source of the next chart, tells its story:

In our November research letter, we shared a Crescat macro model that combines 15 fundamental valuation factors to show how US stocks have recently reached their most overvalued levels since 1900. The problem with speculative excess and the risks it poses to unprepared investors is simple to understand. Ultra-easy financial conditions create major manic tops in markets. As we show in the chart below, with both the tech bubble of 2000 and the housing bubble of 2007, the GS Financial Conditions Index reached cyclically low levels that distinctly marked these market tops. Financial conditions today, driven by historic low interest rates and tight credit spreads, are the loosest yet, the easiest of the past thirty years, at the same time as valuations and leverage are the highest.

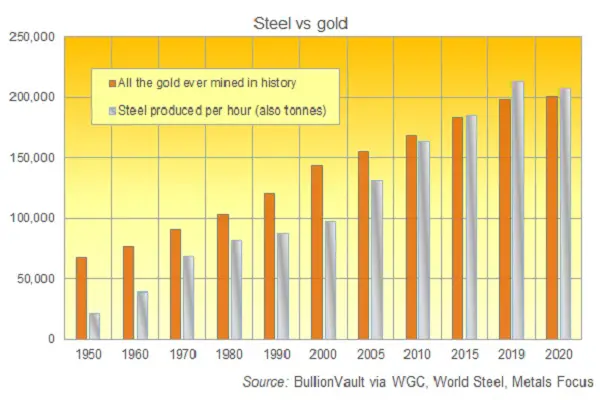

As for why all this financial debauchery is good for safe havens like gold, the next chart illustrates how rare gold remains, despite the fact that humanity has been mining and accumulating it for millennia: More steel is produced in an hour than all the gold that currently exists aboveground.

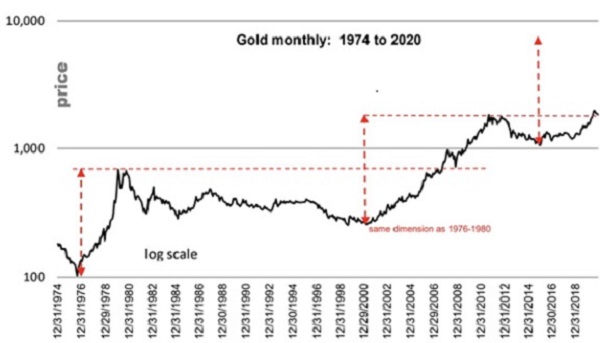

This means, according to technical analyst Michael Oliver, that the current gold bull market will trace the same path as the previous two, with an eventual destination of around $8,000/oz.

7 thoughts on "Extreme Charts — December 4"