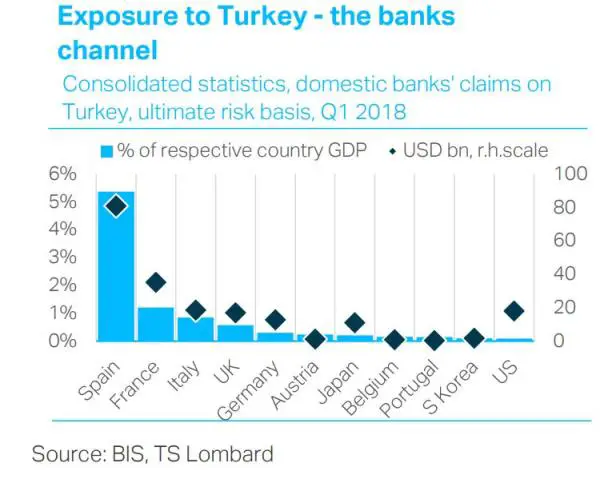

To understand why Europe is watching Turkey’s financial crisis with alarm, you just have to see this chart:

Spanish – and to a lesser extent French and Italian – banks have lent a lot of money to Turkey. So as that country spins closer to default, those banks and their governments are in danger of having massive holes punched in their financial structures.

With Greece its usual mess and Italy’s bond yields spiking, the last thing Europe needs is a banking crisis. So, as today’s Wall Street Journal reports, the Continent is looking – as it always does – for Germany to step in and fix things:

As Turkey Teeters, Germany Considers Offering a Financial Lifeline

ISTANBUL—The German government is considering providing emergency financial assistance to Turkey as concerns grow in Berlin that a full-blown economic crisis could destabilize the region, German and European officials said.

While the talks are at an early stage and may not result in any aid, the possibilities being discussed range from a coordinated European bailout similar to the kind deployed during the eurozone debt crisis to project-specific loans by state-controlled development banks and bilateral aid.

Berlin fears a meltdown of the Turkish economy could spill over into Europe, cause further unrest in the Middle East and trigger a new wave of immigration toward the north.

“We would do a lot to try to stabilize Turkey,” a senior German official said. “We don’t have much choice.”

Other European governments have grown equally concerned. Hosting his Turkish counterpart in Paris on Monday, French Finance Minister Bruno Le Maire said it was important to support Turkey’s efforts to repair its economy.

Why You Should Care About Turkey’s Meltdown

But economists say it is too early to pin down how much money Turkey, a member of the North Atlantic Treaty Organization, might need because much of its potentially troubled debt is in private hands. They have pointed to Argentina, a smaller emerging economy facing similar problems, which received a $50 billion credit line from the International Monetary Fund in June.Two senior officials in Berlin said German Finance Minister Olaf Scholz had discussed some of the options with his Turkish counterpart Berat Albayrak in recent conversations.

Such aid would mark a striking rapprochement between Germany and Turkey, which despite having been close allies for over a century have become increasingly estranged in recent years as Turkish President Recep Tayyip Erdogan’s rule has grown more authoritarian.

Mr. Erdogan is due to visit Berlin on Sept. 28. Financial aid will be on the agenda a week earlier, when Messrs. Scholz and Albayrak are expected to meet in Berlin to prepare the president’s trip.

Germany’s attitude contrasts with that of the U.S., which has shown little interest in calming markets as they pummeled the Turkish currency, the lira, earlier this month. On the contrary, President Trump, locked in a dispute with Mr. Erdogan over the detention of a U.S. pastor in Turkey, has piled sanctions and new tariffs on the country.

German officials said such policies might have amplified Turkey’s woes and reduced market confidence.

“This is an absolutely insane and ill-informed policy,” said one senior German official.

Berlin’s main concern is that a crisis could undo a landmark deal with Turkeyunder which Ankara has cracked down on Europe-bound refugees passing through its territory in exchange for funding. Germany experienced a popular backlash after the country took in nearly two million asylum seekers since 2015.

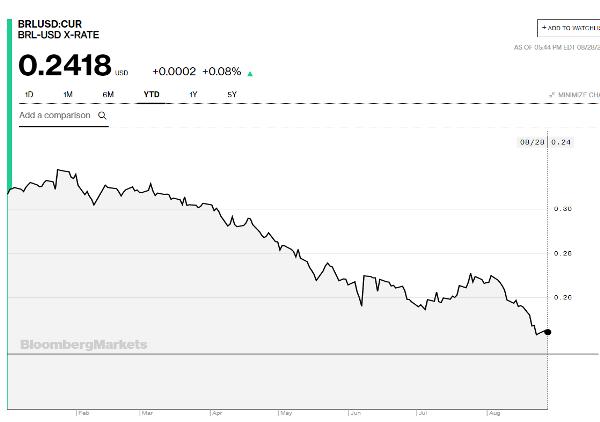

The collapse of the lira—it has lost 40% of its value against the dollar this year—has pushed up inflation and put pressure on companies and individuals who have loans denominated in foreign currency. The threat of mass defaults, in turn, has been weighing on Turkish banks.

Ultimately, however, Europe may find it inevitable to provide some form of assistance to Turkey, a senior EU diplomat in Ankara said.

“We cannot just sit and watch Turkey go down the drain. The migration pressure and the geostrategic importance, as well as the economic links, are too important,” this person said.

Note that the first step in the process doesn’t involve any actual money changing hands. Germany just announces that it’s “considering” helping out and hopes that this will be enough to stabilize the Turkish lira, giving its government breathing room to bring its finances – and its relationship with President Trump – back into balance.

This step usually fails, alas, because by the time a country enters a currency crisis as severe as Turkey’s, everyone understands that its problems are deep-seated and systemic, and thus not something that a little breathing room will fix.

Next up apparently will be an emerging market bailout in the form of a Europe-wide set of loan guarantees (managed and backstopped by Germany) that will, hopefully, not have to be activated. This might work if the guarantee is big enough relative to the debts coming due. But in effect the result is the swapping of Spanish loans to Turkey for German loans. And there’s a limit to how much of the world’s debts even Germany can take on.

Turkey, meanwhile, is just the beginning. Tunisia is teetering, Brazil’s currency is falling, and a big chunk of the Middle East has external debt but little in the way of resources to cover it.

By the time this latest emerging market bailout is complete, the amount of debt added to developed world balance sheets could be enough to spread the pain pretty widely.

7 thoughts on "Let The Emerging Market Bailouts Begin: “We Don’t Have Much Choice”"

US rates rose and emerging markets go bust. Where have seen this before? Confessions of an Economic Hitman. Induce them to borrow and then raise the rates. When they can’t pay, take their mines and energy for pennies. They trusted and they lost.

Excellent, I too have read John Perkins and the paybook never changes. However, this time may indeed be different as EU comes to the rescue, even guarantees may be enough to stabilise the lira as long as Erdogan does the right thing.

Otherwise the problems may persist. It is the world against the US hegemony now, a true WW3 fought on the battlefields of currencies and the dollar is at risk.

Awesome. Bring it.